Mr. Dominic Schnider - Head of Commodity Division and Asia-Pacific Regional Foreign Exchange Investment Director at UBS Wealth Management said that gold purchases by central banks, increased fiscal deficits, reduced US real interest rates and prolonged geopolitical risks will be factors driving gold prices up to 5,000 USD/ounce by the end of Q1/2026. This assessment is made in the context of the commodity market in general entering a new upward cycle.

In 2026, commodities will play an increasingly important role in the investment portfolio" - Mr. Schnider wrote in a report released on Monday. "Our forecast shows attractive profit prospects, supported by supply-demand imbalances, increased geopolitical risks and long-term trends such as global energy transition. In this asset group, we particularly see opportunities in copper, aluminum and agricultural products, while gold continues to be an effective portfolio diversification tool.

According to Mr. Schnider, tighter supply and increased demand are likely to continue pushing up prices of many commodities in 2026.

Both copper and aluminum are forecast to face supply shortages in the near future, which may push prices higher.

The global transition to clean energy and electrification is boosting demand for these metals, making them a long-term structural investment. For crude oil, we expect prices to begin to recover from the second half of the year, when the current surplus situation gradually decreases thanks to stable growth in demand and slowing off-OPEC+ supply, in the context of OPEC+'s limited reserve capacity" - he said.

Mr. Schnider also believes that the upward momentum of gold prices will continue this year.

We believe that gold prices will continue to rise, thanks to buying power from central banks, large budget deficits, falling real interest rates in the US, and geopolitical risks still present," he said.

According to UBS, commodities play an important role in the investment portfolio, although they may experience periods of strong fluctuations. "Results are usually highest when the market faces supply-demand imbalances or macroeconomic risks such as inflation or geopolitical tensions" - Mr. Schnider said. "In such periods, investing in a diverse commodity basket can help investors disperse risks and protect portfolios. When the outlook is positive, we often recommend allocating a maximum of about 5% of the portfolio to a diverse commodity index.

Prospects for 2026

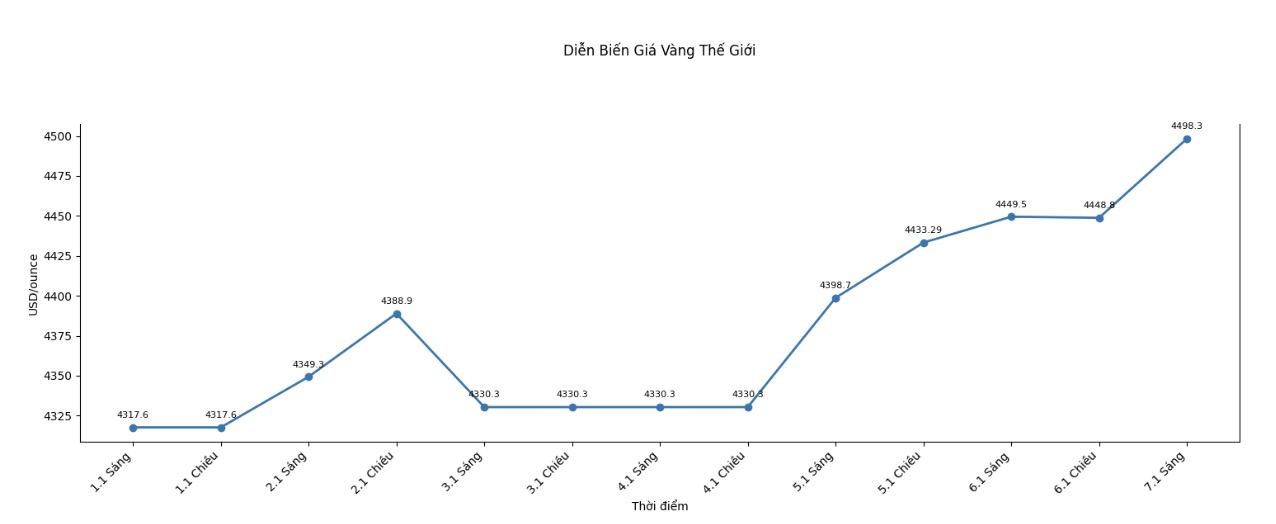

Mr. Schnider said commodities are one of the most volatile asset groups in the face of political instability. Spot gold prices opened up sharply after military actions and continued to rise in the following days, reaching at times 4,491.2 USD/ounce on Tuesday.

In the current context, Mr. Schnider makes very positive predictions for gold prices.

We currently expect gold prices to rise to 5,000 USD/ounce in March, stay around this zone until September, and then cool down to about 4,800 USD/ounce by the end of 2026" - he said.

We believe that goods will bring attractive profits in 2026, while helping to diversify investment portfolios in the face of supply-demand risks, geopolitics and global energy transition" - Mr. Schnider concluded. "We prefer a broad portfolio of goods, gold and some related stocks.

Previously, on December 29, UBS commodity strategists said that any increase in political or economic instability related to the midterm election in the US could push gold prices up to 5,400 USD/ounce.

In a report released last week, the Swiss banking group said it had raised its gold price target to 5,000 USD/ounce in the first three quarters of 2026. After that, UBS forecast that gold prices would adjust down to 4,800 USD/ounce by the end of 2026 - 500 USD higher than the previous forecast of 4,300 USD/ounce.

UBS expects gold demand to continue to increase steadily in 2026, supported by low real interest rates, prolonged concerns about the global economy and instability in US domestic policy - especially related to midterm elections and growing fiscal pressure.

If political or financial risks increase, gold prices could climb to 5,400 USD/ounce (compared to the previous forecast of 4,900 USD/ounce)" - UBS strategists emphasized in the report.