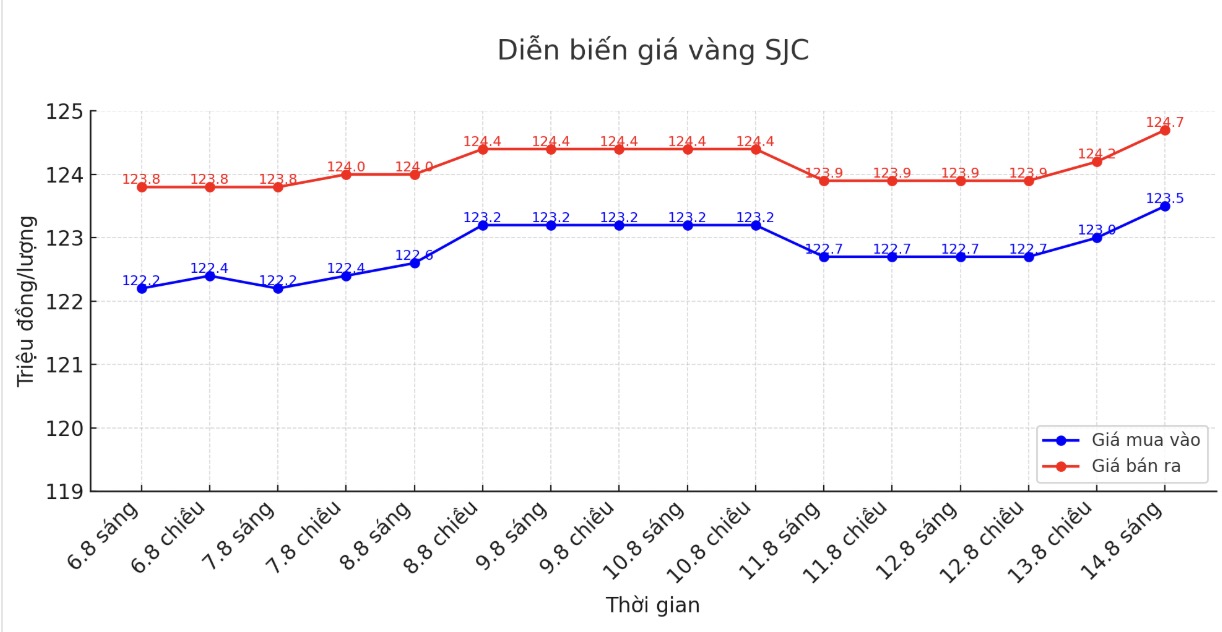

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND123.5-124.7 million/tael (buy in - sell out), an increase of VND800,000/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123-124.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.7-124.7 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

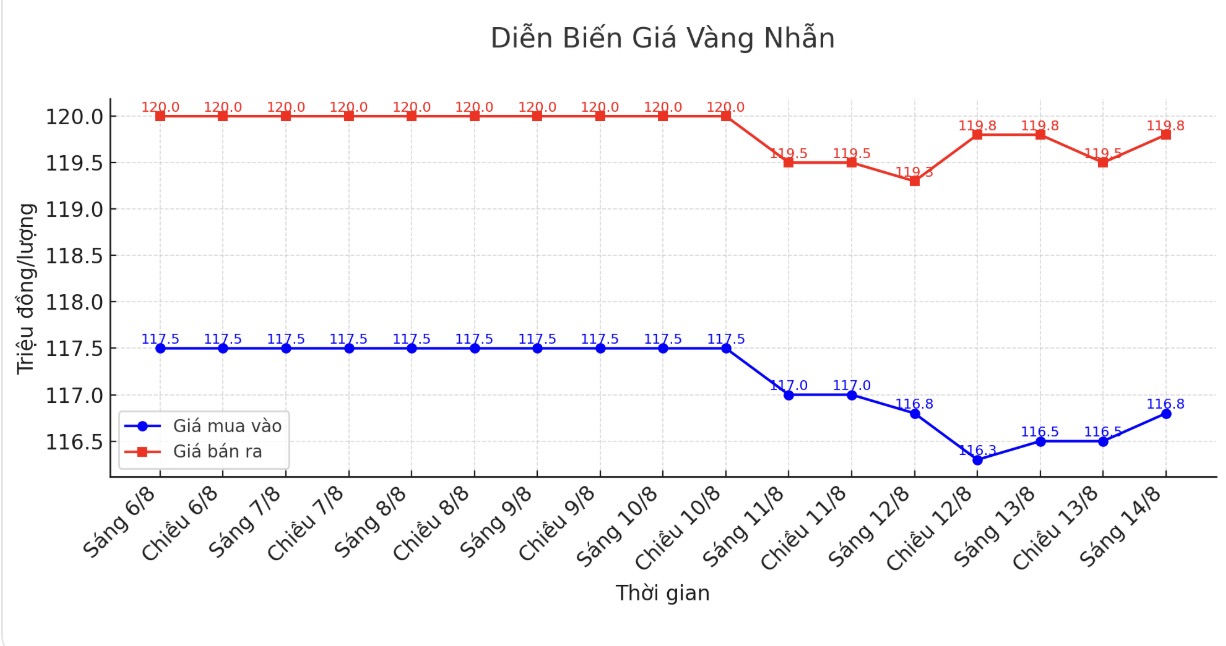

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 116.8-119 1.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and unchanged for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.8-119 1.8 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

