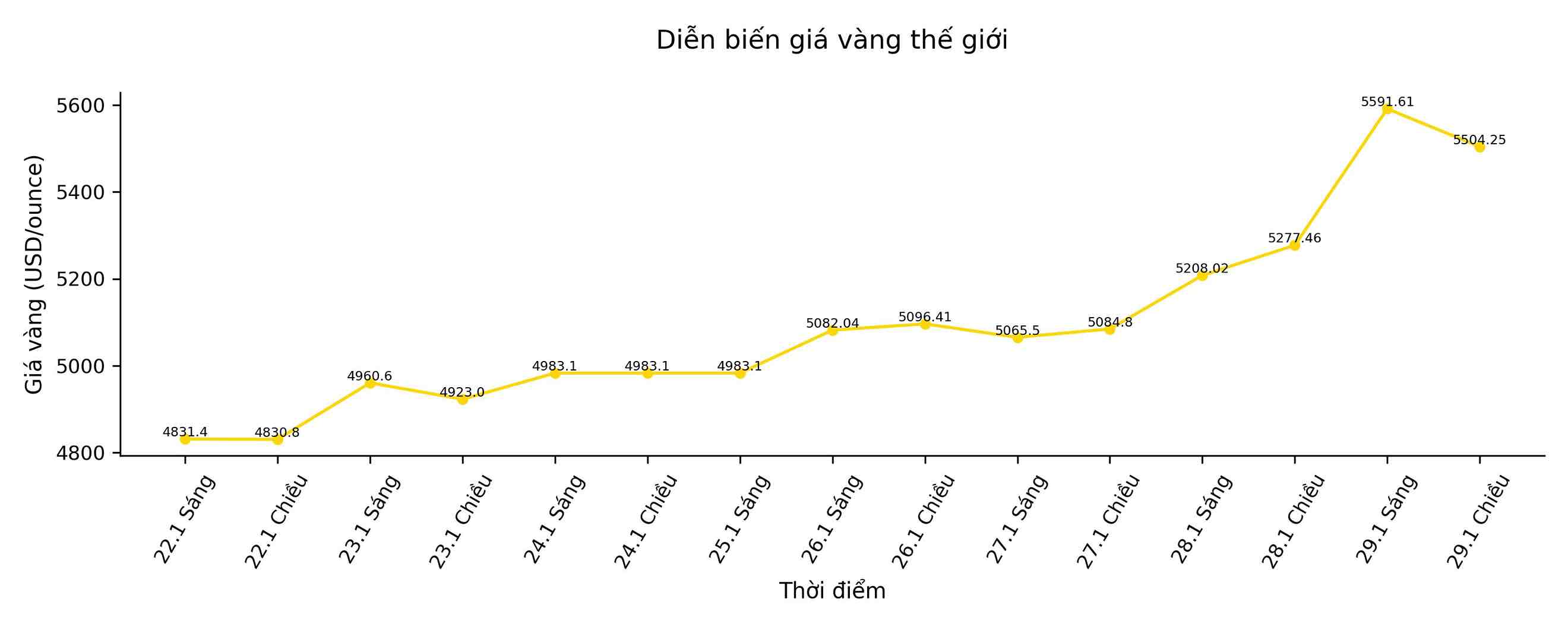

Last week, gold prices jumped to a record high of over $5,500/ounce, extending the "dizzying" rally to the ninth consecutive session, amid a weakening USD and investors massively withdrawing from government bonds as well as legal tenders to find shelter.

This precious metal at one point increased by 3.3%, following a 4.6% increase in the previous session – the strongest one-day increase since the peak of the Covid-19 pandemic in March 2020. Since the beginning of the year, the group of precious metals has climbed sharply in the face of increasing geopolitical tensions and concerns surrounding the independence of the US Federal Reserve (Fed), thereby strongly promoting "debasement trade". Silver also set a new historical high, surpassing 120 USD/ounce in Thursday's session.

The recent breakthrough of gold reflects a rare convergence of many pushes, not from a single catalyst," said Christopher Hamilton, Head of Customer Solutions for Asia-Pacific (excluding Japan) at Invesco. "The speed at which gold continuously breaks important price levels shows that confidence in traditional policy-making tools is eroding very quickly.

Since the beginning of the year, gold prices have increased by nearly 30%, while silver prices have increased by about two-thirds, marking a strong acceleration of long-term price increase cycles. However, according to Mr. Simon Biddle, Head of Precious Metals at Tullet Prebon brokerage company (under TP ICAP Group), the too rapid and prolonged increase has gradually narrowed the ability of banks to participate in the market, reducing liquidity and increasing volatility.

Banks do not have unlimited balance sheets to trade in precious metals" - Mr. Biddle said - "Transaction volume has decreased as they are forced to limit risks.

The latest increase occurred when traders no longer paid too much attention to the Fed's decision to keep interest rates unchanged at Wednesday's meeting – which had been predicted in advance – but stepped up bets on the possibility of the Fed shifting to a more moderate stance, a particularly beneficial factor for non-performance assets like gold. Notably, Rick Rieder of BlackRock – a supporter of stronger interest rate cuts – is emerging as the leading candidate to replace Fed Chairman Jerome Powell at the end of this year.

In addition, the "anti-devaluation trade" continues to support gold prices, in which the strong sell-off in the Japanese bond market last week is the latest evidence of concerns surrounding large fiscal spending. Speculation that the US may intervene to support the yen is also putting pressure on the USD, making the precious metal cheaper for most global buyers.

US President Donald Trump said this week that he is not worried about the USD weakening, even though the world's leading reserve currency has fallen to a nearly 4-year low. However, US Treasury Secretary Scott Bessent later affirmed that the administration supports a strong USD, while rejecting the possibility of intervention to sell USD to buy yen.

Recent moves by the White House from threatening to annex Greenland to military intervention in Venezuela have made the global market more unstable. The US also warned Iran to reach a nuclear deal or face military attacks, and in recent days has threatened to impose additional tariffs on South Korea and Canada.

Gold and silver are ultimate safe haven assets against extreme risks, as geopolitical fluctuations continue" - Mr. Hao Hong, Investment Director of Lotus Asset Management, and also a highly influential economic commentator in China, said - "Gold is the anchor of all valuations: as long as gold continues to rise, other precious metals will also rise.

Silver prices once increased by 3.2%, recording the sixth consecutive increase session. The excessive increase caused CME Group to raise margins for silver futures contracts on the Comex exchange, effective from the end of Wednesday's trading session. In China - where domestic silver prices have far exceeded international levels, the only pure silver investment fund has refused to receive new investors, while the Shenzhen government has established a working group to monitor the operation of a gold trading platform.

However, technical indicators are also sending warning signals: the relative strength index (RSI) of gold has exceeded 90, while of silver around 84. Usually, a level above 70 shows that assets have been overbought and may be about to enter a period of stagnation or correction.

As of this afternoon's trading session, gold prices fell 2.5% to 5,504.11 USD/ounce, after setting a historic peak of 5,597.47 USD/ounce earlier. Silver prices rose 1.3% to 118.21 USD/ounce. Platinum and palladium simultaneously went up, while the Bloomberg Dollar Spot Index fell 0.2% during the day and lost 1.3% throughout the week.