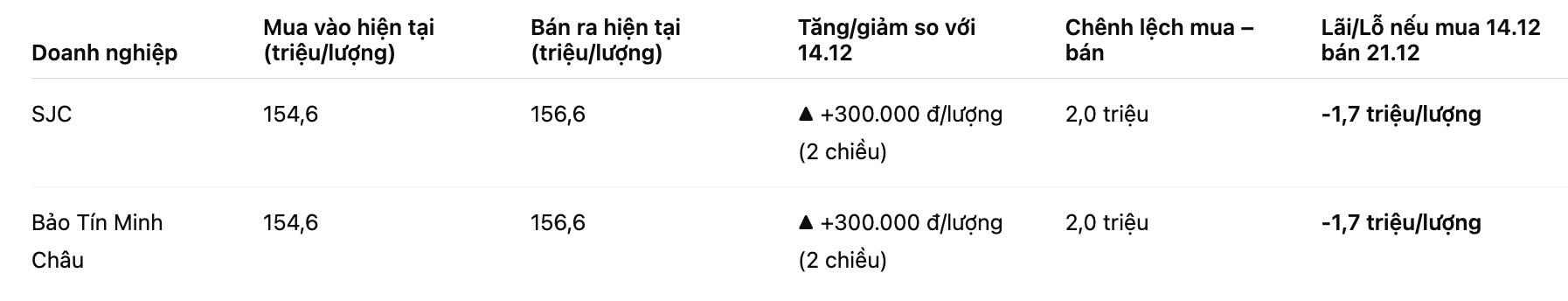

At the end of the trading session on December 21, Saigon Jewelry Company (SJC) listed the price of SJC gold bars at 154.6 - 156.6 million VND/tael (buy - sell). The difference between buying and selling remains around 2 million VND/tael.

Compared to last weekend (December 14), SJC gold price at SJC increased by about 300,000 VND/tael in both directions. However, due to the large margin difference, if buying SJC gold bars on December 14 and selling them in today's session, buyers will still suffer a loss of about 1.7 million VND/tael.

At Bao Tin Minh Chau, the price of SJC gold bars is also listed at the same level at 154.6 - 156.6 million VND/tael. The increase compared to a week ago was 300,000 VND/tael, but short-term investors still cannot avoid losses when settling.

The unfavorable developments recorded in the gold ring market. Bao Tin Minh Chau currently listed the price of 9999 gold rings at 152.2 - 155.2 million VND/tael (buy - sell), down 100,000 VND/tael compared to before. The difference between buying and selling is up to 3 million VND/tael.

Meanwhile, Phu Quy Jewelry Group listed the price of gold rings at 151.6 - 154.6 million VND/tael, an increase of 1.5 million VND/tael compared to a week ago, but the difference remained around 3 million VND/tael.

Calculations show that if buying gold rings at Bao Tin Minh Chau on December 14 and selling on December 21, buyers will lose up to 3.1 million VND/tael. For Phu Quy gold rings, the loss is also up to about 2.9 million VND/tael.

Domestic gold prices have recently recorded a fluctuating situation within a narrow range, despite the world gold price trend increasing. Last week, the world gold price recorded an increase of about 39 USD/ounce, up to 4,337 USD/ounce when closing the weekend trading session.

This increase is supported by US economic data showing a weakening labor market, increasing expectations that the US Federal Reserve (Fed) will soon loosen monetary policy.

It can be seen that the increase in world gold prices has not been reflected commensurate with the domestic market. In the context of fluctuating domestic gold prices, the difference between buying and selling is too high (2 - 3 million VND/tael) which is posing great potential risks to individual investors, especially those who buy gold with the goal of short-term surfing. As long as the gold price remains stable or is slightly adjusted, buyers can suffer a significant loss when selling.

In addition, the FOMO (fear of missing out) mentality when gold prices are constantly mentioned in the highlands can cause investors to make hasty decisions, buying at unfavorable times.

People need to carefully consider investment strategies, closely monitor domestic and world price differences, and avoid using loans or putting all cash flow into gold during the existing risk period.