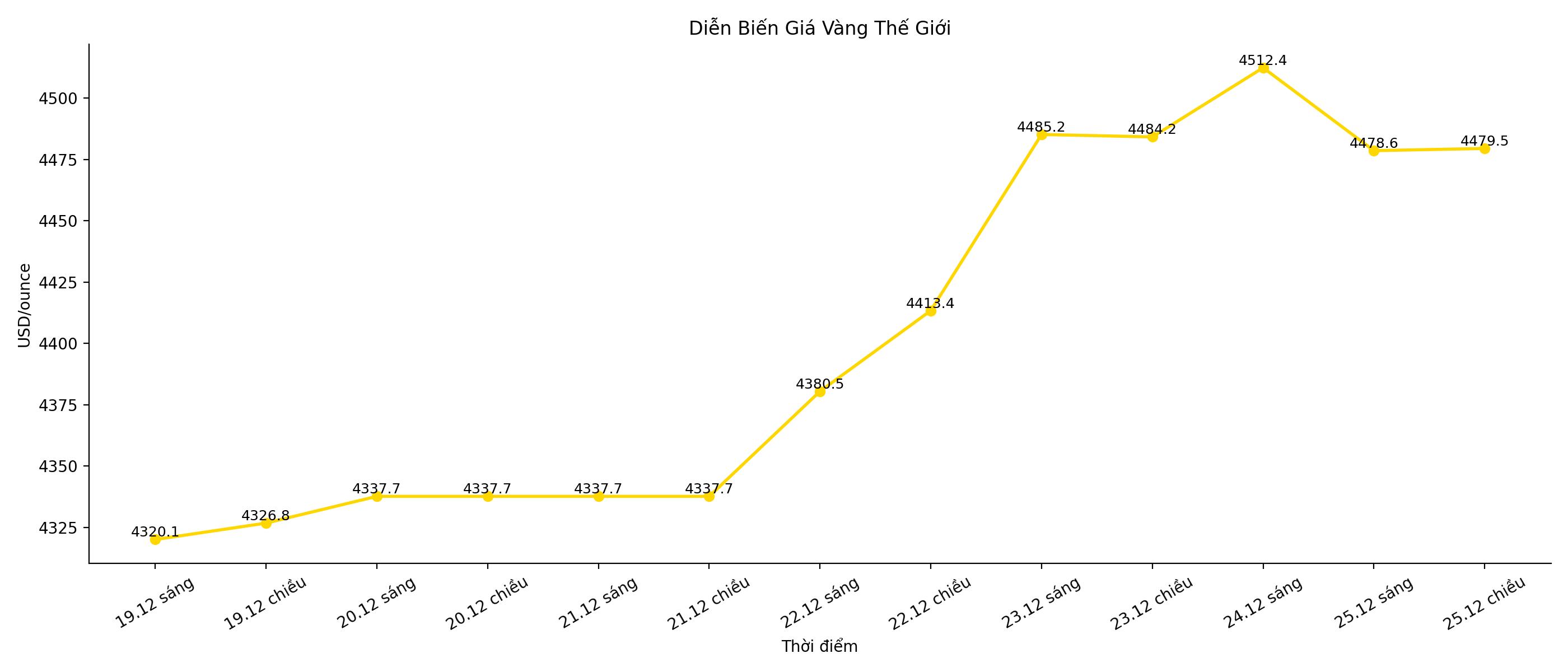

World gold prices have officially surpassed the psychological threshold of 4,500 USD/ounce in the session of December 24, marking a new historical milestone for the precious metal market. Despite failing to hold a peak around $4,5254,526 an ounce when entering the late trading session on Christmas Eve, spot gold has maintained a high range, fluctuating between $4,4704,520 an ounce.

Spot gold prices fell slightly and hovered around $4,480/ounce in this afternoon's session (EST), after previously conquering a record peak of over $4,520/ounce.

Since the beginning of 2025, gold prices have increased by more than 70% - the strongest increase since the late 1970s and continues to affirm its role as a leading macro defense tool in the context of huge global debt, expectations of the US Federal Reserve (Fed) to lower interest rates and confidence in the Predatory forests declining.

Notably, this breakthrough did not have a panic color. The thin liquidity at the end of the year caused gold prices to react strongly to small cash flows, creating an inter-day fluctuation range of up to 50 USD. Short-term investors took advantage of the profit when the price exceeded 4,500 USD, while long-term capital flow patiently waited for adjustments to increase position.

Gold is not alone in this price increase. Silver, platinum, palladium and all set or approached historical peaks, showing that the market is entering a comprehensive re-evaluation cycle of real assets compared to intangible assets. In that picture, gold emerges as the rotating axis of global defence cash flow.

In the medium term, structural factors still support the upward trend of gold. However, after a year of increasing by more than 70%, the reasonable strategy is not to buy and chase at the peak, but to maintain the existing position and wait for adjustments to optimize points. Gold is still on the uptrend, but playing at a high price zone requires more discipline and a long-term vision than ever.