Capital prices increase sharply, eroding business profits

On May 6, the People's Committee of Ha Nam province issued Decision No. 853/QD-UBND prohibiting Cienco4 Group Joint Stock Company (CIENCO4) from participating in bidding activities.

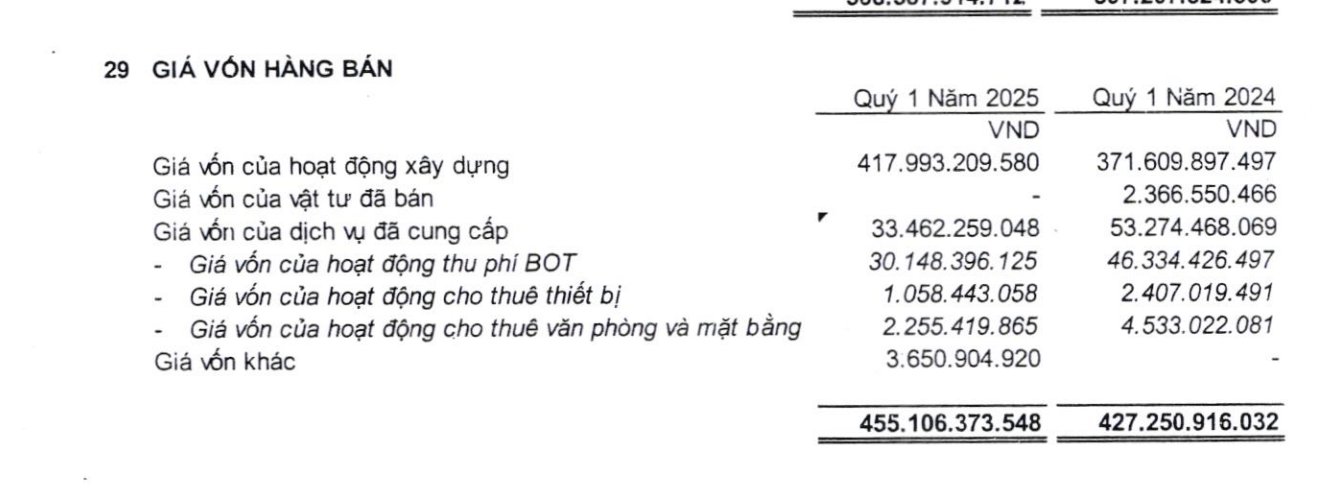

The consolidated financial report for the first quarter of 2025 of CIENCO4 Group Joint Stock Company (Code: C4G) recorded that the company's net revenue reached VND508.6 billion, an insignificant fluctuation compared to VND507.2 billion in the same period in 2024. However, the cost of goods sold increased by 6.5%, to VND455.1 billion, causing the gross profit to decrease sharply by about 33%, to only VND53.5 billion.

According to the explanation, the cost of construction activities of enterprises increased sharply from 371.6 billion VND to nearly 418 billion VND, while the service sector, especially BOT fee collection, decreased significantly from 46.3 billion VND to 30.1 billion VND. This period also saw another capital price of VND3.65 billion that was not recorded last year.

Financial expenses in the period decreased significantly, from VND 48.6 billion to VND 36.6 billion thanks to interest cost reduction, but this was not enough to compensate for the pure profit from business activities that had decreased sharply by 79%, down to VND 9.5 billion.

Another notable point is that profit increased dramatically, reaching VND 11.8 billion compared to VND 1 billion in the first quarter of 2024, helping total pre-tax profit reach VND 21.4 billion, although still down more than 53% over the same period.

As a result, after-tax profit in the first quarter of 2025 only reached 16.9 billion VND, down 59% compared to 41.2 billion VND last year, showing that the business efficiency of enterprises has clearly decreased, mainly due to increased capital costs even though the company has somewhat escaped other unusual sources of profit.

Investing heavily in BOT projects

As of March 31, 2025, total assets of CIENCO4 reached VND 9,414.3 billion, an insignificant change compared to VND 9,409.2 billion at the beginning of the year. Of which, short-term assets accounted for 57% of the structure, reaching VND 5,407.7 billion, up slightly by 1.2% compared to the beginning of the year.

