Completing the 2024 business targets

Over the past year, PVcomBank has always proactively followed closely, promptly grasped market opportunities, maximized internal resources and resolutely pursued a growth strategy associated with quality, safety and sustainability factors.

Thanks to the correct direction of the Board of Directors and the drastic implementation of the entire system, the Bank has completed and even exceeded the General Meeting of Shareholders' targets set for 2024. The scale of operations continues to be expanded in a selective and cautious direction, ensuring stable and safe development in all aspects of operation.

Accordingly, PVcomBank recorded consolidated revenue at 113.4% and consolidated pre-tax profit at 116.8% compared to the annual plan. For Parent Bank alone, pre-tax revenue and profit compared to the 2024 plan reached 113.5% and 187.8%, respectively.

The bank implements strict risk management policies. Capital safety and risk management coefficients are always better complied with than the regulations of the State Bank. The capital cost savings ratio (CAR) is guaranteed according to regulations. The bad debt ratio is strictly controlled below 3%. Outstanding and recovery solutions have been implemented synchronously, drastically and effectively.

Regarding mobilization, PVcomBank always closely follows market developments to proactively operate appropriate interest rate policies. As of December 31, 2024, total capital mobilization from economic organizations and individuals reached VND194,761.2 billion, down slightly compared to 2023, but the mobilization structure has changed positively.

In 2024, PVcomBank has adjusted lending interest rates down twice, while reducing interest rates applied to preferential programs from 4 - 5%, especially for priority areas such as production and business and enterprises operating in the import-export sector.

This has contributed to promoting sustainable economic growth and supporting the business community to overcome difficulties. As of December 31, 2024, PVcomBank's credit balance reached VND 119,921.3 billion, a slight increase compared to the total outstanding balance in 2023.

In addition to effective business, the Bank also actively participates in social security work through practical and meaningful activities such as: supporting people affected by Typhoon Yagi; sponsoring funds to eliminate temporary and dilapidated houses for poor households and those in difficult circumstances...

Strong digital transformation, improving customer experience

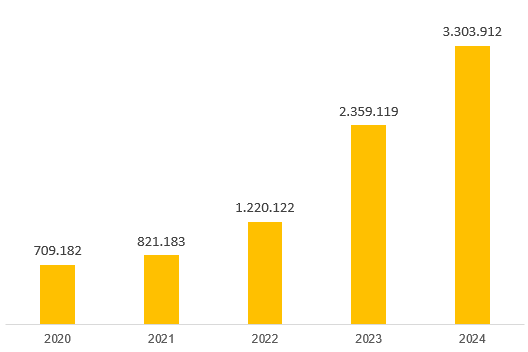

The number of PVcomBank customers has reached 3.3 million customers in 2024. In the context of the current strongly competitive financial - banking market, the fact that an average-sized bank can expand nearly 1 million customers in just one year is a clear demonstration of its ability to effectively exploit the partner ecosystem.

This impressive result is thanks to PVcomBank's outstanding advantages, especially the well-invested digital platform, contributing to improving user experience and promoting the development of modern financial products.

As one of the pioneering banks in deploying the service of opening payment accounts and issuing direct debit cards on the VNeID application of the Ministry of Public Security, PVcomBank has marked an important step in the digital transformation journey and enhancing the customer experience.

Connecting the banking ecosystem with the national database through the VNeID platform not only helps optimize security, but also simplices administrative procedures, improves service quality and brings practical benefits to both people and businesses.

In addition, with the PVConnect digital banking platform, customers can experience more than 200 outstanding features - from online international money transfer, refund shopping, card limit adjustment, automatic bill payment to conducting non-financial transactions via Video Call...

For institutional customers, in 2024, PVcomBank launched the PVConnectbiz market - a superior digital banking platform with many advantages such as: applying AI to enhance identification, making transactions faster and more accurate; improving transaction processing efficiency through a channel-based banking system that meets international standards; improving the ability to automatic service monitoring from the system, monitoring and preventing risks...

In the comprehensive digitalization journey, PVcomBank not only focuses on customer experience but also focuses strongly on modernizing and automating internal operating processes. PVcomBank is one of the pioneering credit institutions participating in implementing technical adjustments to transfer money according to NAPAS's 2.0 standard.

In addition, the bank has been cooperating with strategic partners who are leading technology companies in the world, specifically: launching a project to deploy the Customer Data Platform (CDP) with customer customer customer skills (CSP) partners, digitizing processes using CS4BA platforms...

With the achieved results, PVcomBank has been honored by The Asian Banking and Finance as "Best Digital Transformation Bank", "Bank with effective digital products for small and medium-sized enterprises" ...

Resolutely achieve the goal of effective, safe and sustainable development

2025 is a year predicted with many intertwined opportunities and challenges for the global economy as well as Vietnam. For PVcomBank, inheriting the achievements it has achieved, in 2025, the bank will continue to implement restructuring according to the approved roadmap, aiming for sustainable growth and improving operational efficiency.

Regarding the business plan for 2025, PVcomBank sets a consolidated revenue and pre-tax profit target of VND199,949 billion and VND111 billion, respectively.

At the end of the Congress, reports from the Board of Directors, the Executive Board, the report on the 2025 business plan and the 2024 financial report, along with a series of other reports, were approved by shareholders at an almost absolute ratio.