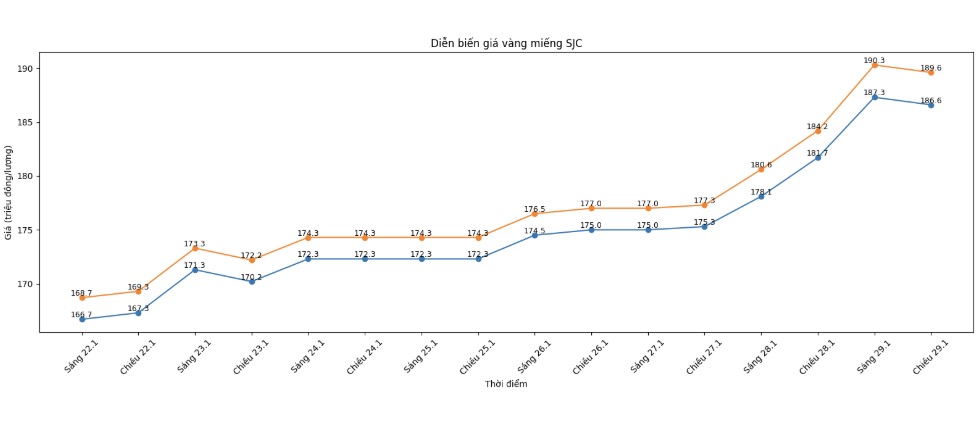

SJC gold bar price

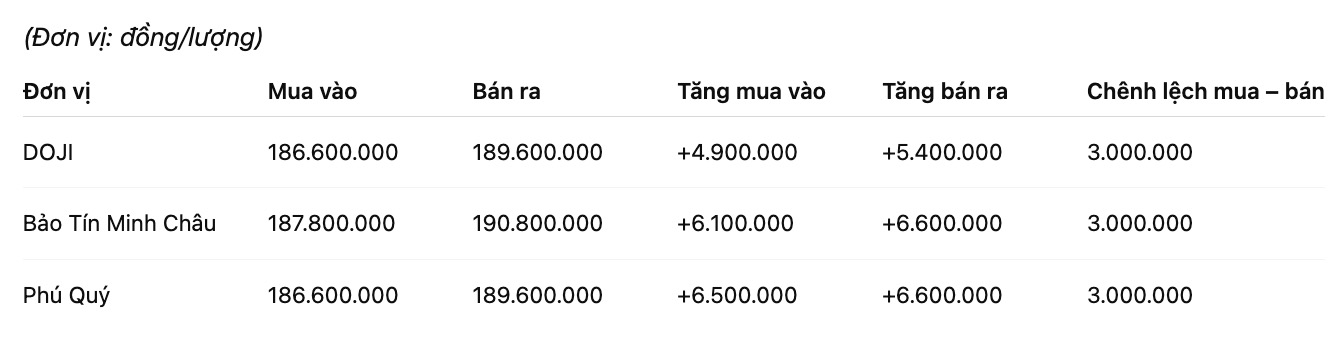

As of 5:30 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 186.6-189.6 million VND/tael (buying - selling), an increase of 4.9 million VND/tael on the buying side and an increase of 5.4 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 187.8-190.8 million VND/tael (buying - selling), an increase of 6.1 million VND/tael on the buying side and an increase of 6.6 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 186.6-189.6 million VND/tael (buying - selling), an increase of 6.5 million VND/tael on the buying side and an increase of 6.6 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

