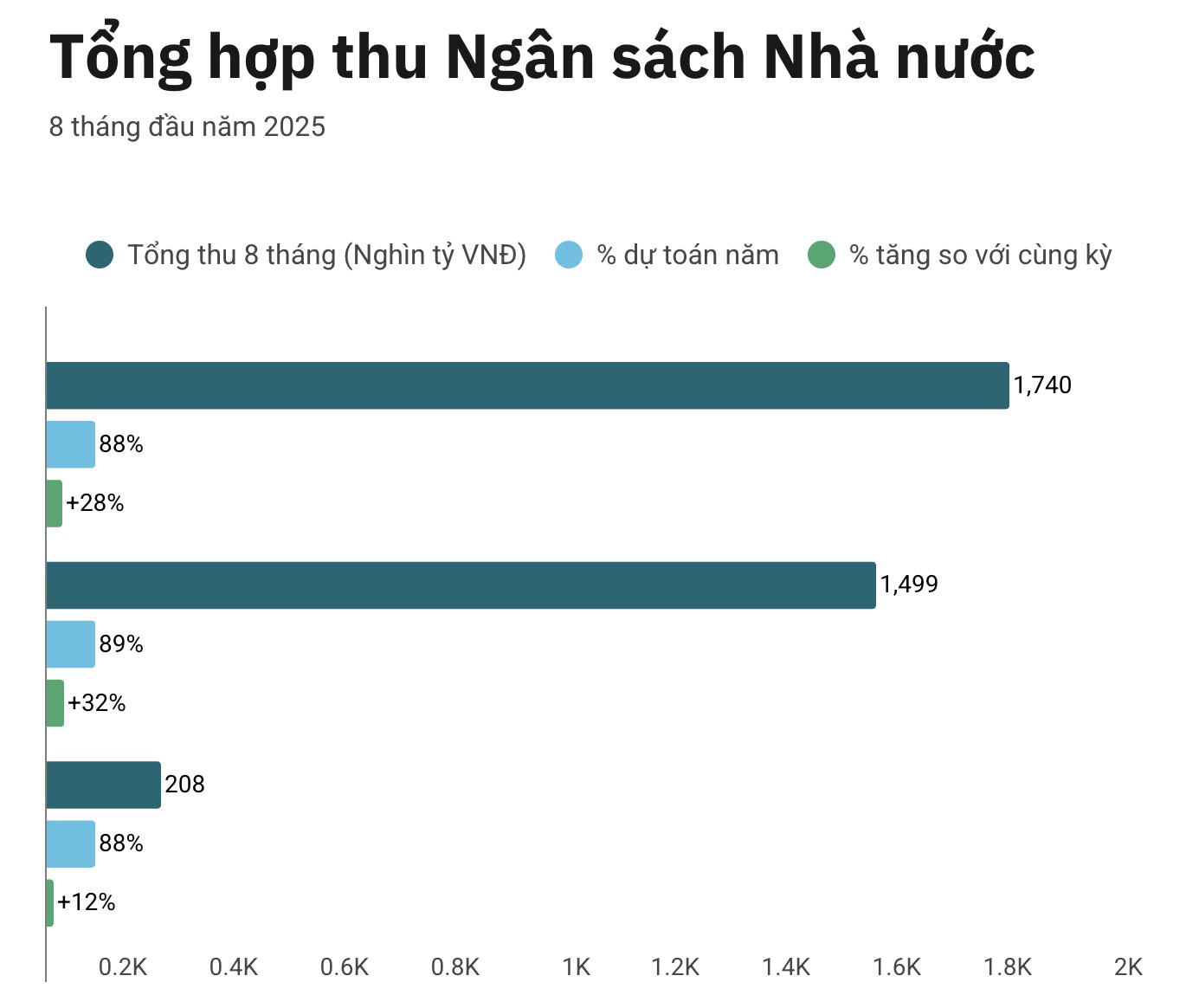

Budget revenue is still increasing, showing the effectiveness of macro solutions.

The effectiveness of support policies is focused on and key

To support businesses to overcome the storm, in recent times the financial industry has proactively advised and proposed many policies on tax, fee, and land rent exemption, reduction, and extension. The total scale of fiscal support solutions in the 2021-2025 period is estimated to be about 1.1 million billion VND, a record figure, demonstrating the Government's consensus and determination in removing difficulties for the business community and people.

