The precious metal fell by 1.1% in the first session of the day, adjusting after three consecutive increasing sessions, bringing the price above $4,888/ounce on Wednesday. Mr. Trump announced the "Greenland framework" on social media after meeting with North Atlantic Treaty Organization (NATO) Secretary-General Mark Rutte, but did not provide further details.

Mr. Trump's toughness on Greenland earlier triggered a diplomatic crisis with Europe and caused the financial market to falter, thereby increasing the attractiveness of gold. After the latest announcement, the USD and the stock market partially recovered from the previous days' decline. The Bloomberg Dollar Spot Index - the measure of the strength of the USD increased by 0.1%.

Gold has increased by more than 70% in the past year, continuously setting new peaks and maintaining a breakthrough momentum in the first weeks of 2026. The upheaval of global geopolitical order accompanied by new attacks by the Trump administration targeting the Federal Reserve (Fed), eroding confidence in the USD and supporting precious metals.

However, Mr. Trump's efforts to fire Fed Governor Lisa Cook for unproven mortgage fraud charges have faced concerns from US Supreme Court judges in a hearing on Wednesday. Both conservative and liberal judges expressed doubts about this move, saying it could disrupt the Fed's independence and disrupt the market. The court is expected to issue a ruling in July.

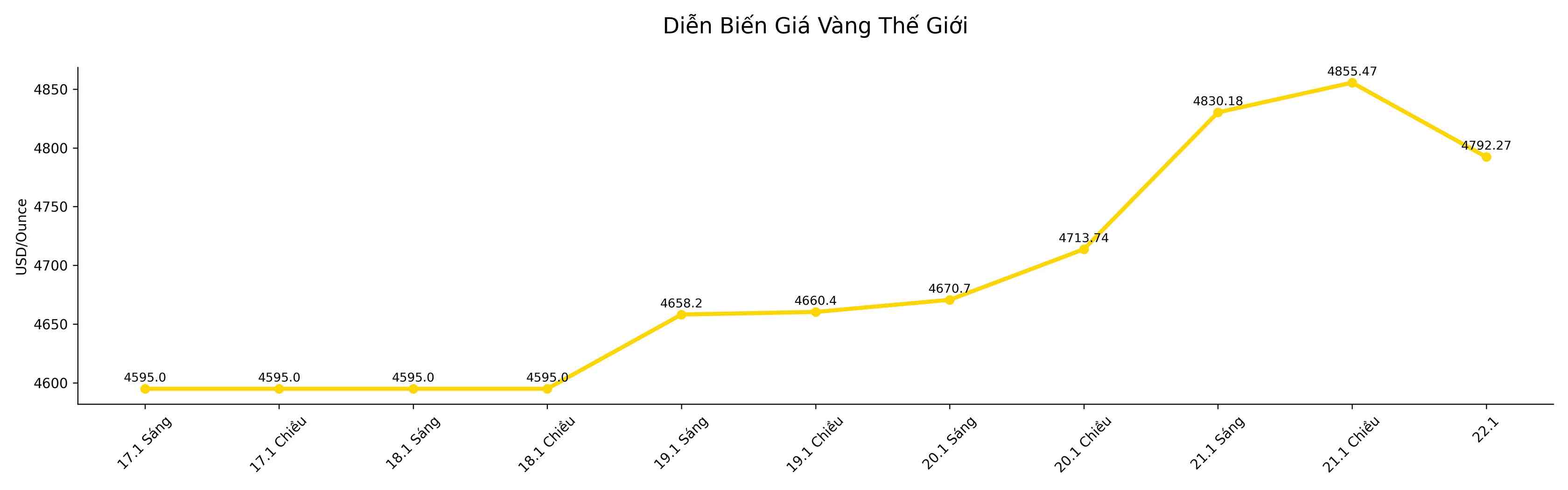

In this morning's trading session, spot gold prices fell 1% to 4,783.27 USD/ounce. Silver prices fell 2.1% to 91.13 USD/ounce. Platinum and palladium also simultaneously adjusted down.