Gold prices continue to set a new record, marking the 50th peak this year, as geopolitical tensions escalate and expectations of the US continuing to cut interest rates are becoming increasingly clear. Silver prices also simultaneously set an all-time high.

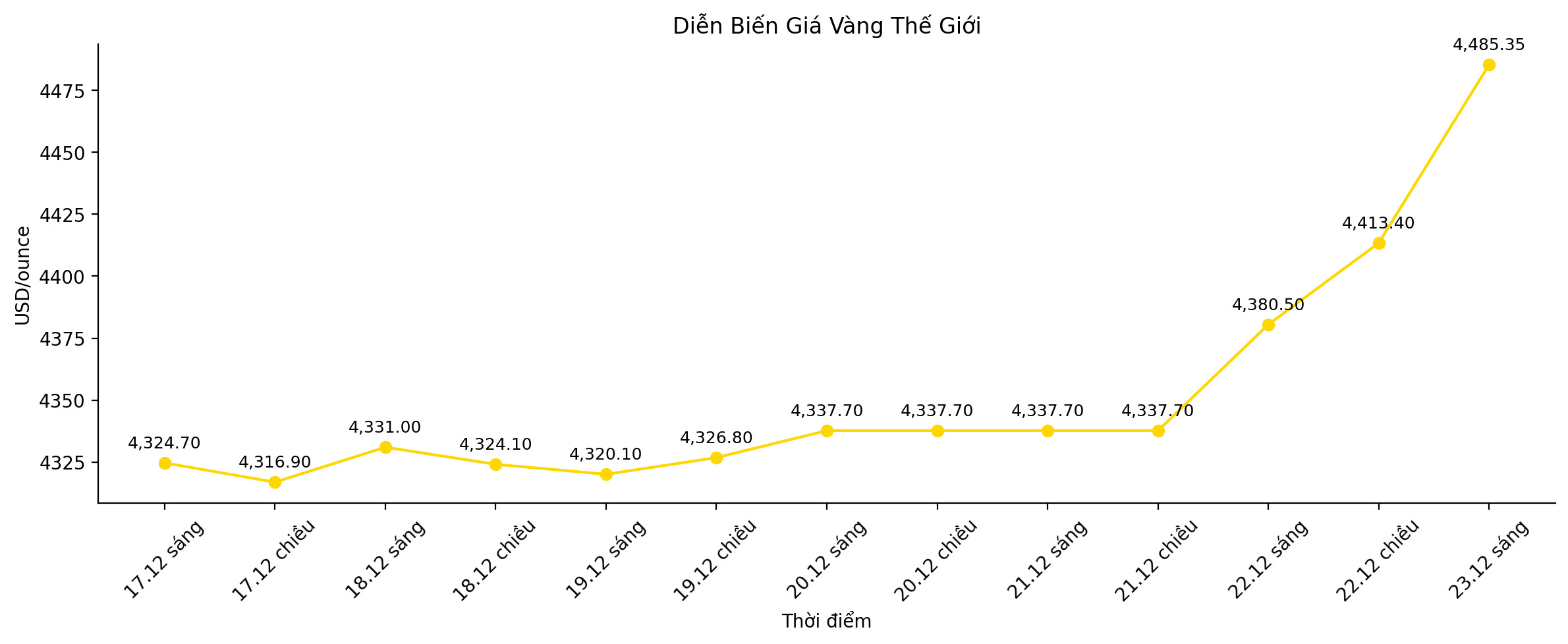

In the latest trading session, gold prices increased at times to nearly 4,500 USD/ounce, extending the increase after the strongest breakthrough in more than a month. Investors are betting that the US Federal Reserve (Fed) will continue to lower interest rates next year, thereby creating incentives for precious metals that do not yield.

Gold's safe-haven appeal has been further strengthened over the past week by geopolitical tensions, especially in Venezuela, where the US has blocked oil tankers to increase pressure on the Trump administration.

Since the beginning of the year, gold prices have increased by about 70% in a heated rally, supported by strong buying from central banks and inflows into gold-guaranteed ETFs. The precious metal is heading for its best annual gain since 1979. Data from the World Gold Council (WGC) shows that total gold holdings in ETFs increased in all months of the year, except for May.