2025 continues to be a pivotal year with a series of fiscal support policies implemented selectively and effectively. A typical example is the reduction of value-added tax (VAT) tax rate from 10% to 8% for some groups of goods and services. This policy has directly impacted consumers, helping to reduce retail prices, thereby stimulating spending and shopping.

Assessing the effectiveness of the policies, Ms. Nguyen Thi Cuc - President of the Vietnam Tax Consulting Association - emphasized that: Reducing budget revenue and stimulating spending will create more wealth and material things in the coming stages, thereby helping the State to sustainably increase tax revenue. She affirmed that this is an effective strategy to nurture long-term revenue. Along with that, the policy of reducing VAT and applying electronic invoices not only stimulates consumption and supports businesses, but also promotes the digital economy, increases transparency and competitiveness. In the digital age, these policies create conditions for businesses, especially small and medium enterprises, to innovate and improve competitiveness.

Dr. Nguyen Thi Khanh Phuong - Deputy Head of the Department of Science Management and Development Cooperation, Institute of Banking Science Research, Banking Academy - commented that the most obvious achievement is the synchronous implementation of financial support solutions to reduce cost burdens and improve cash flow for businesses. She especially emphasized the role of reducing VAT from 10% to 8% and extending tax and land rent payments (according to Decree 82/2025/ND-CP) in maintaining liquidity for businesses. The biggest achievement is not only "rescuing" businesses in the short term but also creating a favorable policy environment, supporting recovery and long-term breakthroughs.

Ms. Phuong believes that reducing VAT brings a "double boost": both stimulating consumption in the context of weak purchasing power, indirectly reducing input costs, improving profits for businesses. Meanwhile, extending tax payment and land rental is considered a "safe zone" for cash flow, especially important for small and medium-sized enterprises that are prone to liquidity shortages.

However, she also noted that these policies are often short-term and have been extended many times, making it difficult for businesses to forecast and plan long-term business. In the future, policies need to move towards stability and higher predictability.

A solid recovery through the lens of public investment disbursement

Not only stopping at tax exemption and reduction policies, the State Budget (NSNN) is also an effective tool to stimulate growth through spending activities. The total accumulated state budget expenditure in the first 8 months of 2025 reached more than 1,450 trillion VND, equal to 56.3% of the annual estimate and increasing by 31.5% over the same period. Notably, development investment expenditure reached VND 409.2 trillion, equal to 51.7% of the annual estimate and up 49.4% over the same period. This is a bright spot, showing the determination of the Government in promoting public investment disbursement.

Increasing development investment spending, especially in large infrastructure projects, has a strong spillover impact on the entire economy. When these projects are implemented, the demand for construction materials, machinery, equipment and labor increases, creating " jobs" for thousands of businesses and people. From there, budget revenue from production and business activities also increased, creating a positive counterpart. The promotion of public investment disbursement in the context of budget revenue reduction policies being applied is a testament to flexibility in management, ensuring both goals: Supporting businesses and maintaining fiscal discipline.

In the recently published macroeconomic report, the World Bank (WB) in Vietnam also made an important assessment. The World Bank recommends that policies to support growth and protect against external uncertainty should focus on boosting public investment, mitigating risks in the financial sector, and reforming economic restructuring. In particular, fiscal policy needs to continue to take the lead in supporting long-term resilience and growth, in the context of limited monetary policy space due to prolonged interest rate differentials and exchange rate pressure.

The WB further stated that Vietnam's low public debt level allows for increased investment, especially to narrow the gap in infrastructure shortages in the fields of energy, logistics and transportation, with the need to focus on public investment management, performance assurance, debt safety and risk monitoring.

To make preferential policies more practical and continue to be effective, Dr. Nguyen Thi Khanh Phuong pointed out that policy implementation needs to apply process optimization solutions such as promoting digitalization and data connection, helping businesses reduce time to process procedures.

Dr. Phuong also gave an example of international models such as Singapore's Gobusiness/ Gov Assist platform, or how Australia uses salary tax data to pay direct subsidies, thereby suggesting that Vietnam needs to switch from the "Enterprise seeks policy" model to "policy proactively seeks businesses". To achieve this, it is necessary to have regulations on transparent processing time, publicize disbursement progress, and increase accountability.

Regarding the coordination between policies, Dr. Phuong believes that fiscal policy can only truly be effective when there is smooth coordination with monetary and trade policies. Based on the PCI 2024 survey, she said that about 54% of businesses still reported difficulties in accessing loans and 49% had difficulty finding customers. This shows that fiscal support only creates a "push" when it goes hand in hand with reasonable credit flows and market expansion policies.