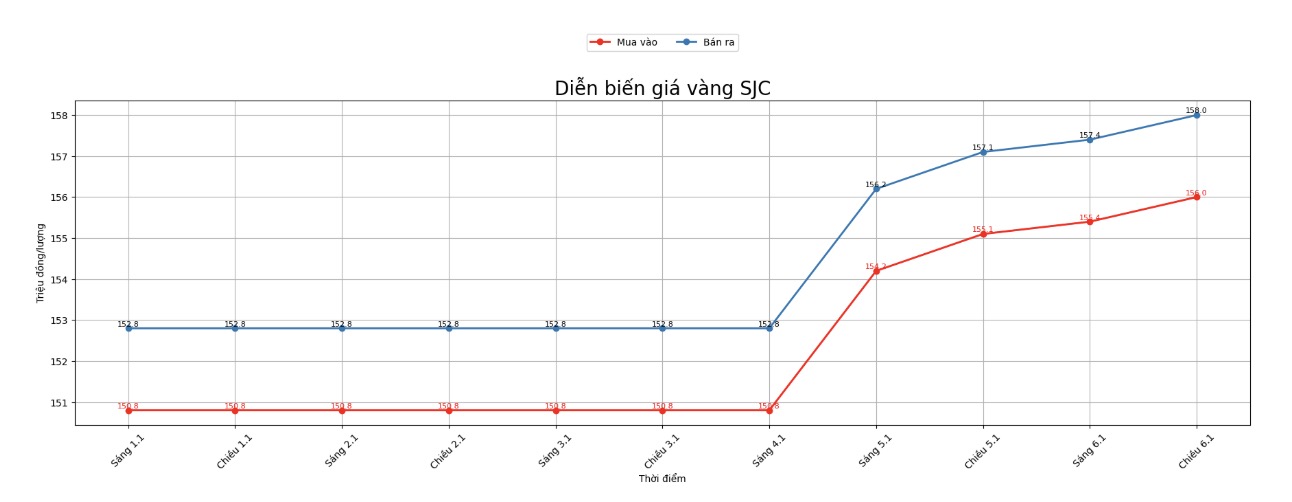

SJC gold bar price

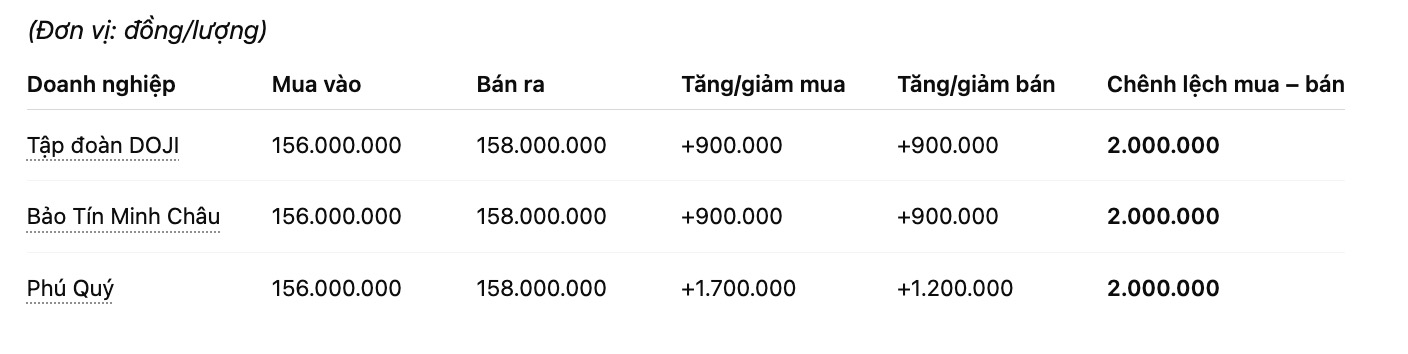

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 156-158 million VND/tael (buying - selling), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 156-158 million VND/tael (buying - selling), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at the threshold of 156-158 million VND/tael (buying - selling), an increase of 1.7 million VND/tael on the buying side and an increase of 1.2 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

