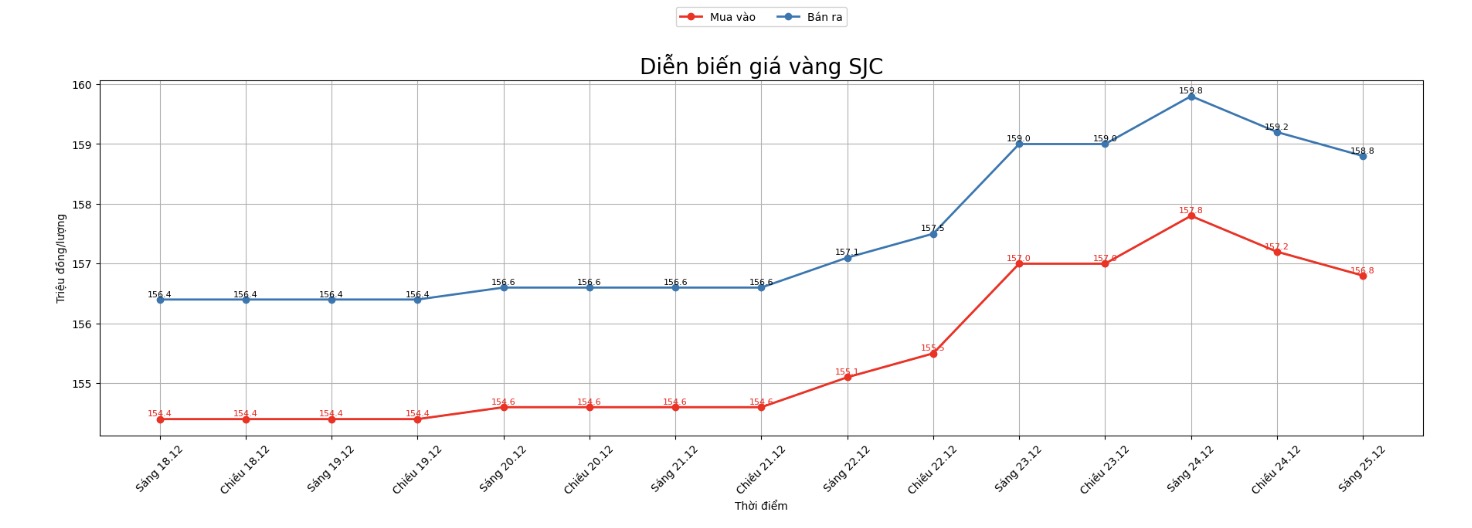

Updated SJC gold price

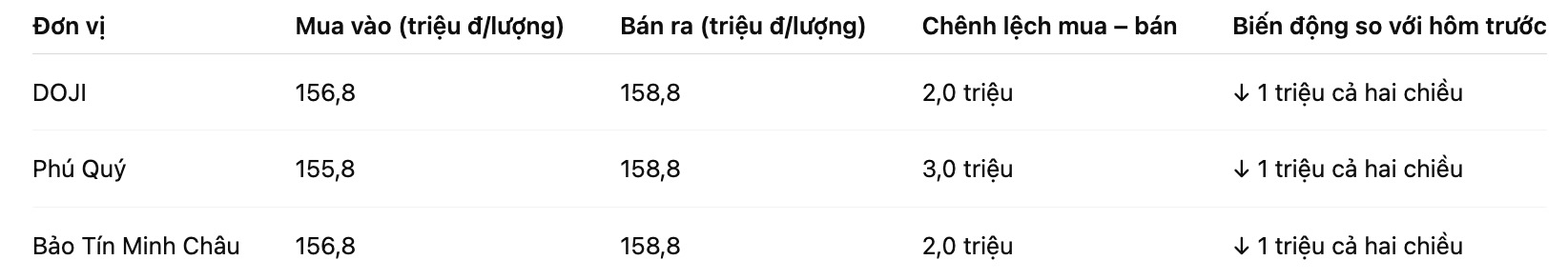

As of 9:15 a.m., DOJI Group listed the price of SJC gold bars at 156.8-158.8 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 155.8-158.8 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 156.8-158.8 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