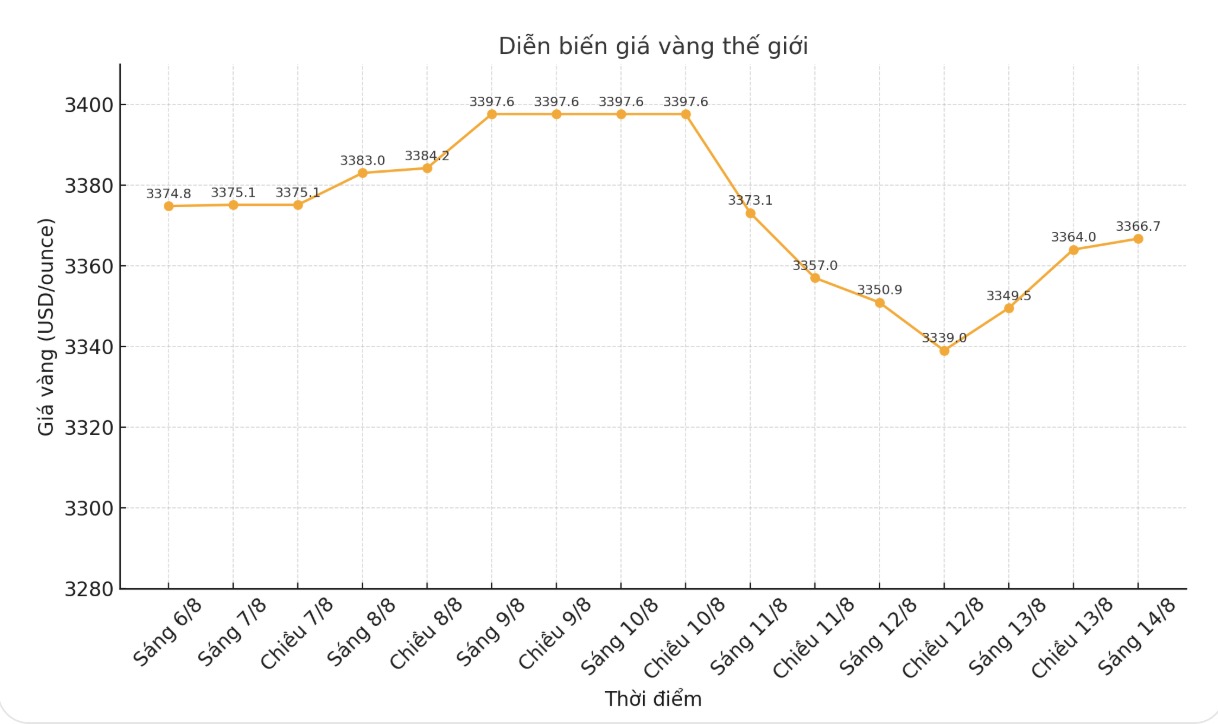

World gold price

At 9:05, the world gold price was listed around 3,366.7 USD/ounce, up 17.2 USD compared to a day ago.

Gold price forecast

World gold prices recovered, supported by the USD index falling to a three-week low and US Treasury bond yields falling in the middle of the week.

The gold and silver markets also recorded buying momentum as many Wall Street companies predicted that the US Federal Reserve (FED) would start cutting interest rates in September, in the context of a weakening labor market and maintained relatively low inflation.

Nomura economists forecast the Fed to cut key interest rates by 25 basis points at the FOMC meeting in September, followed by two more cuts in December and March. The market is also reflecting this expectation, with another decline expected in December.

US inflation data released on Tuesday showed the core index (excluding food and energy) increased 3.1% in July compared to the same period last year, slightly higher than the forecast but not considered a concern.

Larry Tentarelli - analyst at Blue chip Daily Trend Report, commented that inflation is still high, putting the Fed in a difficult position. Tensions between President Trump and the Fed over interest rate policy are shaking investor confidence. Any move that affects the Fed's independence could send gold prices soaring.

The disagreement between US President Donald Trump and the FED on maintaining or cutting interest rates has added to the market's instability. Analysts warn that if the Fed's independence is affected, confidence in the USD could decline, benefiting the gold market.

In a recent sharing, thorsten Polleit - Distinguished Professor of Economics at Bayreuth University and publisher of BOOM & BUST REPORT said that gold and silver are at an important structural breakout due to the uncontrolled growth of the paperback system.

There is a strong effort to search for safe-haven assets. People are increasingly skeptical about the purchasing power of all legal currencies, and this is clearly demonstrated in the global gold market, he said.

In the long term, Polleit said he would not be surprised if gold prices double in the next 5 to 10 years.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...