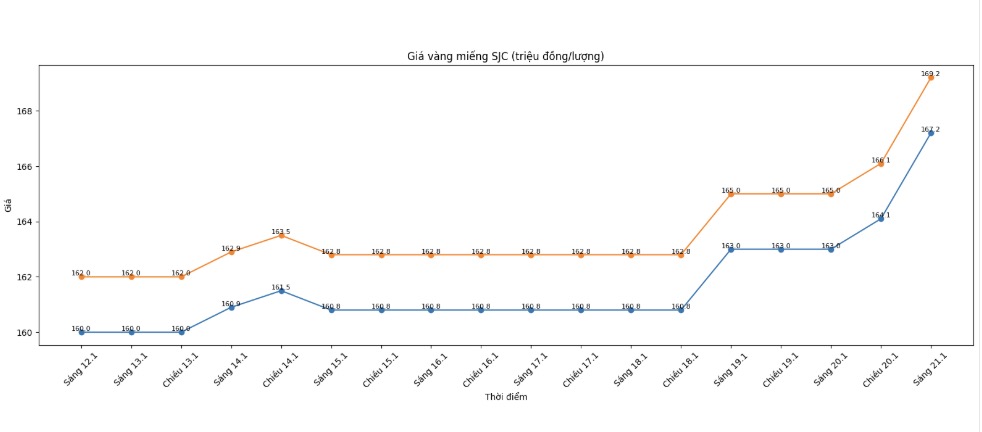

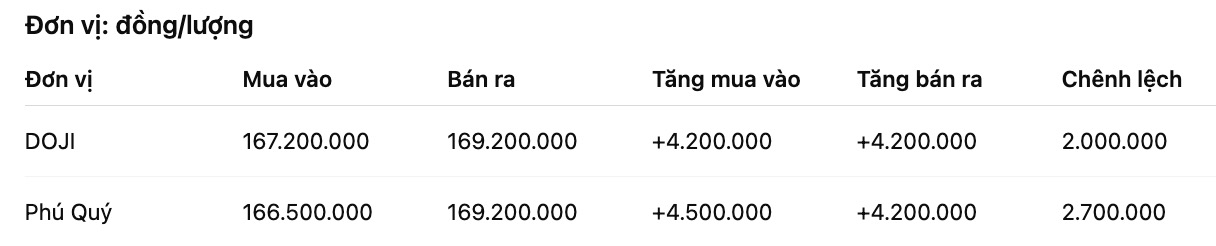

SJC gold bar price

As of 9:15 am, SJC gold bar prices were listed by DOJI Group at the threshold of 167.2-169.2 million VND/tael (buying - selling), an increase of 4.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 166.5-169.2 million VND/tael (buying - selling), an increase of 4.5 million VND/tael on the buying side and an increase of 4.2 million VND/tael on the selling side. The difference between buying and selling prices is at 2.7 million VND/tael.

