Goldman Sachs raised its gold price forecast for the end of 2026 to 5,400 USD/ounce, from the previous 4,900 USD, with the assessment that the private sector and central banks in emerging markets continue to expand their gold holdings.

Spot gold prices rose to $4,836.76/ounce in Thursday's trading session after a slight decrease in the morning trading session. This sheltered metal has increased by more than 11% since the beginning of 2026, extending last year's 64% breakthrough increase.

We assume that buying power comes from the private sector - a group of investors that diversify global policy risks and are factors that prevent gold prices from exceeding expectations in 2026, thereby raising our starting price forecast level" - Goldman Sachs stated in a report released on Wednesday.

This bank also expects the net buying volume of central banks to reach an average of 60 tons in 2026, in the context that many emerging countries are forecast to continue to shift foreign exchange reserves to gold.

Last week, Commerzbank also raised its gold price forecast for the end of this year to 4,900 USD/ounce, citing increased shelter demand.

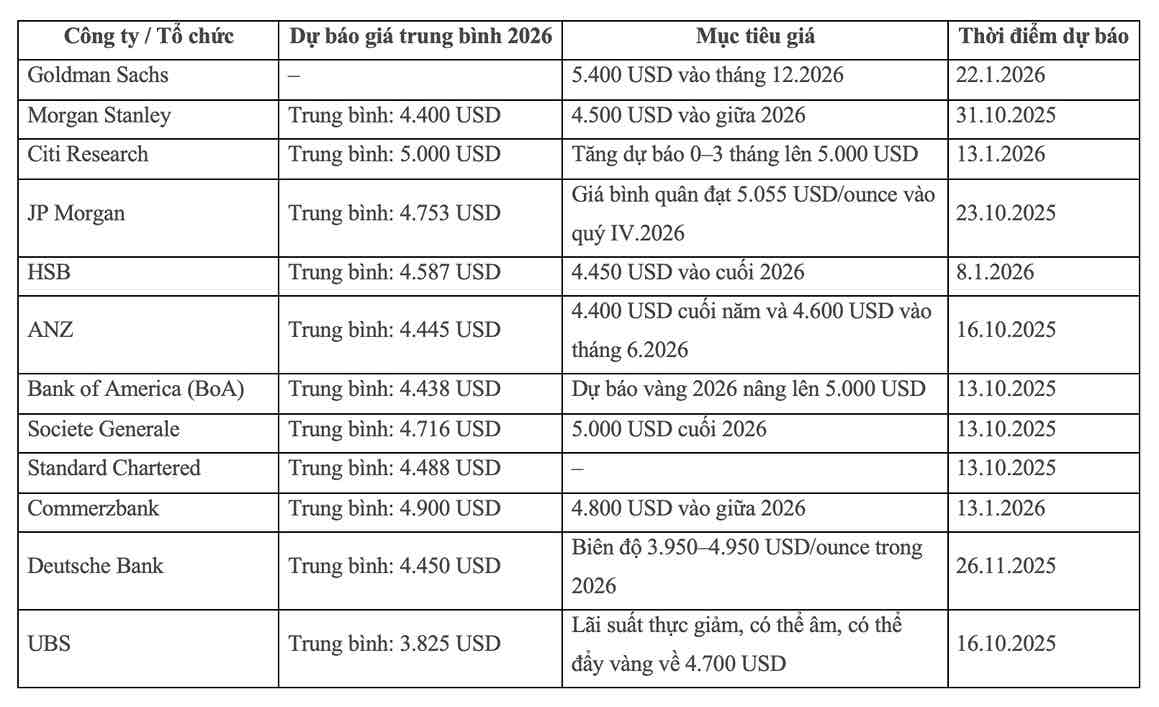

List of latest gold price forecasts by analysts (USD/ounce):