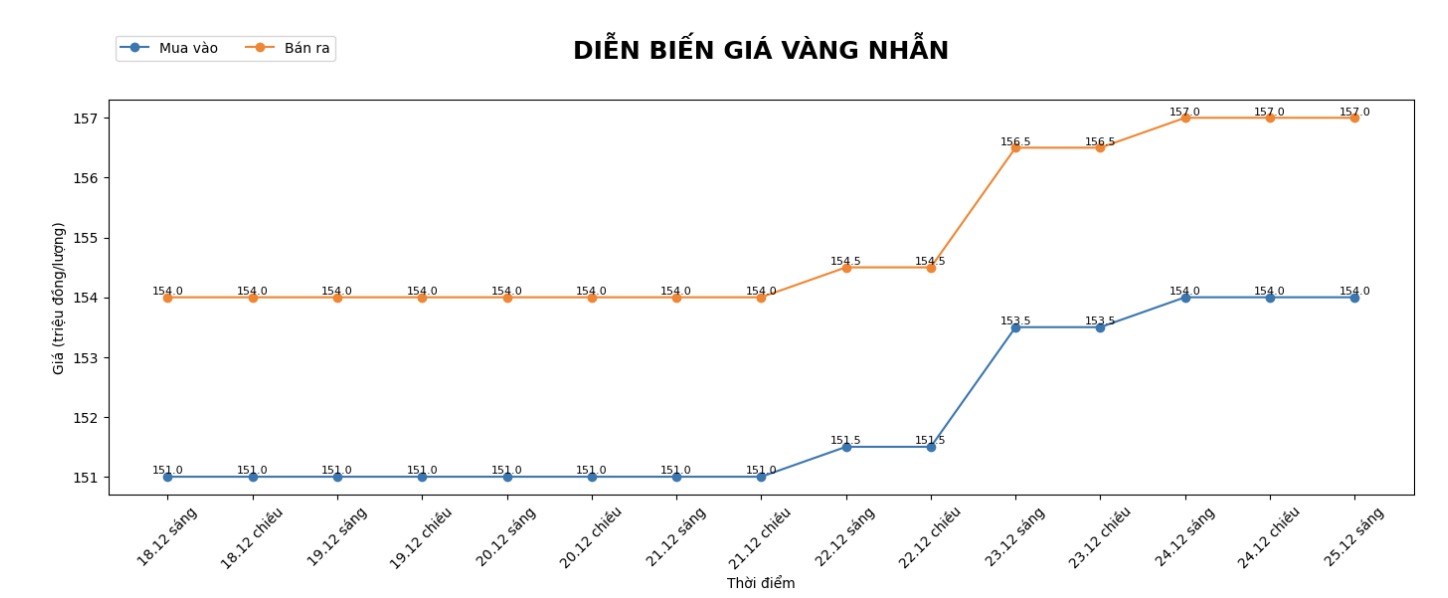

9999 round gold ring price

As of 9:05, DOJI Group listed the price of gold rings at 154-157 million VND/tael (buy - sell), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.3-158.3 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 154.5-157.5 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

