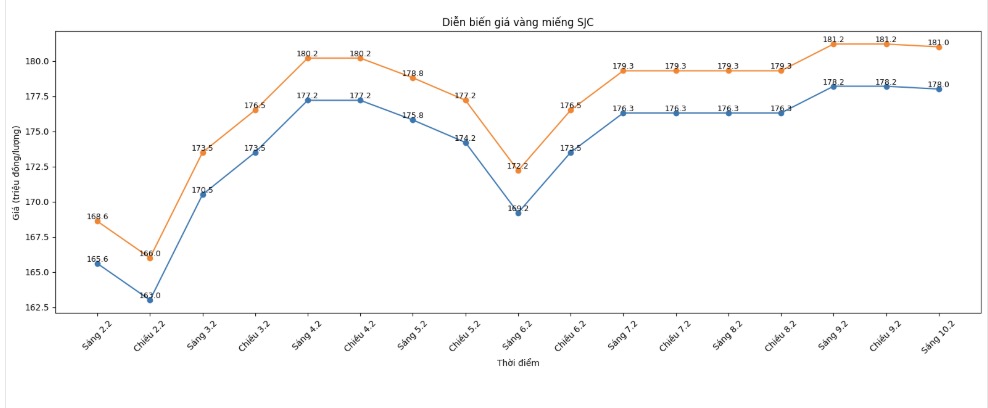

SJC gold bar price

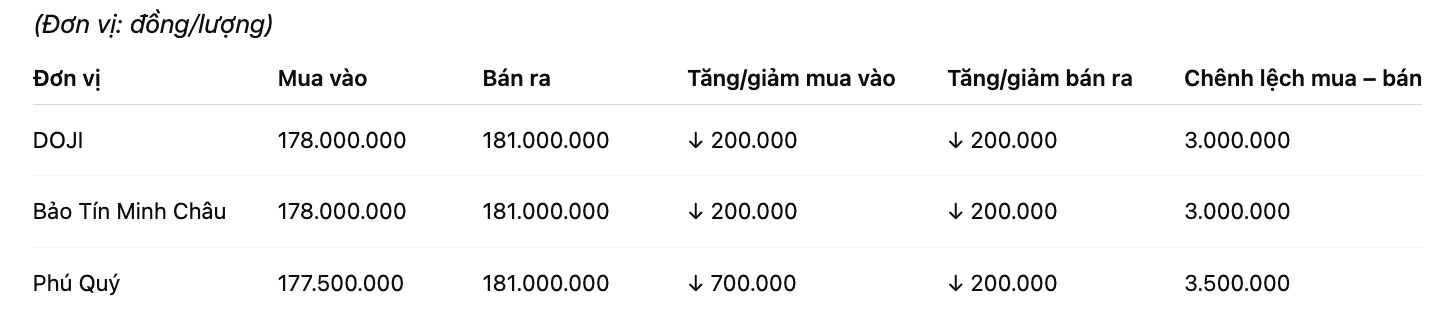

As of 9:15 am, SJC gold bar prices were listed by DOJI Group at 178-181 million VND/tael (buying - selling), down 200,000 VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), down 200,000 VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 177.5-181 million VND/tael (buying - selling), down 700,000 VND/tael on the buying side and down 200,000 VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3.5 million VND/tael.