US President Donald Trump's drastic moves to reshape global trade, along with statements threatening the independence of the Fed, also gave momentum to gold's rally this year. Investors play a key role, in the context of the trend of "losing currency value" causing capital flows to withdraw from government bonds and legal currencies due to concerns about large public debt.

After adjusting from the peak of 4,381 USD/ounce in October - when the market was considered too hot, gold prices have quickly recovered and are expected to maintain their upward momentum next year. Goldman Sachs Group Inc. is one of the banks that forecast gold prices to continue to increase in 2026, with a base scenario of 4,900 USD/ounce and an upside risk.

Silver prices increased by 1.4%, approaching the $70/ounce mark. With an increase of about 140% since the beginning of the year, the increase of silver is even more impressive than gold. Recent momentum comes from speculative cash flow and supply disruptions at major trading floors after the historic "short squeeze" in October.

In London, silver deposits recorded a significant amount of metal pouring in, but the majority of available silver in the world is still concentrated in New York, as traders await the results of the US Commerce Department's investigation into whether important mineral imports threaten national security factors that could lead to tariffs or limit trade. Meanwhile, the amount of silver stored at warehouses linked to the Shanghai Stock Exchange fell to its lowest level since 2015 last month.

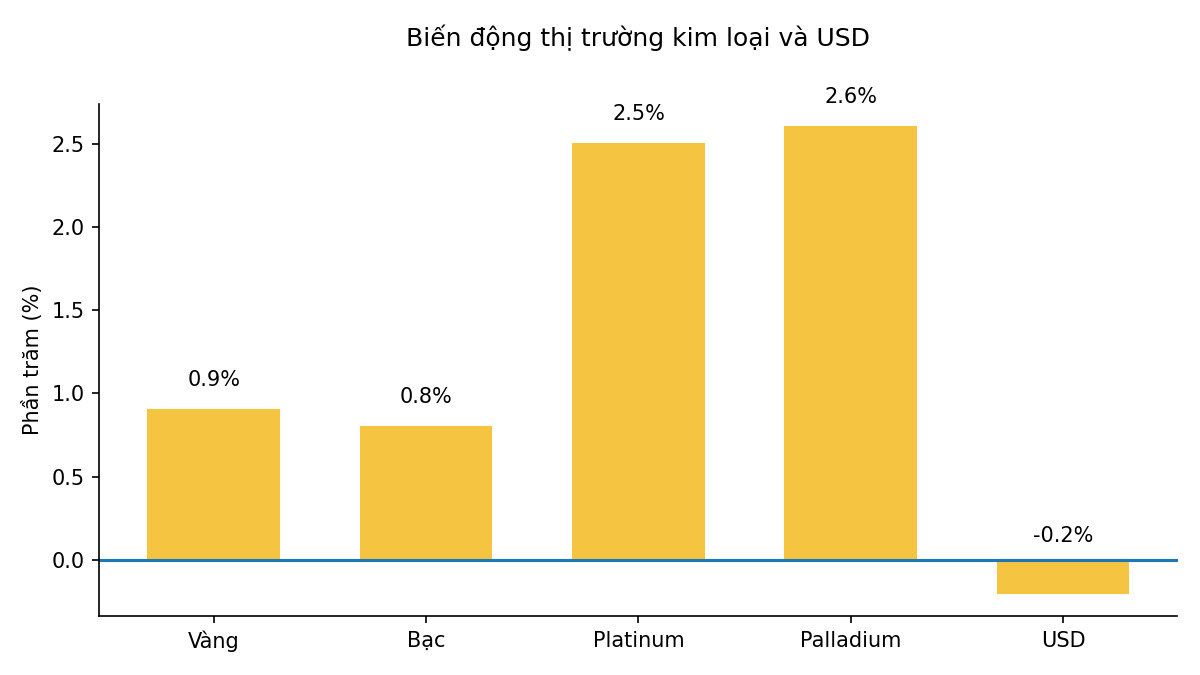

As of 11:22 (Singapore time), spot gold prices increased by 0.9% to 4,484.18 USD/ounce, after reaching a record peak of 4,497.74 USD/ounce before. Silver prices increased by 0.8% to 69.62 USD/ounce. platinum increased by 2.5%, palladium increased by 2.6%, while Bloomberg Dollar spot Index decreased by 0.2%.