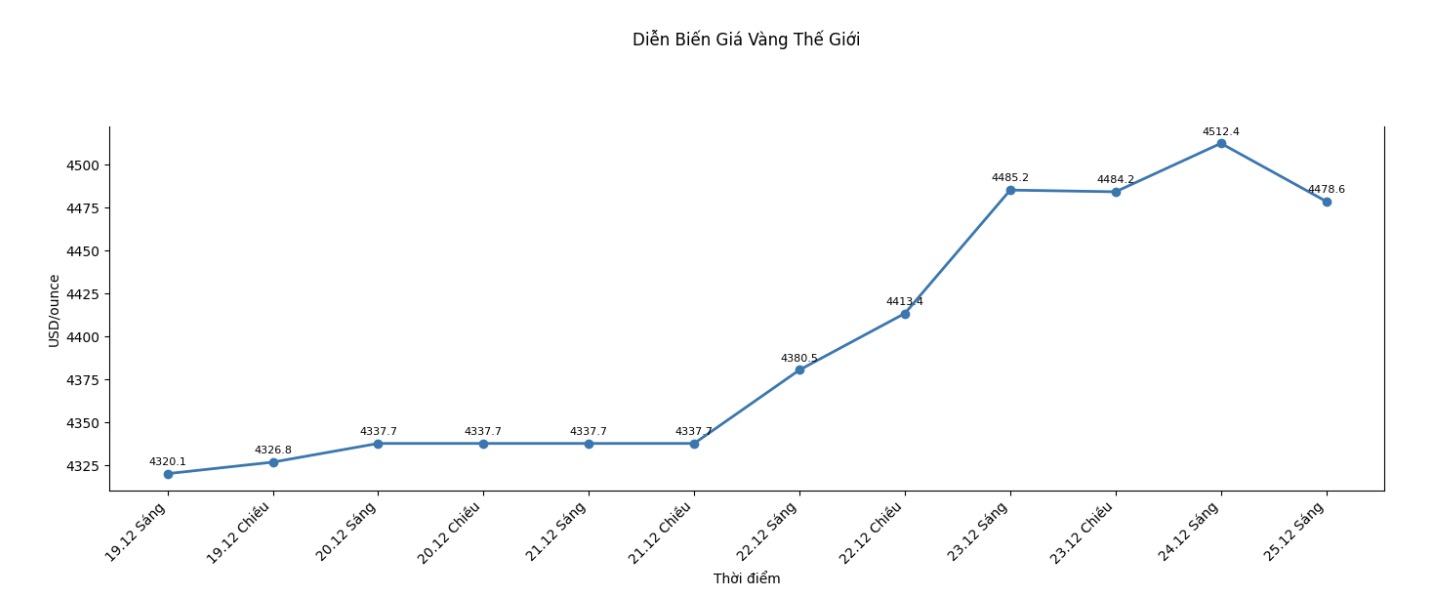

World gold price

At 9:20 a.m., the world gold price was listed around 4,478.6 USD/ounce, down 33.8 USD compared to a day ago.

Gold price forecast

World gold and silver prices fell due to profit-taking pressure from investors. Both precious metals have previously set an all-time high.

Safety-haven demand and increasing technical signals have pushed the two metals to very high price levels. Small gold and silver traders are also falling into a FOMO state (fear of missing out) due to the strong increase in the market.

Meanwhile, platinum prices this week soared to an all-time high, trading above $2,300/ounce for the first time due to tight supply and record high borrowing costs. The metal has gained more than 150% this year, its biggest yearly gain since Bloomberg began collecting data in 1987.

Mr. Gregory Shearer - head of Basic Metals and Precious metals Strategy at JP Morgan Bank - said that although it is difficult to pinpoint the exact timing of catalysts and capital flows pushing gold prices up, experts strongly believe that demand for gold will be strong enough to continue pushing prices up to $5,000/ounce by 2026.

"We even think that assumptions about investor demand may be quite cautious. We have put forward a scenario where if we only need to diversify 0.5% of foreign assets held in the US into gold, this new demand will be enough to push gold prices to $6,000/ounce," said Mr. Shearer.

Meanwhile, JP Morgan Global Research Center forecasts that the average gold price will reach 5,055 USD/ounce in the fourth quarter of 2026 and may reach 5,400 USD by the end of 2027.

Technically, the next gold bull target for the February delivery gold contract is the closing price exceeding the strong resistance level at $4,600/ounce. On the other hand, the short-term bearish target for the sellers is to pull the contract price below the important technical support zone at 4,300 USD/ounce.

The immediate resistance level is at a record peak for the night of 4,555.1 USD/ounce, followed by 4,575 USD/ounce. The first support zone was determined to be a low on the day of 4,474.3 USD/ounce, then 4,433 USD/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...