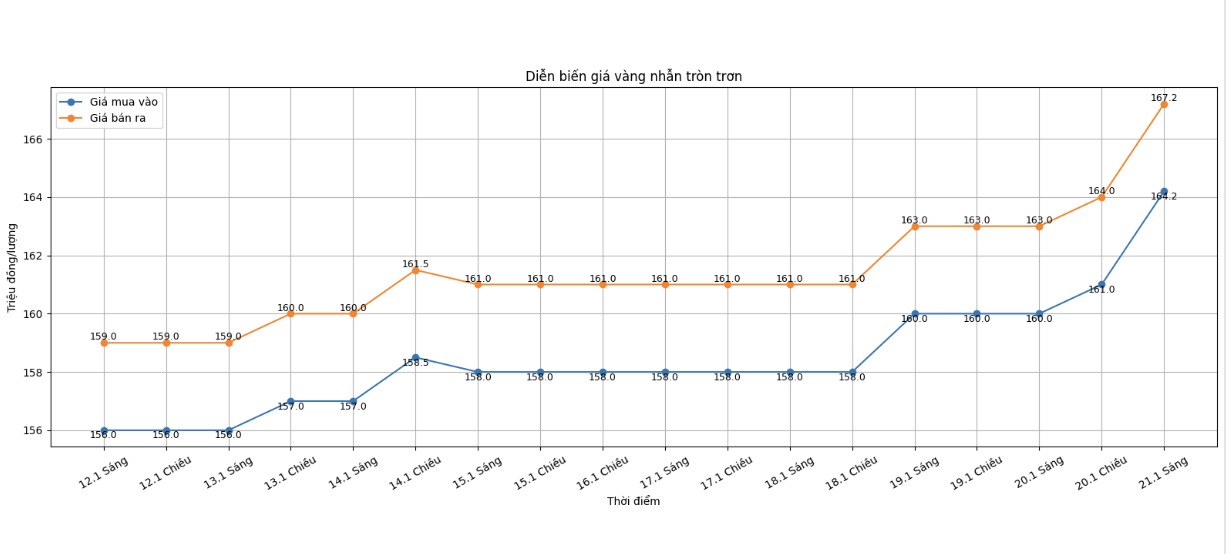

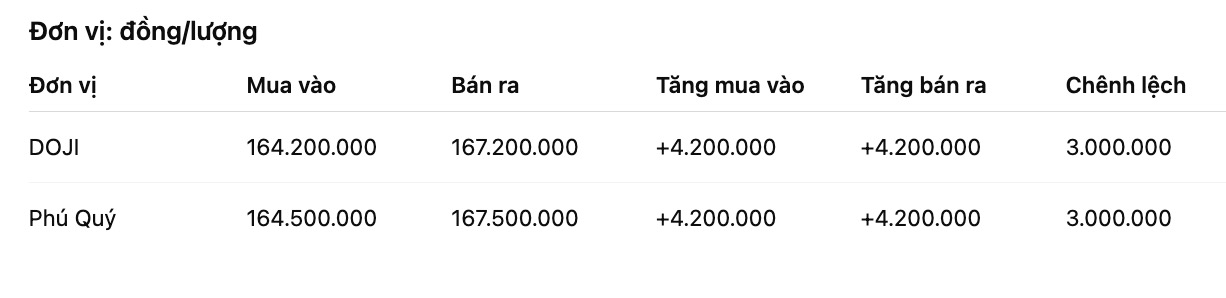

9999 gold ring price

As of 9:15 am, DOJI Group listed the price of gold rings at the threshold of 164.2-167.2 million VND/tael (buying - selling), an increase of 4.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 164.5-167.5 million VND/tael (buying - selling), an increase of 4.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

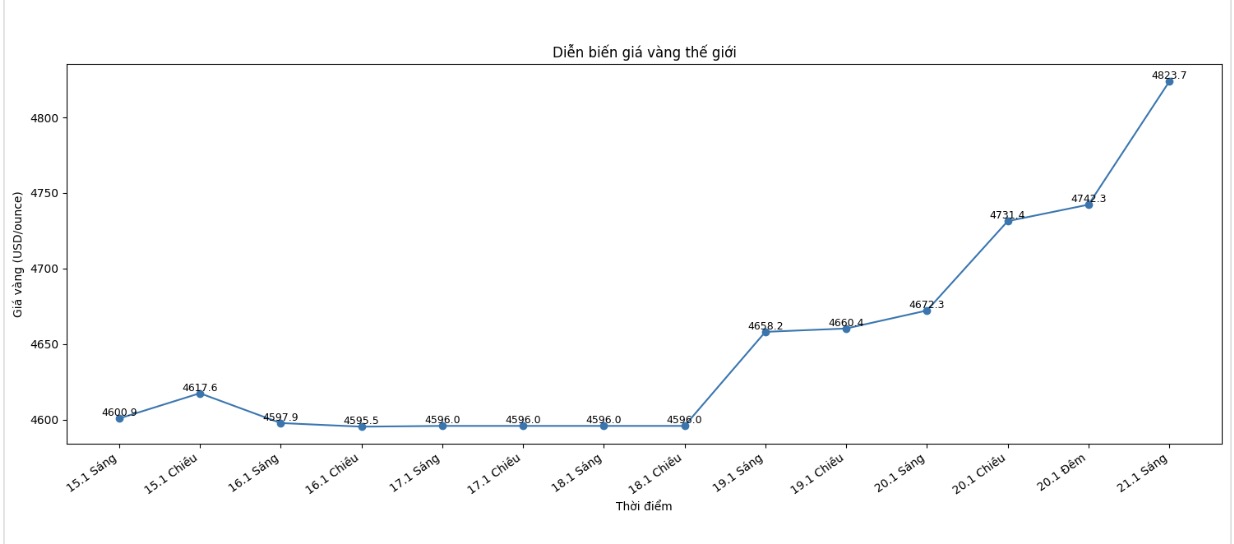

World gold price

At 9:22 am, world gold prices were listed around the threshold of 4,823.7 USD/ounce, up 151.4 USD compared to the previous day.

Gold price forecast

World gold prices are entering a period of strong fluctuations when they first surpassed the 4,800 USD/ounce mark, about half a year earlier than many previous forecasts. This development shows that defensive sentiment is clearly dominant in the global financial market, in the context of a series of increasing economic and geopolitical risks.

According to analysts, the increase in gold is not only temporary but is supported by many fundamental factors. Tensions between the US and Europe related to trade issues, tax policies and geopolitics continue to make investors turn to gold as a safe haven. In addition, instability in the stock and bond markets in many major countries also drives cash flow to move to precious metals.

Another important driving force comes from monetary policy expectations. The market is betting on the possibility that the US Federal Reserve (Fed) will begin a interest rate cut cycle in 2026. A low-interest environment often creates favorable conditions for gold – a non-profit asset – to maintain its attractiveness in the medium and long term.

Mr. Aakash Doshi - Head of Gold Strategy at State Street Investment Management, said that although gold prices are in a high zone, the long-term upward trend has not been broken. According to him, short-term corrections or sideways phases are unavoidable, but do not change the general outlook. "The probability of gold reaching the 5,000 USD/ounce mark in the next 6–9 months has increased significantly, possibly approaching 40%," Mr. Doshi said.

Meanwhile, many major financial institutions also expressed optimism about the prospects of gold. Previously, Morgan Stanley predicted that gold prices could reach 4,800 USD/ounce in the fourth quarter of 2026, but reality shows that the market has increased faster than expected. This reinforces the view that gold is entering a new price level, supported by persistent net buying demand from central banks and capital returns to gold ETF funds.

However, experts also recommend that investors be cautious of short-term fluctuations, as prices have increased rapidly in the short term. However, in the context of global economic and political instability that shows no signs of cooling down, gold is still considered an effective risk hedging channel, with positive prospects in the medium term.

Notable economic data of the week

US President Donald Trump speaks at WEF, US announces data on houses waiting for sale

US announces Q3 GDP (last figures), PCE index, weekly jobless claims

US S&P's preliminary PMI index of manufacturing and services

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...