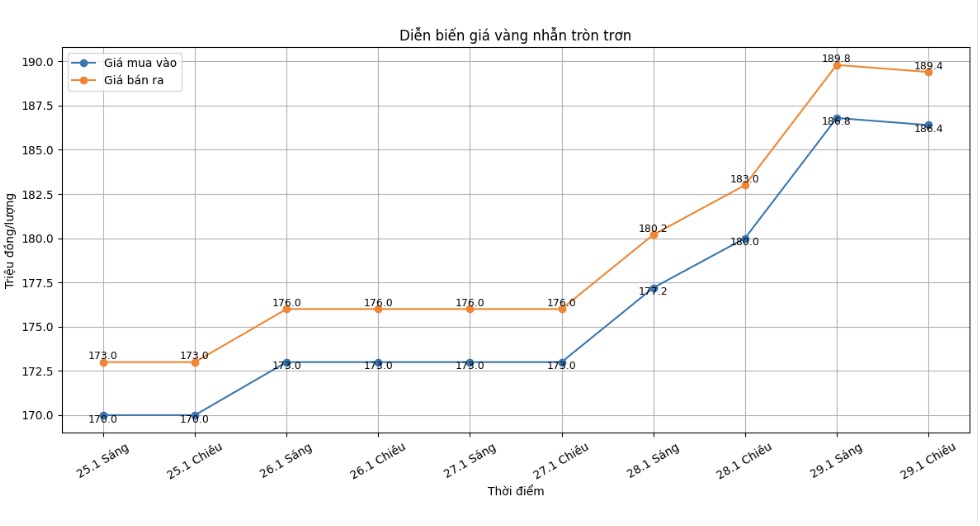

9999 gold ring price

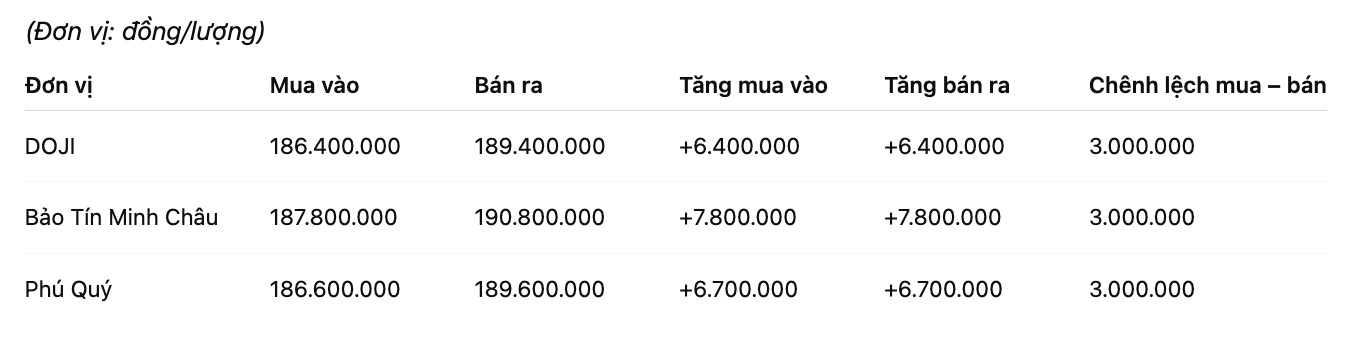

As of 5:30 PM, DOJI Group listed the price of gold rings at the threshold of 186.4-189.4 million VND/tael (buying - selling), an increase of 6.4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 187.8-190.8 million VND/tael (buying - selling), an increase of 7.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 186.6-189.6 million VND/tael (buying - selling), an increase of 6.7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

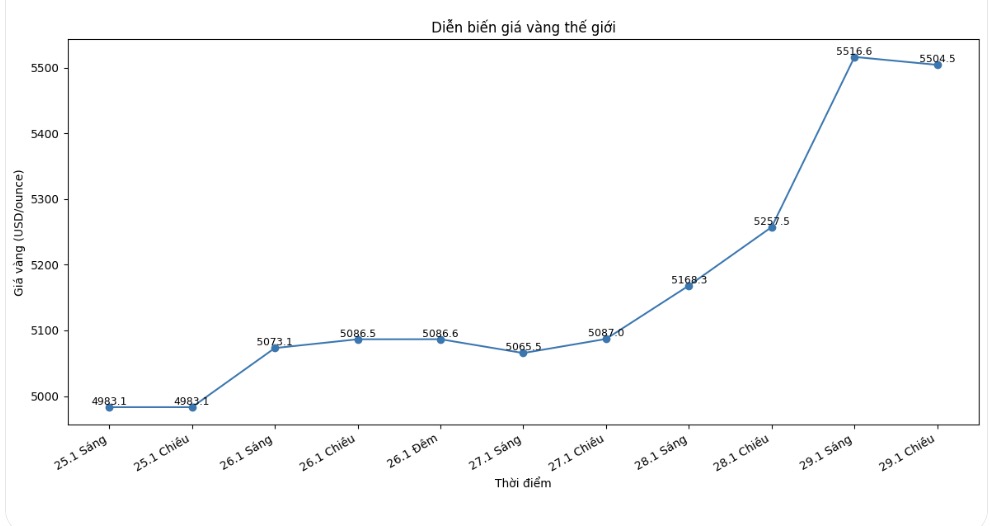

World gold price

At 5:36 PM, world gold prices were listed around the threshold of 5,504.5 USD/ounce; up 247 USD compared to the previous day.

Gold price forecast

The strong increase in world gold prices in recent times is not only due to the prolonged weakening of the USD, but also reflects the increasing concern of investors about geopolitical instability, especially the escalating tensions in the Middle East related to Iran.

The back-and-forth tough statements between the US and Iran, along with the risk of widespread conflict in a region that is already sensitive to global energy and finance, have made defensive sentiment clearly return to the market. In that context, gold continues to affirm its role as a safe haven asset, attracting cash flow whenever geopolitical risks increase.

Along with geopolitical factors, the weakening of the USD is creating important momentum for gold prices. The US facing large public debt pressure, high inflation and unclear monetary policy have raised concerns about the sustainability of the current monetary system. The trend of reducing the proportion of US assets in the global investment portfolio is considered one of the long-term drivers supporting precious metals.

According to Ms. Julia Khandoshko, Managing Director of Mind Money, although the market may witness technical corrections after a period of hot increase, the medium and long-term outlook for gold is still maintained positively. She believes that the dedollarization process is happening faster, while the demand for gold reserves from emerging economies continues to stabilize, helping gold play a key role in the context of increasing instability.

From a geopolitical perspective, Mr. Edward Meir, an analyst at Marex, said that tensions related to Iran and the risk of regional conflict may cause the global financial market to fluctuate more strongly in the near future. According to him, when geopolitical risks have not shown signs of cooling down, gold is likely still the priority choice of defensive cash flow.

In the short term, the market may witness volatile sessions when profit-taking forces appear in high price areas. However, with the current macroeconomic context, adjustments are assessed to be likely only temporary and may open up accumulation opportunities for long-term investors.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...