World gold prices fell in the latest trading session as investors temporarily put aside escalating geopolitical tensions to shift attention to a series of important US economic data to be released this week.

Spot gold fluctuated around $4,470/ounce, after increasing by more than 4% in the previous three sessions. The precious metal market was supported by a series of notable geopolitical developments.

However, in the context that geopolitics still contains many risks, traders are focusing more on the outlook for US monetary policy. The focus of this week is the US December jobs report, scheduled to be released on Friday, along with a series of other key economic indicators.

A US manufacturing activity index released on Tuesday showed results weaker than expected, thereby strengthening confidence that the US Federal Reserve (Fed) may continue to cut interest rates. Sharing this view, Fed Governor Stephen Miran said that the US central bank may need to cut interest rates by more than 1 percentage point in 2026, emphasizing that current monetary policy is putting pressure on the economy.

The three consecutive interest rate cuts in the past year are considered an important driving force for the upward momentum of precious metals, which are non-profitable asset groups.

Gold has just closed its year of strongest price increase since 1979, continuously setting new records thanks to central bank buying demand and strong capital flows into gold ETF funds. The upward momentum of silver is even more impressive, as the metal increased by nearly 150% last year, thanks to supply shortages and concerns that the US may impose import tariffs.

In the trading session on Wednesday, silver prices at times decreased by 2.2%, but since the beginning of the year have still increased by about 12%, with strong buying demand from individual investors, especially in China.

In the opposite direction, the market also faces some short-term risks. Rebalancing large-scale commodity indices may put downward pressure on the precious metals group, as passive investment funds are forced to sell to adjust their ratios. Citigroup estimates that this process could cause about 6.8 billion USD of gold futures contracts and an equivalent amount of silver to be withdrawn from the market.

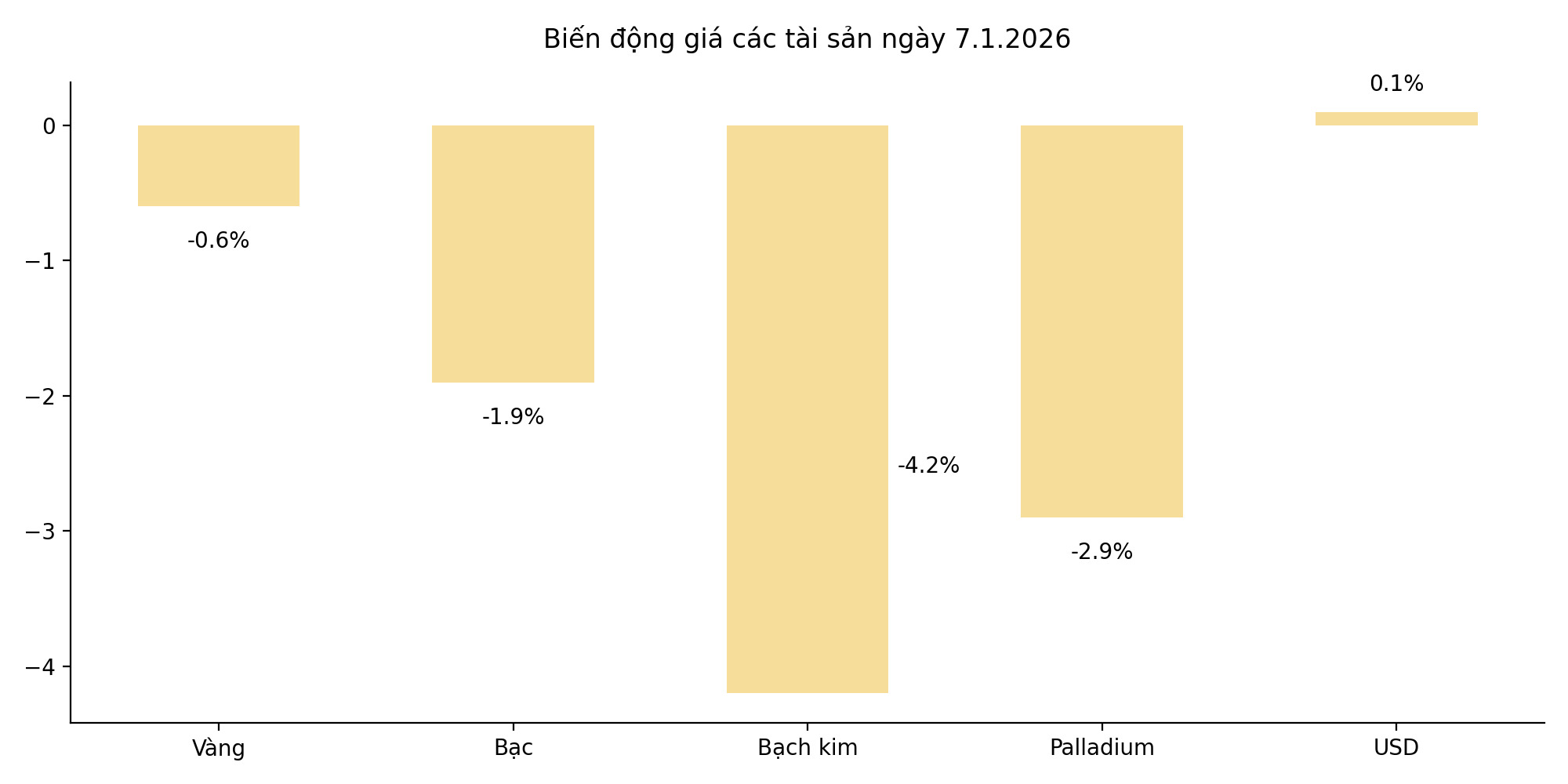

As of noon trading today, gold prices fell 0.6% to 4,466.04 USD/ounce. Silver prices reversed to decrease by 1.9% to 79.69 USD/ounce. Platinum plunged 4.2%, while palladium fell 2.9%. Bloomberg Dollar Spot Index – the measure of the strength of the USD edged up 0.1%.