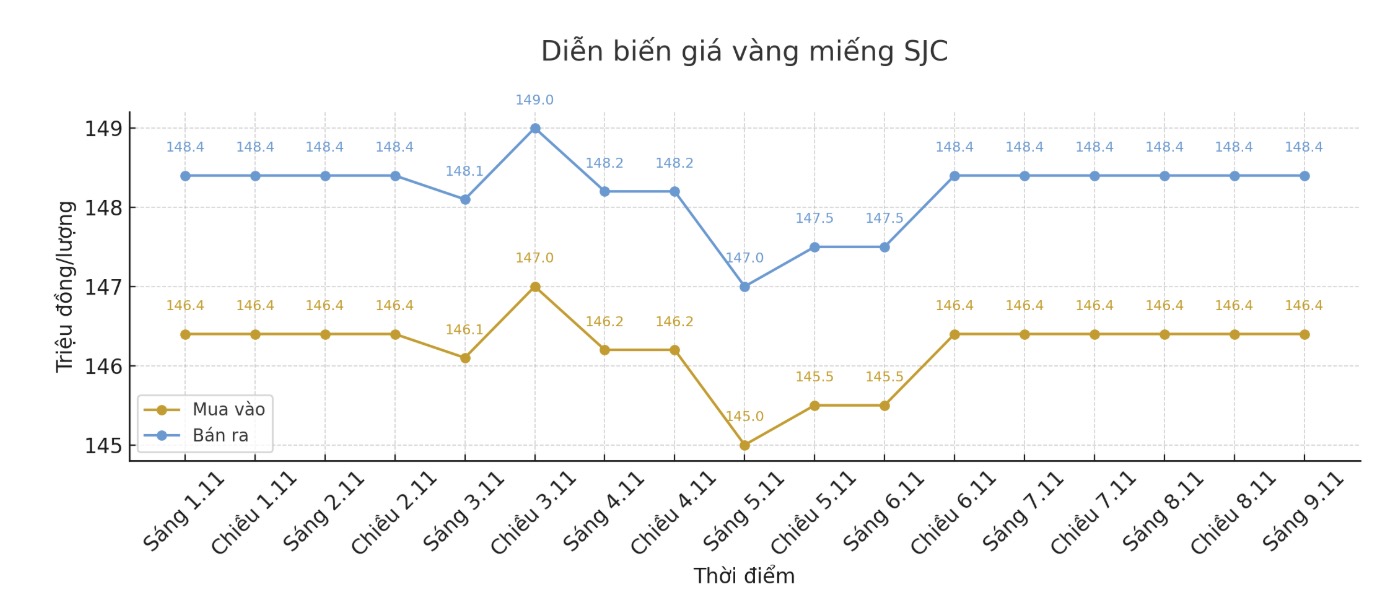

Although gold prices last week were basically flat, many investors still suffered large losses due to the high difference between buying and selling. At the end of the trading session on November 9, Saigon Jewelry Company SJC listed the price of SJC gold bars at 146.4 - 148.4 million VND/tael (buy - sell), unchanged from the closing price of the previous session (November 2). The difference between the buying and selling prices at this enterprise remains at 2 million VND/tael.

At the same time, Bao Tin Minh Chau listed SJC gold bars at 146.9 - 148.4 million VND/tael, unchanged from last week, with a difference of 1.5 million VND/tael.

Thus, if investors buy SJC gold bars at SJC or Bao Tin Minh Chau on November 2 and sell on November 9, the loss will be 2 million VND and 1.5 million VND/tael, respectively, even though the gold price will not decrease.

