Difficult core operations

International Investment, Trade and Service Joint Stock Company (ILS) was established in April 1980 and was initially a state-owned enterprise under the Hanoi People's Committee.

In 2016, the Company changed to the model of a Joint Stock Company according to Decision No. 6955/QD-UBND of the Hanoi People's Committee.

As of June 2025, the state still owns up to 45% of ILS capital. However, from ILS's financial picture, it shows that this enterprise has not operated effectively after equitization, with many years of prolonged losses and low profits when there are.

In the period of 20152022, enterprises have suffered losses of up to 5 out of 8 years, of which 2021 and 2022 recorded deep losses of VND 17.4 billion and VND 18.6 billion, respectively. In previous years, although the loss was lower, it lasted consecutively, from 5.9 billion VND in 2015 to 3.6 billion VND in 2019.

Entering the first quarter of 2025, profits fell sharply, to only VND 445 million and VND 3.2 billion in the first half of the year. These figures show that the business situation has not really escaped the difficult period.

Recorded net revenue in the second quarter of 2025 reached 42.6 billion VND, up 15.7% over the same period last year. Gross profit reached nearly 7 billion VND, not much fluctuation compared to the same period.

However, the gross profit margin decreased from 18.75% to 16.4%, showing lower profit on revenue than the same period. After deducting expenses, net profit from business operations reached only 1.7 billion VND, down more than 22%.

However, thanks to other income from contract fines and debt settlement, profit after tax in the second quarter reached VND2.8 billion, up nearly 15% over the same period. Of which, the profit belonging to shareholders of the parent company reached 2.5 billion VND.

Accumulated in the first 6 months of 2025, ILS achieved revenue of VND 73.5 billion, down slightly compared to the same period last year. Of which, revenue from service provision accounts for mainly VND54.7 billion, the remaining VND18.7 billion comes from sales of goods. Revenue decreased but after-tax profit still increased to 3.2 billion VND thanks to large contributions from other income, reducing interest costs, instead of efficiency in core business operations.

Accumulated losses continue

Regarding capital structure, the total outstanding debt of ILS as of June 30, 2025 was VND 369.9 billion, accounting for more than 51% of total capital. Of which, short-term debt was at VND 114.4 billion, down nearly 48% compared to the beginning of the year.

However, long-term debt skyrocketed to VND255.4 billion, 1.7 times higher than at the beginning of the year. Long-term financial loans and rents alone have increased dramatically from 1.2 billion VND to 16.7 billion VND; while other long-term repayments have also increased sharply from 143.2 billion VND to nearly 234 billion VND.

equity as of June 30, 2025 reached VND351 billion, almost unchanged compared to the beginning of the year. The entire capital contribution of shareholders is still kept at 360 billion VND.

Notably, the enterprise is recording a cumulative loss of VND61 billion, as of the end of the second quarter of 2025. This is the net loss after tax accumulated over many years.

Many ILS capital items are at risk

Another issue of concern is that ILS is having to set aside large reserves, which poses a potential risk of losing investment capital.

According to ILS' financial report dated June 30, 2025, ILS' total consolidated assets reached VND 720.9 billion, up slightly compared to the beginning of the year. Of which, short-term assets increased by 23.3% to VND162.6 billion, mainly due to money and money equivalent increases sharply to VND20.7 billion.

Short-term receivables also increased by nearly 20%, to VND 135.9 billion, with customers' receivables alone accounting for more than VND 99 billion.

Notably, the company is setting aside short-term and difficult-to-request reserves of up to VND66 billion, equivalent to more than 66% of receivables from customers, showing high credit risk even though the reserve value has decreased slightly compared to the beginning of the year. However, ILS did not explain this clause in detail.

