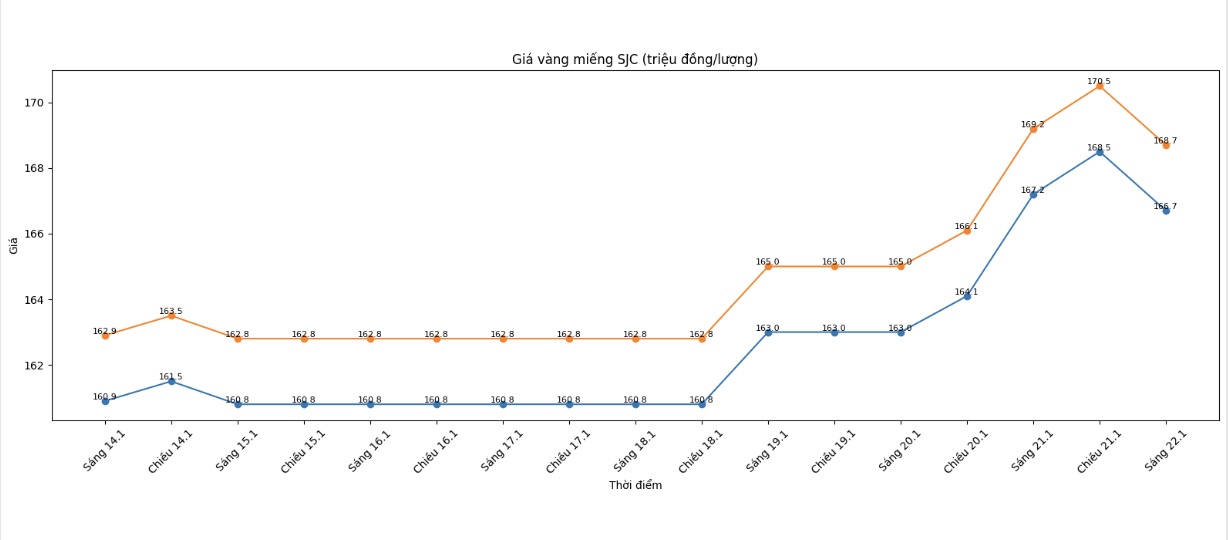

SJC gold bar price

As of 9:15 am, SJC gold bar prices were listed by DOJI Group at the threshold of 166.7-168.7 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 166-168.7 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2.7 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 166.7-168.7 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

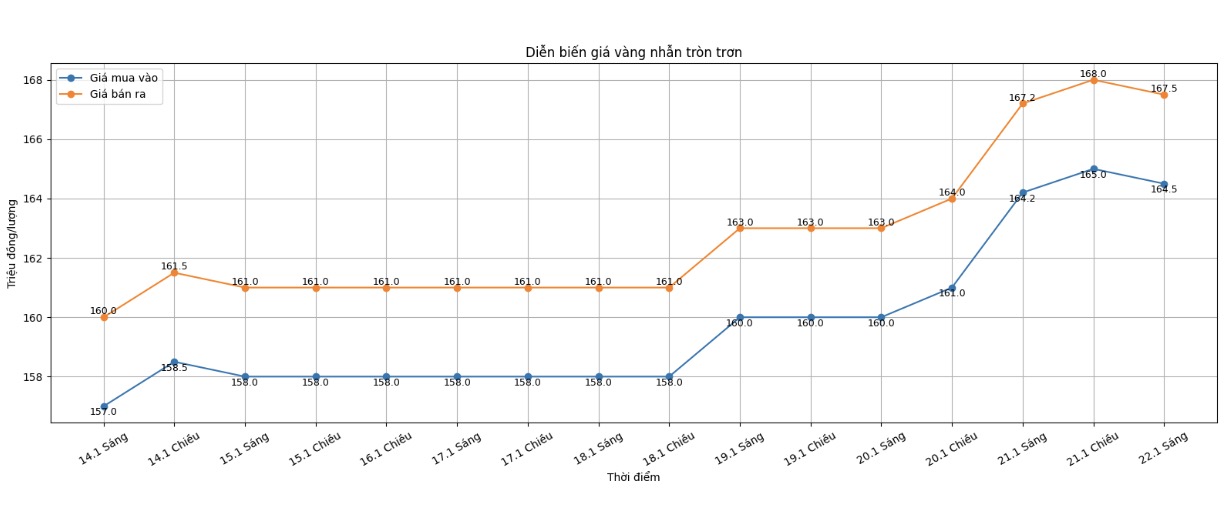

9999 gold ring price

As of 9:15 am, DOJI Group listed the price of gold rings at 164.5-167.5 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 1647-167.7 million VND/tael (buying - selling), an increase of 200,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 166-169 million VND/tael (buying - selling). The difference between buying and selling is 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