Cash and cash equivalent decreased by about 18.5%, down to VND 183.7 billion, mainly due to a sharp decrease in cash balance of 38.7%, to VND 60 billion.

Short-term loans account for the largest proportion of short-term assets, reaching more than VND 4,206 billion, unchanged much compared to the beginning of the year, but the short-term loan receivables have decreased slightly, compensating for increased advances to sellers. Inventory was at VND941.7 billion, up 10.8% over the beginning of the year.

Of which, the majority is unfinished production and business costs, reaching VND 924.1 billion. In this list, the Ben Thanh - Suoi Tien project recorded unfinished costs of about 156.8 billion VND. The rest are other projects such as Hieu 2 Bridge, Long Son Urban Area, T&C Urban Area - 61 Nguyen Truong To and other projects.

By the end of the first quarter of 2025, Cienco4 invested in 8 associated companies with the investment value of VND 327.5 billion, down slightly compared to VND 330.9 billion at the beginning of the year. In particular, investing in associated companies accounts for VND 33.97 billion, mainly concentrated in Cienco4 Consulting Joint Stock Company (3.04 billion VND), construction and investment company 415 (10.3 billion VND), 412 (10.1 billion VND) and Cienco4 Japan Bridge (3.43 billion VND). These amounts do not fluctuate much compared to the beginning of the year, maintain stability.

Investing in joint ventures accounts for a larger proportion, reaching VND 293.5 billion, with notable items such as: Cau Yen Lenh BOT Company Limited (VND 39 billion), Hai Thanh Company Limited - BOT National Highway 1A CIENCO4 - TCT319 (VND 94.3 billion) and Thai Nguyen - Cho Moi BOT Company Limited (VND 160.1 billion). Hai Thanh BOT alone decreased by about 9 billion VND compared to the beginning of the year (from 103.1 billion VND to 94.3 billion VND), possibly due to profit allocation or capital contribution adjustment.

In general, CIENCO4's long-term financial investment structure still focuses mainly on BOT projects and transport infrastructure, accounting for more than 89% of the total investment portfolio.

Great pressure from the burden of debt

By the end of March 3, 2025, CIENCO4's total liabilities were at 5,476.3 billion VND, negligible fluctuations compared to the beginning of the year, this figure and 1.4 times higher than the equity of the enterprise. Short -term debt accounts for a large proportion of 3,044.4 billion dong, up 3.1% compared to the beginning of the year; Long -term debt at VND 2,431.9 billion, slightly decreased by 4.2% compared to the beginning of the year.

Notably, total outstanding loans are still high, at VND2,832 billion, accounting for 51.7% of total payables. That shows that the high leverage level and pressure to repay loans are still a big challenge, requiring the company to maintain stable cash flow from business operations and collect debts.

In the first quarter of 2025, the pure cash flow from CIENCO 4's business activities was VND 29.8 billion, down sharply from VND 61.7 billion in the same period in 2024. Although revenue from sales and service provision increased to VND 608.5 billion (compared to VND 544.1 billion last year), the pressure to pay suppliers, employees, interest and taxes has eroded most of the cash flow, especially payments to suppliers increased skyrocketing from VND 330 billion to nearly VND 476 billion.

Investment cash flow continued to be negative at VND 21.6 billion, but has improved significantly compared to the negative VND 162.8 billion in the same period last year.

Notably, financial activities in the first quarter of 2025 moved to a negative 49.8 billion VND, while in the same period last year, they were at 44.3 billion VND. The main reason comes from increased repayment of principal loans (358.4 billion VND compared to 289.8 billion VND), while the cash flow from borrowing only reached 316.1 billion VND (lower than 341.5 billion VND last year).

As a result, net cash flow in the negative period was 41.6 billion VND, improving compared to the negative level of 56.8 billion VND last year, but still causing money and its equivalent at the end of the period to decrease to 183.8 billion VND, down about 18.5% compared to the beginning of the year and down sharply by 71.8% compared to the same period last year.

Overall, business cash flow is positive but decreased, investment activities are better controlled, while financial activities cause withdrawal pressure, showing that CIENCO4 is under great cash flow pressure from repayment of loans.