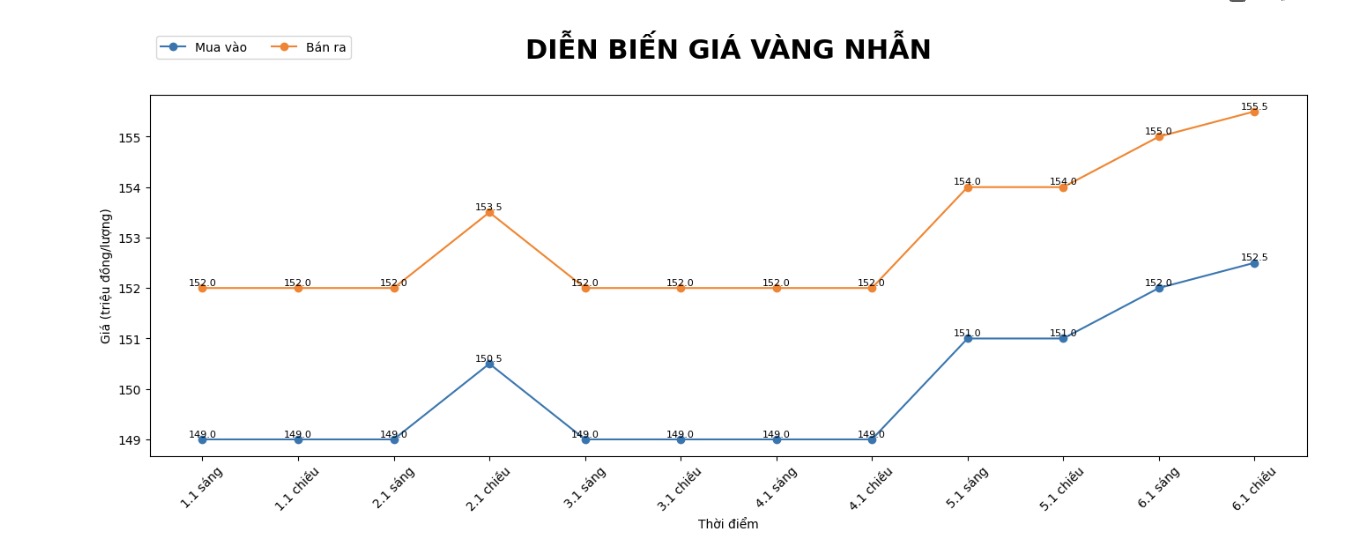

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of plain gold rings at 152.5-155.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both buying and selling directions. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 153-156 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

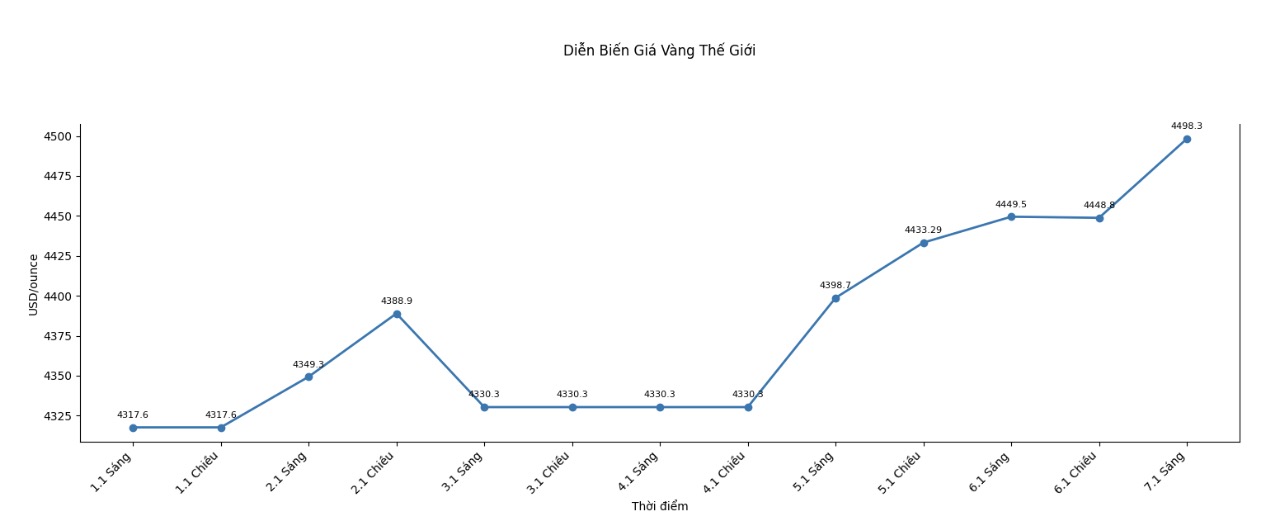

World gold price

World gold price listed at 6:07 am at 4,498.3 USD/ounce, up 58.6 USD.

Gold price forecast

Gold and silver prices rose sharply thanks to increased demand for safe havens after the US raid at the end of the week in Venezuela, arresting the country's leader. More importantly, the above developments have forced precious metal traders to consider more about geopolitical risks that could erupt in the coming months.

At the same time, the short-term technical status of gold and silver has also improved significantly in the past week.

While the global stock and financial markets appeared quite calm before the US raid on Venezuela, even some major stock indices set record highs this week, gold and silver investors are more cautious, considering possible geopolitical consequences in the near future.

US President Donald Trump has warned Central and South American countries about drug smuggling into the US, and declared that Washington will reaffirm its influence in the Western Hemisphere. Mr. Trump also expressed his desire for the US to take over Greenland.

A Bloomberg report suggests that if the US truly controls Greenland, the NATO defense organization may face the risk of disintegration.

China, Russia and some other countries have criticized the US for its actions in Venezuela.

In foreign markets, the USD index increased in price. Crude oil prices decreased slightly, fluctuating around 58 USD/barrel. The yield of US Treasury bonds for 10-year terms is currently around 4.2%.

On the basic metal market, the futures price of copper has exceeded the 6-USD/pound mark in last night's trading session, setting a new record high ahead of expectations that global supply will continue to tighten this year.

Technically, the buying side of February gold futures is aiming for the next goal of closing through a strong resistance level at a record high of the contract, 4,584 USD/ounce. Meanwhile, the short-term goal of the selling side is to push the price below the important support zone of 4,200 USD/ounce.

The nearest resistance level is at the day's peak of 4,501.8 USD/ounce, followed by 4,550 USD/ounce. The first support is at the overnight bottom of 4,437.9 USD/ounce, followed by 4,400 USD/ounce.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...