Both precious metals benefit greatly from the decline of the greenback. More and more experts are questioning the long-term role of the USD as a key global reserve currency.

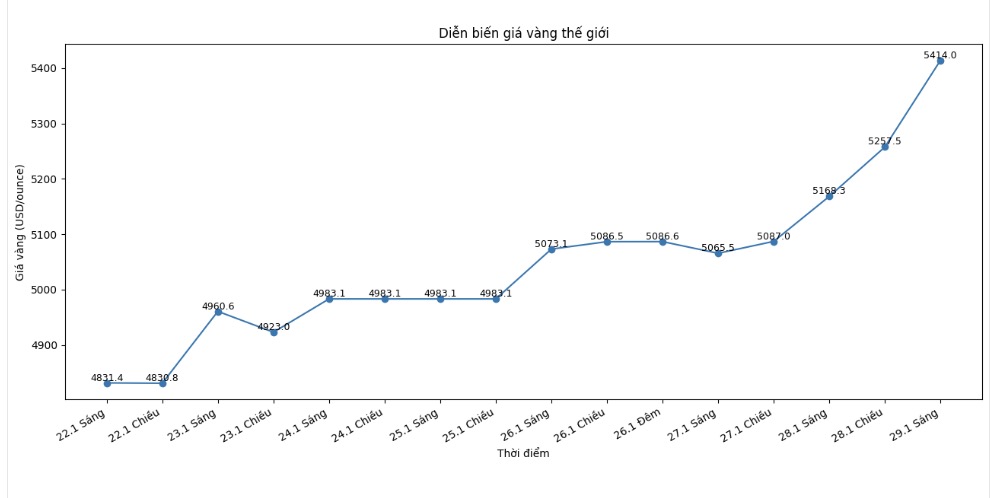

Silver prices this morning, January 29, surpassed the 116 USD/ounce mark, while gold prices traded around 5,414 USD/ounce, as the market continued to absorb geopolitical instability and increased economic fluctuations from US administration policies.

Ms. Julia Khandoshko - Managing Director of Mind Money, said that although gold may face a short-term correction, the long-term upward trend has not been broken.

We are witnessing a faster dedollarization process, stable demand from developing economies and continued global monetary easing. Besides, concerns about the sustainability of US public debt and geopolitical tensions, such as new tariff measures. These factors continue to support the safe haven role of gold," she said.

Analysts also believe that gold and silver are benefiting from the psychological wave of US asset ratio reduction returning, starting in April 2025, when the US implements tough trade measures to narrow the trade deficit.

According to Linh Tran - market analyst at XS.com, the increasingly important role of gold is clearly reflected in the global reserve structure.

In the context of the entire global financial system, it can be seen that gold prices are rising not only due to short-term market concerns, but also due to changes in confidence in the global monetary and fiscal order. This is not a temporary shock, but a process of repositioning gold's role in the system" - she wrote in the report - "Gold's outlook will not depend on a single factor such as interest rates or USD, but is linked to the overall stability of the global financial system".

The weakening momentum of the USD is quite clear. In 2025, the USD index recorded one of the strongest declines in more than 50 years, losing about 9.4% from nearly 108.5 points at the end of 2024 to about 97.3 points at the end of the year.

This trend continues to extend to the beginning of the new year, with the USD falling nearly 2% in January. This week, the USD index continued to fall to its lowest level in many years, at 95.55 points.

The weakening USD is taking place in the context that US officials are not too concerned about this development. However, experts warn that the impact of a weak currency is not simple and is continuing to strengthen the attractiveness of gold as a tool to prevent inflation and preserve asset values.

Mr. Aaron Hill - Head of Market Analysis at FP Markets - said: "A weak USD can support exports, but at the same time increase inflationary pressure. When the USD depreciates, imported goods become more expensive, business input costs increase and may eventually be transferred to consumers. Instability in current policies makes investors more cautious about US assets, thereby creating more downward pressure on the USD.

Not only USD, confidence in legal tenders in general is also showing signs of decline. The market is still sensitive to recent fluctuations in the Japanese bond market, raising concerns about liquidity risks in the global financial system.

Mr. Guy Wolf - Head of Global Market Analysis at Marex - said that concerns about currency devaluation globally may continue to support gold prices for many years to come, as the portfolio redistribution process gradually takes place.

“Individual investors are returning to gold as a tool for monetary risk hedging and insurance against geopolitical instability, high stock market valuations and macroeconomic risks. Gold's upward momentum is not only due to the weakening USD, but also reflects the erosion of confidence in legal tender globally, as gold appreciates in most currencies,” he said.

Regarding prospects, Mr. Nitesh Shah - Head of Commodity Research and Macroeconomics at WisdomTree, said that gold prices may still increase significantly from now until the end of the year. According to him, WisdomTree's models continue to recommend investors allocate 15-20% of their portfolio to gold.