recovery after the crisis and five rare losses

F88 Investment Joint Stock Company has just been officially granted a stock code since June 12, 2025, with more than 8.26 million registered shares. The company said it will complete the procedures to become a UPCoM in July, and aim to list HoSE within the next two years.

However, behind the advances in the capital market, F88 may face a series of pressures - not only from the need for transparency, but also from the problems inherent in the once controversial business model.

Looking back at 2023, F88 had to endure a serious crisis when the police simultaneously inspected branches in Ho Chi Minh City and many provinces and cities, leading to the temporary suspension of operations at some transaction points. Notably, 10 F88 debt collection staff were prosecuted for alleged extortion of customer property. Although the company later announced that it had "normallized operations", the incident has caused many consumers to begin to suspect about operating culture and service quality. Partners such as The Gioi Di Dong also announced the temporary suspension of financial cooperation.

At the same time, F88's 2023 financial report showed a post-tax loss of up to VND 528.8 billion, the reason being explained that the company had made a sudden high-risk provision. More than VND3,000 billion in outstanding loans were strictly controlled after F88 applied a policy of " erasing 100%" of debts overdue for 90 days, but this also caused the total credit cost to increase sharply. Although technically, the loss reflects the intentional "clearing of books", in the eyes of the capital market, this is still a big question mark about the quality of assets, especially when F88 is preparing to open the door to reach individual investors.

In 2024, F88 has recorded a recovery: after-tax profit reached 351.3 billion VND, revenue reached 3,347 billion VND. The net bad debt ratio and the cost/revenue ratio improved. However, if we go deep into the credit structure, some indicators show that pressure is still present.

During the year, F88 wiped out more than VND 2,143.8 billion in loans and purchase debts, recovering about VND 459.4 billion (about 21%). The provision for the end of the term reached VND48.9 billion - low compared to the amount ofold that has been handled. These are factors that the market is closely monitoring in the context of businesses preparing to go on the stock exchange.

