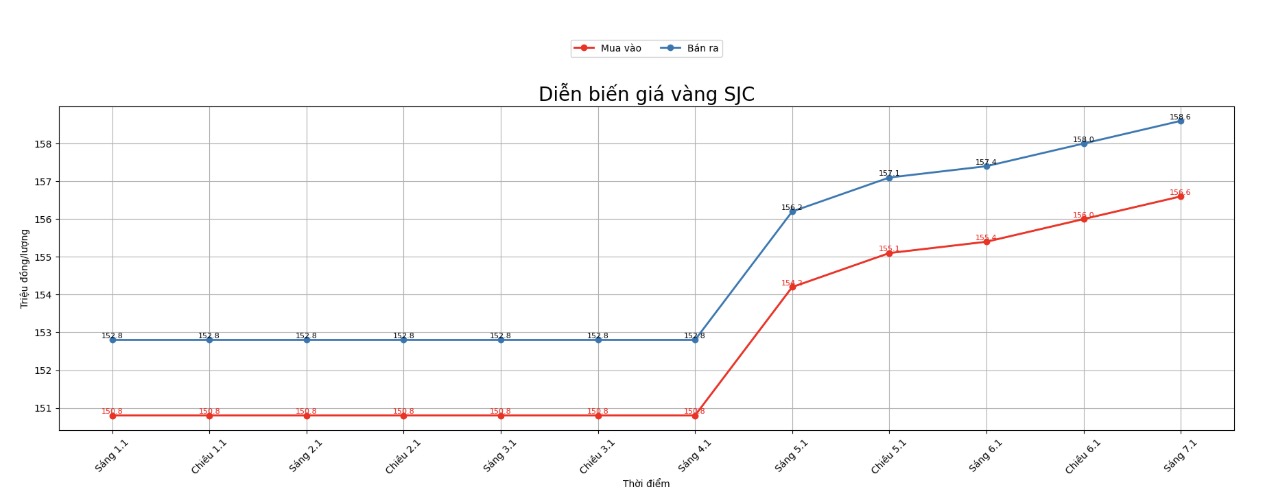

SJC gold bar price

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 156.6-158.6 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 156.6-158.6 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 156.6-158.6 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

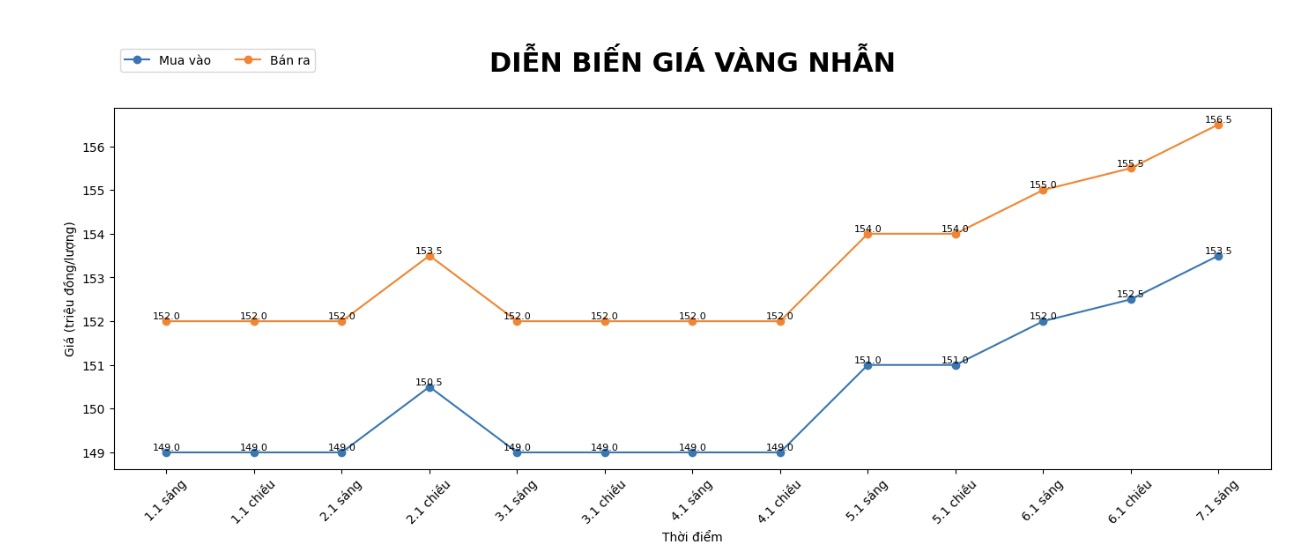

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at 153.5-156.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.8-158.8 million VND/tael (buying - selling), an increase of 800,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 153.8-156.8 million VND/tael (buying - selling), an increase of 1.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

