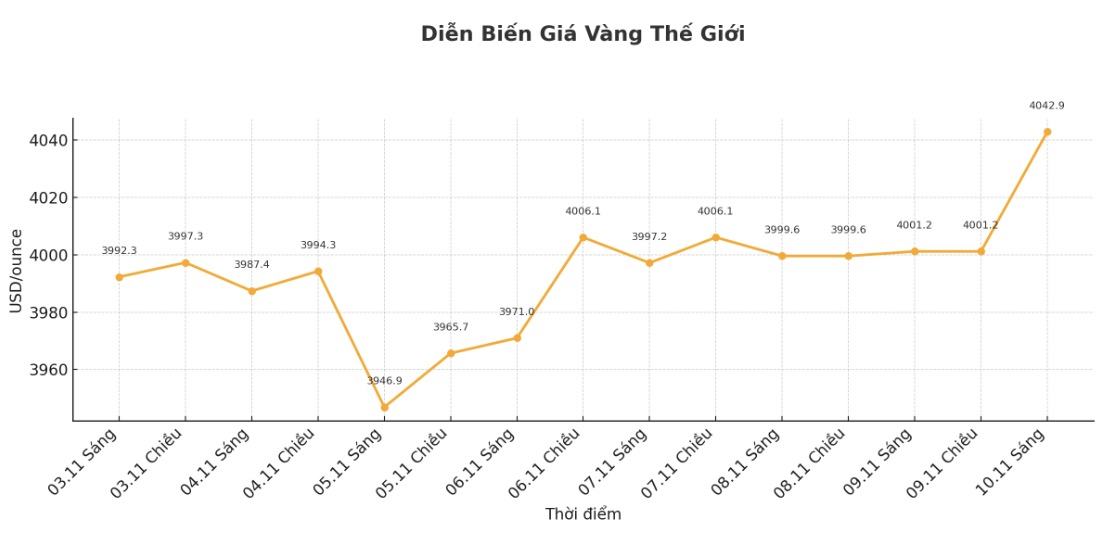

Gold prices increased for the second session, in the context of a weakening US economy.

Spot gold prices hovered around $4,045 an ounce, after almost flat-lying at the end of last week. The precious metal continued its upward momentum from Friday, as the US consumer confidence index fell to near a record low, as the government's suspension and prices escalated, increasing optimism about the economic outlook.

Meanwhile, the long-running political deadlock in Washington appears to be approaching its end, after a group of dovish Democratic senators agreed to support a government reopening deal, according to a source familiar with the negotiations. The temporary suspension of economic data release has forced the Federal Reserve (FED) to "fly in the mist" as it seeks to balance high inflation and a weak labor market.

If the end of the closure helps the government to re-publish economic data delay, the Fed will have more room to ease policy sooner, in case the data shows slowing growth, he added.

Gold prices have fallen about 8% from a record above $4,380 an ounce set in mid-October. However, the precious metal has been on the rise for more than 50% since the start of the year, and much of the factor that has fueled the strong rally from economic and geopolitical uncertainty to demand from central banks and individual investors is still present.

Spot gold prices increased 1.1% to 4,045.96 USD/ounce at 9:26 am Singapore time.

The Bloomberg Dollar spot is almost flat, while silver, platinum and palladium are all up.