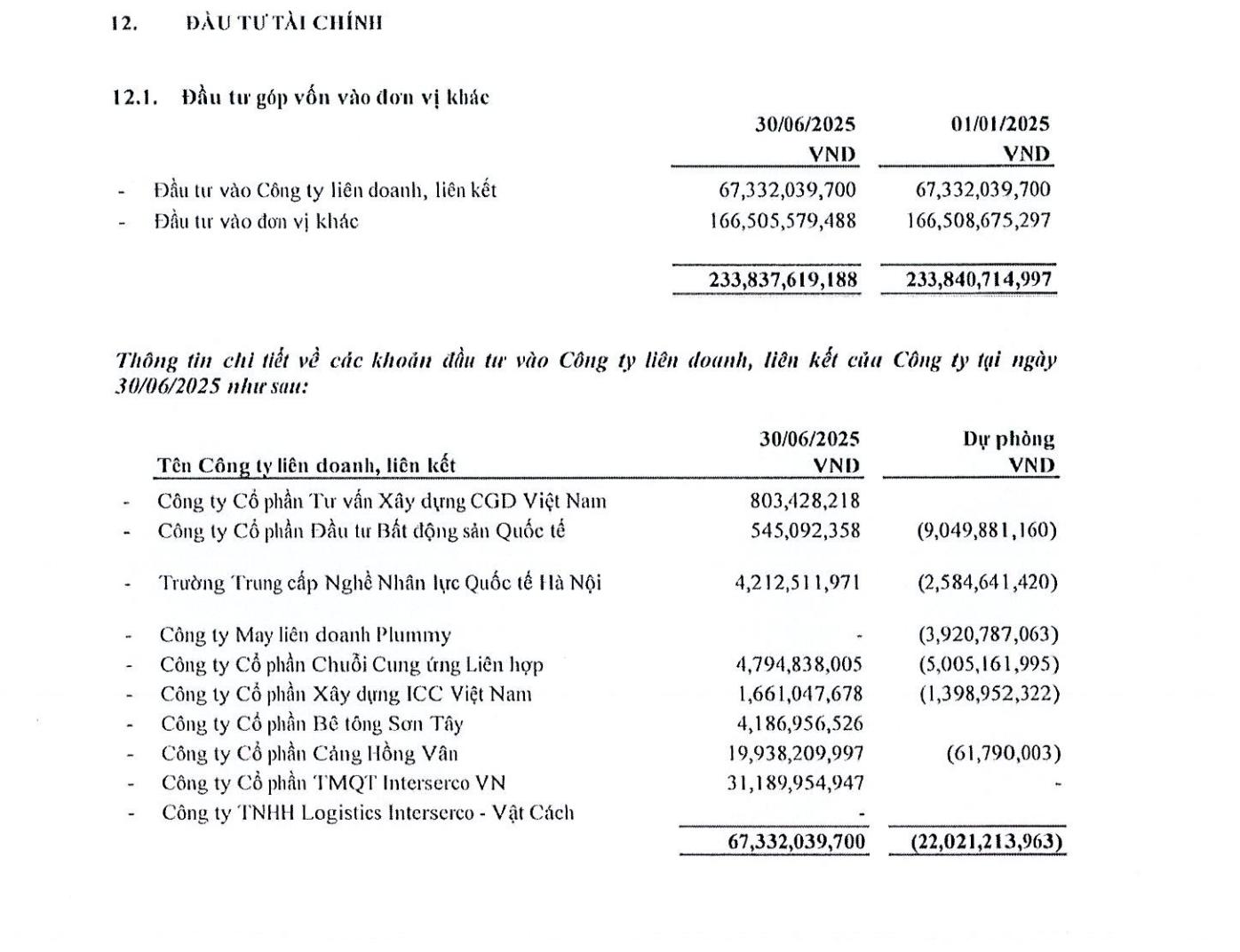

In contrast, long-term assets decreased slightly by 4.7%, down to VND558.3 billion. The long-term financial investment portfolio is stable at VND 229.6 billion, including VND 67.3 billion invested in joint ventures and associates and VND 166.5 billion invested in other units.

At the time of reporting, ILS was contributing capital to 10 joint ventures and associations with a total investment value of 67.3 billion VND. However, most of these investments are ineffective and require large reserves.

Of which, the investment in International Real Estate Investment Joint Stock Company has a book value of VND545 million but has allocated a reserve of up to VND9 billion, 16 times higher than the remaining investment value. Similarly, the investment in Hanoi International Human Resources College is worth VND4.2 billion, with a reserve of more than VND2.58 billion; Supply Chain Joint Stock Company invests VND4.79 billion, with a reserve of VND5 billion.

The total value of provisions for investments in joint ventures and associates is up to 22 billion VND, while the remaining investment value is only 67.3 billion VND. This reflects that some investments have not met expectations and are at risk.

"Bury capital" in a large project

Most of the unfinished value is concentrated in the ICD My Dinh dry port construction investment project in the old Duc Thuong commune (now Hoai Duc commune, Hanoi), with a recorded value of nearly 267.3 billion VND.

The cost of basic unfinished construction also includes 1.89 billion VND, serving the renovation of the Vocational College and some repair items at Son Tay port.

Although there is no major change in the total unfinished investment value, the prolonged progress of key projects is putting great pressure on ILS's capital efficiency and long-term refinancing plan.

ILS's long-term asset structure shows a large proportion of long-term investment and assets under construction, while a large part of financial investments are facing the risk of losing capital, reflected in the high reserve allocation at many joint ventures and associate companies.