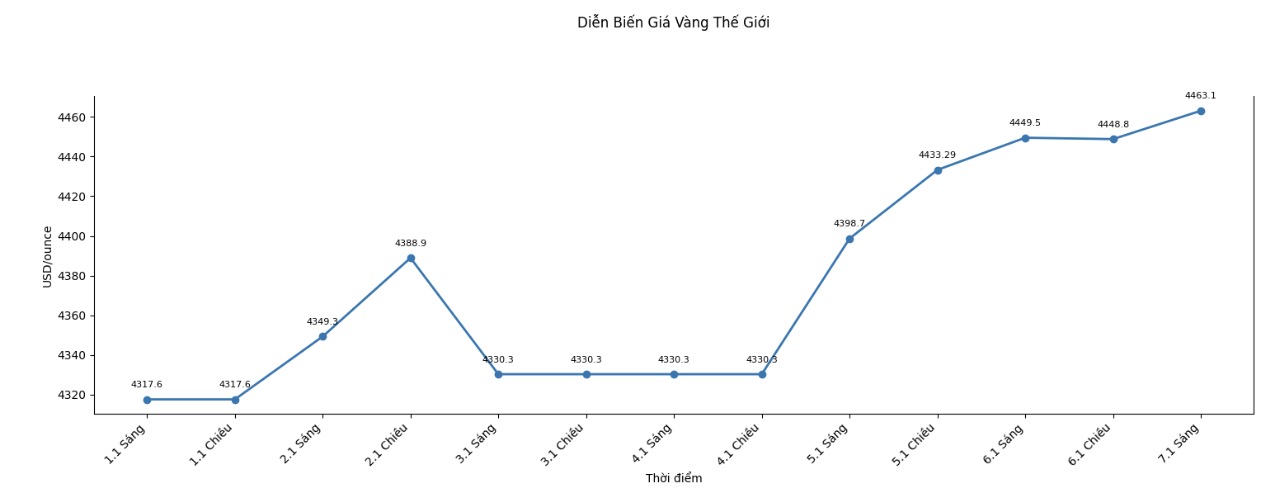

World gold price

At 9:00 AM, world gold prices were listed around the threshold of 4,449.5 USD/ounce, up 50.8 USD compared to the previous day.

Gold price forecast

In the context of increasing geopolitical instability and many volatile global economic prospects, the gold market continues to be assessed by international investors as the top safe haven.

Many major financial institutions believe that the upward trend of gold prices is not only short-term but may extend to 2026, with record high price scenarios.

According to UBS forecasts, gold prices are likely to approach the 5,000 USD/ounce mark in early 2026, as the commodity market enters a new upward cycle. Mr. Dominic Schnider - Head of Commodity and Foreign Exchange Investment for the Asia-Pacific region of UBS - said that persistent purchasing power from central banks, large fiscal deficits in the US, declining real interest rates and prolonged geopolitical risks will continue to support gold prices to rise. According to him, gold still plays an important role in diversifying investment portfolios as the world faces many unpredictable macroeconomic shocks.

Recent tense developments in Venezuela further strengthen the defensive psychology of precious metal investors. After the US raid to arrest the country's leader, gold and silver prices surged sharply, reflecting concerns about the risk of widespread instability in Central and South America.

Although the global stock market has not reacted negatively, gold investors remain cautious about the possibility of escalating geopolitical tensions, especially in the context of the US increasing tough statements about security and strategic influence in the Western Hemisphere.

From a technical perspective, the short-term trend of gold has also improved significantly. Gold futures prices are approaching strong resistance zones, showing that buyers are still dominant, although the risk of short-term correction has not been completely eliminated.

Sharing the same optimistic view, Goldman Sachs assesses gold as the most attractive asset in the commodity group for 2026. This bank emphasizes the key role of buying demand from central banks, expected to remain at a high level and create a foundation for gold prices to set new peaks.

According to Goldman Sachs, if the trend of asset diversification spreads wider to the private investor sector, gold prices can completely surpass the current base scenarios, despite technical corrections in the short term.

In general, with the synergy of geopolitical factors, monetary policy and safe-haven needs, gold price prospects in the medium and long term are still positively assessed, although the market may continue to fluctuate strongly in each period.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...