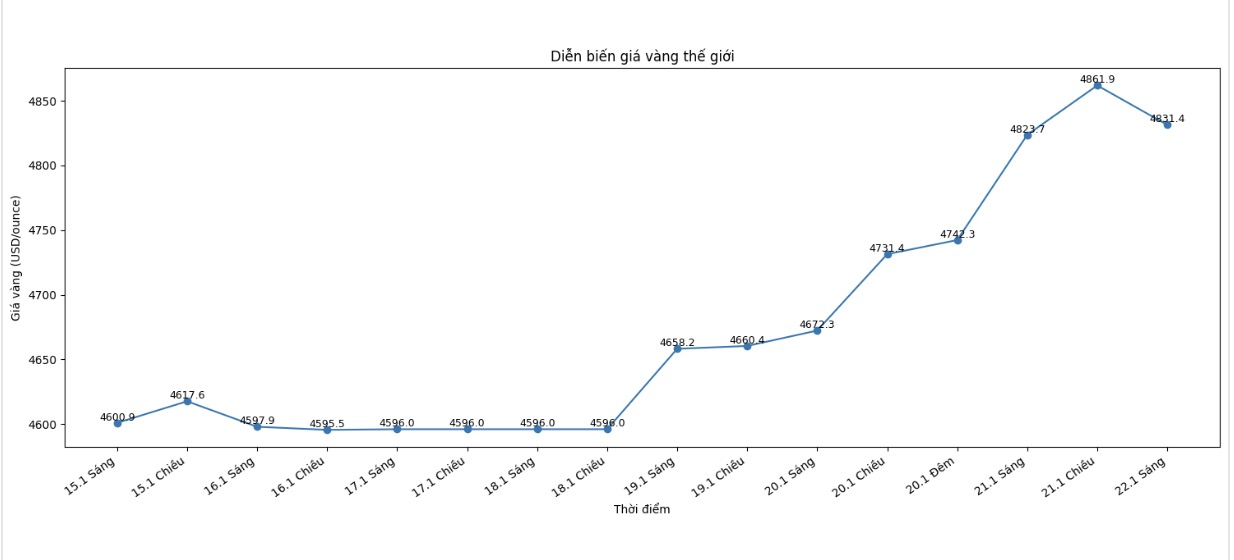

World gold price

At 9:26 am, world gold prices were listed around the threshold of 4,790.4 USD/ounce, down 33.3 USD compared to the previous day.

Gold price forecast

After a hot streak and consecutive record peaks, world gold prices have turned around and adjusted sharply in the most recent session. The main reason comes from the improved risk sentiment in the global market, after new statements by US President Donald Trump related to the Greenland issue.

Mr. Trump's withdrawal of tough statements, while ruling out the possibility of using force, has caused shelter demand to decline significantly, dragging gold prices down sharply, at times losing about 100 USD/ounce compared to the peak.

At the same time, the recovery of the USD and the strong increase in the US stock market have created more pressure on the precious metal. Cash flow tends to return to risky assets, while gold - which has benefited greatly from geopolitical concerns - temporarily loses short-term support momentum. According to analysts, in the context of improved risk appetite, gold prices are likely to face more fluctuations and technical corrections in the coming sessions.

However, many experts believe that this decline is not enough to change the long-term upward trend of gold. Mr. Ryan McIntyre - Senior Executive Partner of Sprott Inc. - said that the gold market has not yet attracted large cash flow from institutional investors. According to him, many organizations have only stopped at the "observation" and "orientation" stages, and have not really entered the action phase in the process of making capital allocation decisions.

Mr. McIntyre said that the paradox lies in the fact that gold prices have increased very strongly, but gold ETF funds, mining stocks and institutional capital flows are still quite sluggish. This shows that the gold market has not fallen into the late excitement phase of the cycle, but there is still room for further gains as large investors are forced to restructure their portfolios due to risks from public debt, bonds and prolonged inflation.

In the short term, gold prices are forecast to continue to fluctuate strongly according to political developments and the strength of the USD. However, in the medium and long term, many opinions still lean towards the scenario that gold maintains an important safe-haven asset position, especially when the fundamental instabilities of the global economy have not been thoroughly resolved.

Notable economic data of the week

US President Donald Trump speaks at WEF, US announces data on houses waiting for sale

US announces Q3 GDP (last figures), PCE index, weekly jobless claims

US S&P's preliminary PMI index of manufacturing and services

Gold price data is compared to the previous day.

See more news related to gold prices HERE...