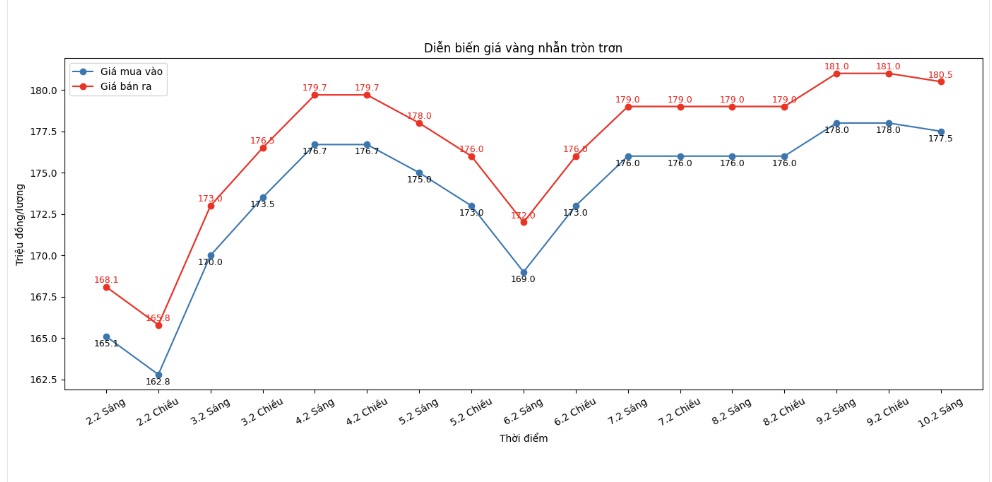

9999 gold ring price

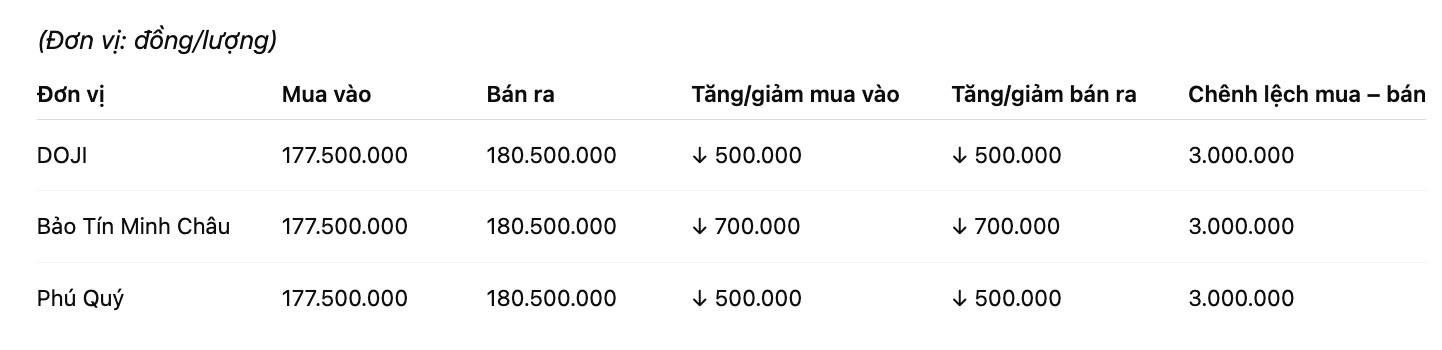

As of 9:00 AM, DOJI Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling), down 500,000 VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling), down 700,000 VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling), down 500,000 VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 to 3.5 million VND/tael, posing a risk of losses for investors.

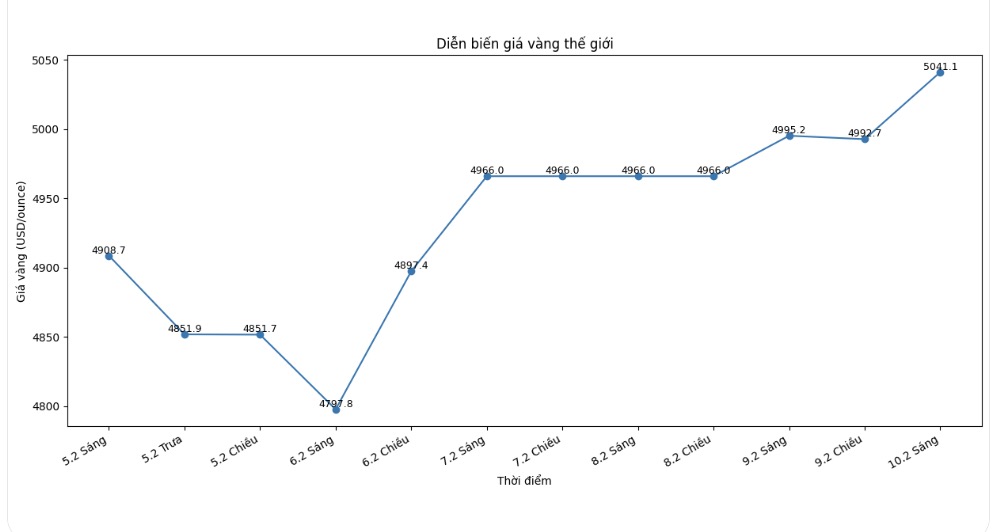

World gold price

At 9:15 am, world gold prices were listed around the threshold of 5,041.1 USD/ounce, up 45.9 USD compared to the previous day.

Gold price forecast

World gold and silver prices are experiencing a period of strong fluctuations as safe-haven sentiment returns to unpredictable global economic and financial instability. The USD is clearly weakening, while crude oil prices are rising again, continuing to provide support for the precious metal group in the short term. However, the current upward momentum is assessed as unsustainable as the market is greatly affected by speculative cash flows.

US financial officials said that active trading in some Asian markets, especially China, has contributed to increasing the volatility of gold prices recently.

Faced with this development, many exchanges have applied risk control measures, including raising margin requirements, to limit excessive speculation. This shows that gold prices are being significantly dominated by short-term positions, rather than long-term fundamentals.

Notably, according to the latest report from the US Commodity Futures Trading Commission (CFTC), investment funds have sharply narrowed their positions betting on rising gold prices. Net buying fell 23%, to 93,438 contracts in the week ending February 3rd - the lowest level in many months. This development took place after gold prices recorded a rare sharp drop in more than a decade, showing that cautious sentiment is returning to institutional investors.

This week, the market will specifically monitor a series of important US economic data, including the jobs report and the consumer price index (CPI). According to Bloomberg's assessment, the January jobs report is more meaningful than usual because it comes with an annual adjustment in the number of jobs. Current forecasts show that the US economy may only create about 69,000 jobs, while the unemployment rate remains high at 4.4%. With the CPI, analysts expect core inflation to continue to cool down, thereby opening up room for monetary policy adjustments.

Meanwhile, Heraeus experts believe that gold is gradually moving away from its traditional safe-haven asset role to enter a period of high volatility. "Gold prices have increased too quickly for many years, making the market sensitive to strong corrections. The possibility of setting a new peak in the short term is not high, as the market needs more time to absorb psychological shocks," Heraeus's report said, while identifying an important support zone around the $4,400/ounce mark.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...