Cost structure and capital pressure are still factors to monitor

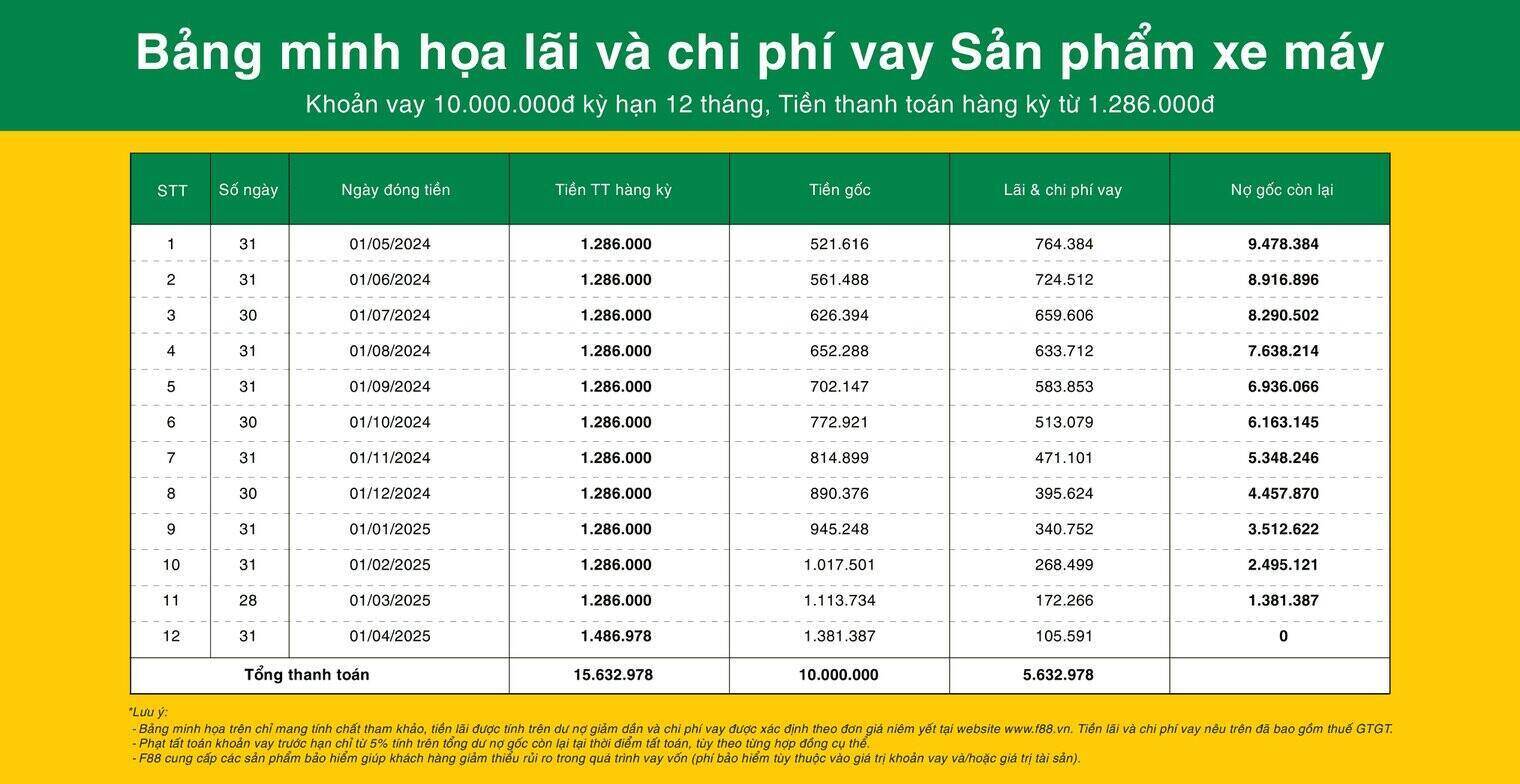

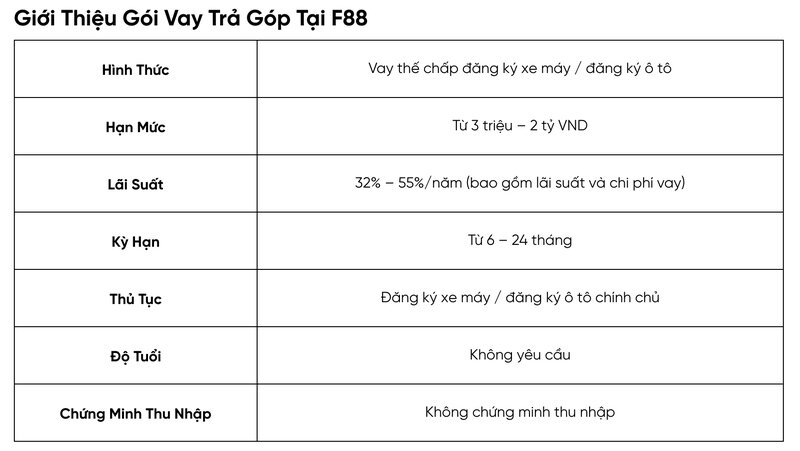

A report from Lendable - an international financial partner that has just poured in an additional 30 million USD in loan capital to F88 in the first quarter of 2025 - shows that F88 has an average Associatedateateate Credit Rate (APR) of up to 40-55%/year in many customer records.

In the explanation of the 2024 financial report, F88 said that the actual lending interest rate ranges from 1.1% to 1.6%/month, plus service fees from 3.4% to 5.4%/month, depending on the type of mortgaged assets and customer records. The total actual annual borrowing cost is equivalent to 54% to 84%/year, significantly higher than the credit level of commercial banks or large consumer finance companies.

Although businesses have repeatedly explained that the fee is within the general level of the consumer finance industry, the problem is that mass customers do not easily distinguish between interest rates and total borrowing costs.

In fact, most customers borrowing capital from financial chains like F88 often only care about the amount of money they have to pay monthly, paying little attention to the total annual loan cost. This creates a significant awareness gap between " danh tieng interest rates" and "real loan costs" - which include fees such as management, appraisal, loan insurance, etc. When misunderstanding arises, especially with loans with a total cost exceeding 45%/month, negative reactions from borrowers are likely to occur, even though all terms are clearly stated in the contract. This is a communication risk that any consumer finance enterprise cannot take lightly, especially when it has become a public company.

Not stopping there, F88's expansion strategy relies heavily on loans. In 2024, F88 issued bonds with a total value of more than VND 665 billion, in parallel with international loans from CLSA Lending Ark and Lendable worth more than VND 2,200 billion.

F88's total outstanding debt after 12 years is VND 3,308.5 billion, while equity reached VND 1,727.8 billion, corresponding to a financial leverage ratio of about 191.5% - significantly higher than the average among microfinance enterprises.

In the document sent to shareholders in May 2025, F88 announced a plan to increase charter capital to more than VND 1,100 billion through a plan to issue reward stocks at a ratio of 1:12. This move aims to expand equity, preparing for a listing roadmap on the HoSE.