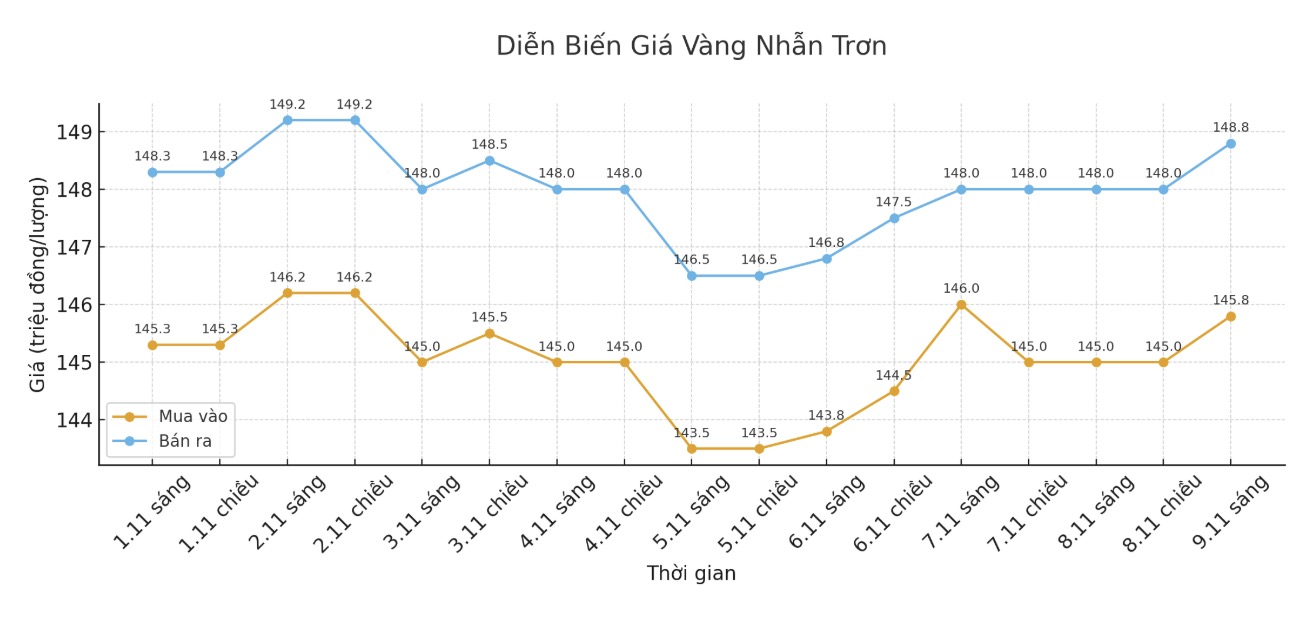

In the 9999 gold ring group, the loss is even heavier. Bao Tin Minh Chau listed the price of gold rings at 145.8 - 148.8 million VND/tael (buy - sell), down 400,000 VND/tael in both directions compared to last week. The difference between the buying and selling prices is up to 3 million VND/tael.

Meanwhile, Phu Quy Group kept the price unchanged at 145.4 - 148.4 million VND/tael, with a similar difference. If buying gold rings on November 2 and selling today, buyers at Bao Tin Minh Chau will lose about 3.4 million VND/tael, while at Phu Quy will lose about 3.8 million VND/tael.

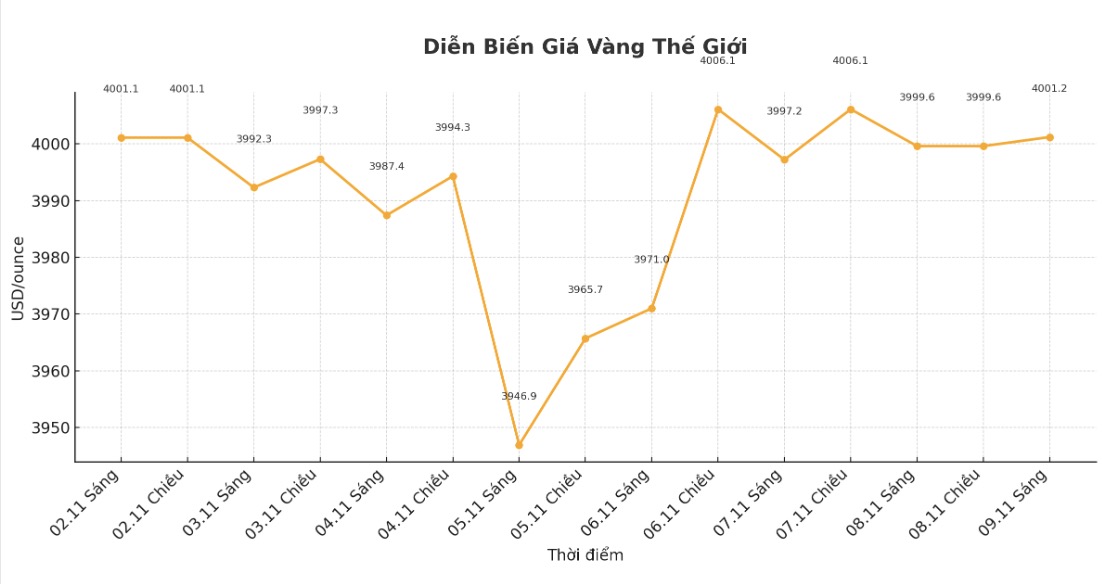

Domestic gold prices are moving sideways in the context of the world not having many fluctuations. In the international market, gold prices closed the trading session of the week at 4,001.2 USD/ounce, almost unchanged from a week ago.

Buyers suffered heavy losses due to the huge gap between the buying price and the selling price. When the difference remains at about 2 - 3 million VND/tael, just need to make a short buy - sell transaction, investors have lost a significant amount, even if the price does not decrease.

Along with that, the FOMO mentality (fear of missing out) continues to dominate the market. Many people rush to buy gold when prices only increase slightly, hoping that prices will continue to increase, forgetting that the high margin of difference makes the ability to make a profit almost zero in the short term.

Meanwhile, most Wall Street experts remain neutral, showing that the world market is in a state of hesitation and has not yet established a clear uptrend. The latest survey shows that Wall Street experts are tending to be more cautious about the short-term outlook for this precious metal.

Of the 21 experts surveyed, 13 people (equivalent to 59%) are neutral, 7 people (32%) predict prices will increase and only 2 people (9%) think prices will decrease. For retail investors, 55.7% expect gold prices to rise next week, 17.6% predict a decrease and 26.7% expect prices to move sideways.

This means that surfing gold in the current period has high potential risks. If domestic gold continues to move sideways or decrease in price, and the buying-selling gap remains large, speculators face the risk of heavy losses. Investors should be cautious, closely monitor world developments and avoid following the crowd psychology to limit the risk of losses.

See more news related to gold prices HERE...