World gold prices fell on Tuesday but still stood firm above the 5,000 USD/ounce mark, as investors maintained a cautious sentiment in the face of a series of important US jobs and inflation data expected to be released this week - factors that could orient the interest rate roadmap of the US Federal Reserve (Fed).

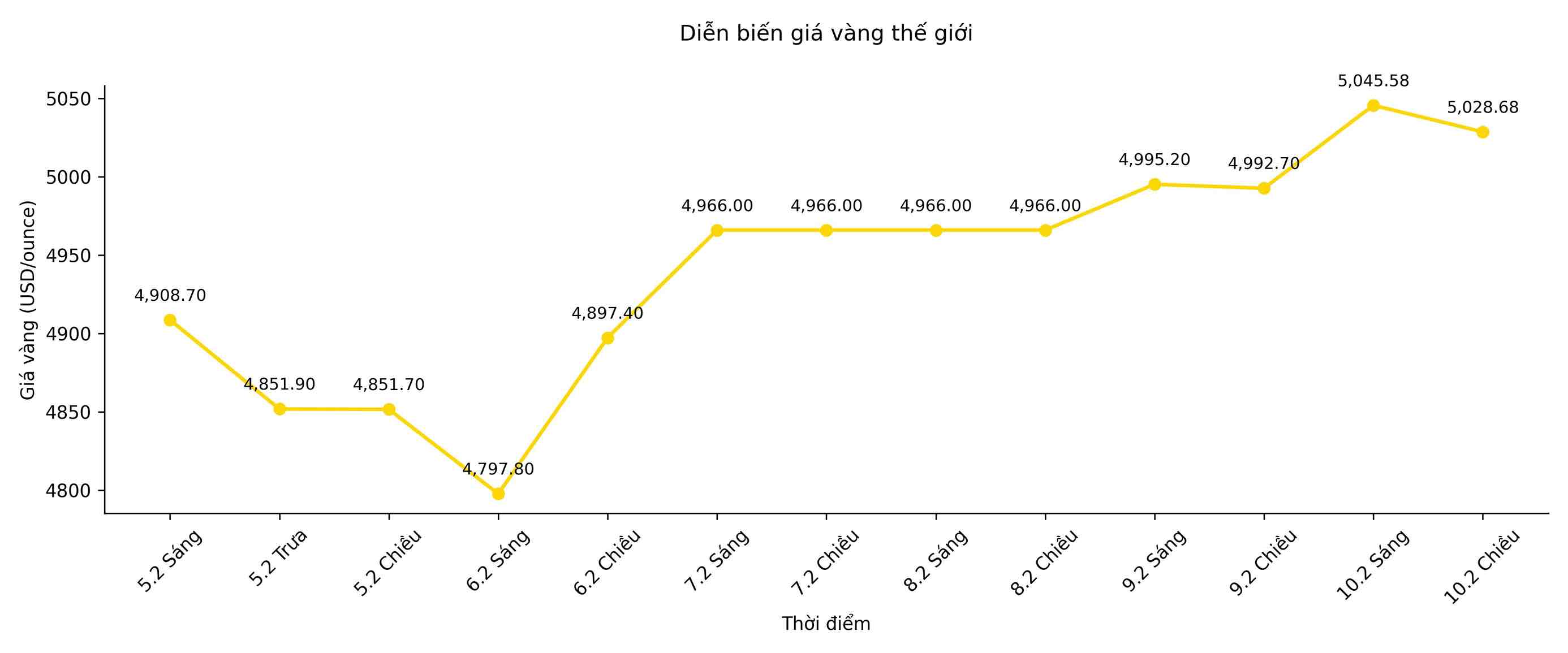

Spot gold prices fell 0.7% to 5.028.68 USD/ounce in this afternoon's trading session. Previously, this precious metal had increased 2% in Monday's session, as the USD weakened to its lowest level in more than a week. On January 29, gold prices once hit a historical peak at 5,594.82 USD/ounce.

On the futures market, US gold for April delivery fell 0.5%, to 5,052 USD/ounce.

Spot silver prices fell sharply by 2.1%, to 81.64 USD/ounce, after jumping nearly 7% in the previous session. This metal also once set a historical peak at 121.64 USD/ounce on January 29.

Commenting on market trends, Mr. Ilya Spivak, Head of Global Macroeconomics at Tastylive, said that "Cold War" tensions and economic competition between the US and China will continue for many years, thereby creating long-term support for gold. However, in the short term, the market is still considering the extent of the impact of Fed monetary policy expectations.

Gold prices are currently pulled back to the 5,000 USD zone from both the top and bottom, while silver shows greater volatility due to speculation" - Mr. Spivak added.

Meanwhile, the USD continued to face downward pressure in Tuesday's session, while the yen maintained its upward momentum after the overwhelming victory in Japanese Prime Minister Sanae Takaichi's election.

Commenting further on the US economic outlook, White House economic advisor Kevin Hassett said that job growth in the US may slow down in the coming months, due to slow labor growth and improved labor productivity - factors being discussed within the Fed.

Currently, investors expect the Fed to have at least two interest rate cuts, each of 25 basis points in 2026, with the first cut possibly taking place in June. In a low interest rate environment, gold - a non-rotating asset - is often beneficial.

This week, the market will focus on monitoring important US economic data, including December retail sales, January consumer price index (CPI) and January non-farm payrolls report.

In other precious metals, platinum prices fell 2.1% to $2,084.09/ounce, while palladium lost 1.7%, to $1,710.75/ounce.