According to J.P. Morgan (one of the world's largest financial - banking corporations, headquartered in the US), after a year of unprecedentedly strong price increases, the global gold market is expected to continue to maintain an upward trend in 2026.

According to the latest report from J.P. Morgan Global Research believes gold could average $5,055 an ounce by the fourth quarter of 2026, driven by persistent demand from investors and central banks, along with the emergence of new demand sources.

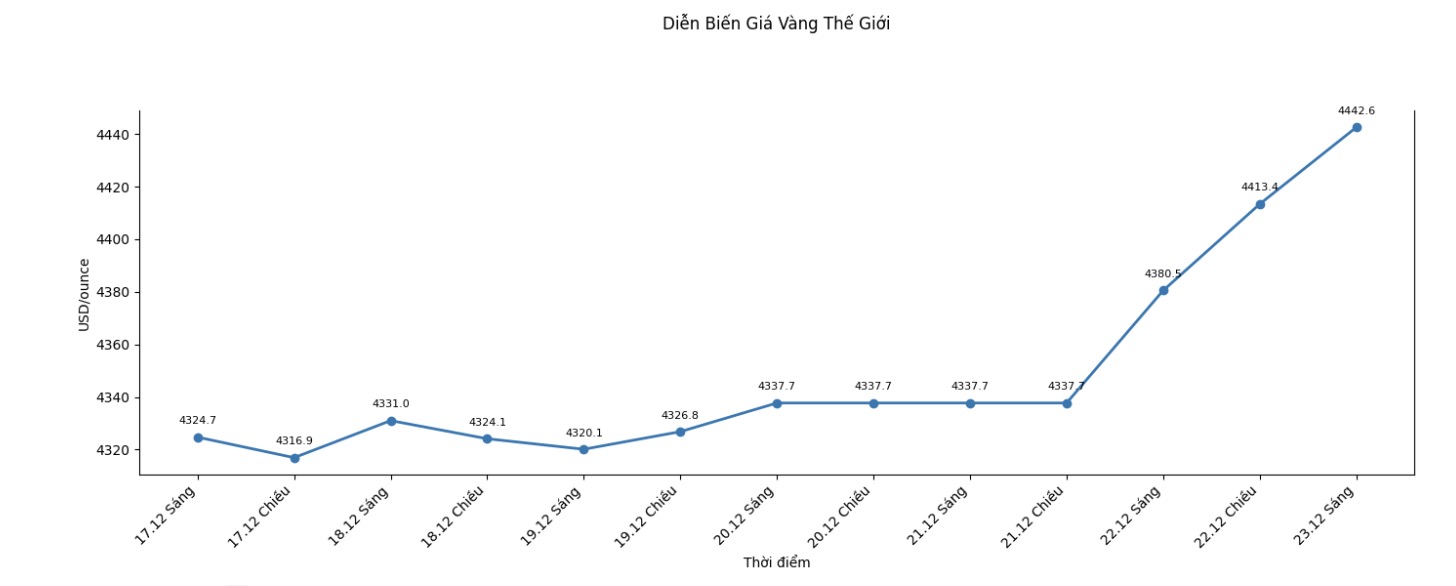

In 2025, gold prices have hit new peaks many times and surpassed the $4,000/ounce mark for the first time. The main driving force comes from strong cash flow into gold ETFs, central bank buying demand and investor asset diversification in the context of declining US interest rates and weakening the USD.

According to J.P. Morgan, although the gold rally is not going in a straight line, the fundamental factors driving gold prices up have not yet weakened. Ms. Natasha Kaneva, Head of Global Commodity Strategy at this bank, said that the long-term trend of diversifying reserves and portfolios to gold still has a lot of room.

Gold demand remains high

J.P.'s data. Morgan shows that in the third quarter of 2025 alone, total demand for gold from investors and central banks reached about 980 tons, 50% higher than the average of the previous four quarters. With an average gold price of $3,458/ounce in the same period, this demand is equivalent to about $1109 billion in capital - nearly double the previous period.

The bank said that the relationship between quarterly gold demand and price fluctuations explains about 70% of the change in gold prices over time. According to J.P.'s model. Morgan, for gold prices to continue to increase every quarter, the market needs to minimize about 350 tons of net demand from investors and central banks. For every 100 tons of bridge over this level, gold prices could increase by about 2% quarterly.

Entering 2026, J.P. Morgan forecasts gold demand from the two groups to average 585 tons per quarter. Of which, central banks are expected to buy about 190 tons per quarter; demand for gold bars and coins reaches about 330 tons per quarter; while capital flows into ETFs and futures contracts are estimated at 275 tons for the whole year, mainly focusing on the first half of the year.

Central banks continue to be a pillar

Although the global central bank has been buying more than 1,000 tons of gold per year for three consecutive years, J.P. Morgan believes demand from this region will remain high. The bank forecasts total central bank purchases in 2026 to reach about 755 tons - lower than the peak in recent years, but still significantly higher than before 2022.

According to J.P.'s analysis. Morgan said the decline in buying volume did not reflect the change in trend, but was largely due to technical factors. When gold prices are at a very high level, central banks do not need to buy too much in volume to achieve the desired gold proportion in total reserves.

Data from the International Monetary Fund (IMF) shows that by the end of 2024, the total amount of gold held by global central banks will reach nearly 36,200 tons, accounting for about 20% of total official reserves, a sharp increase compared to 15% at the end of 2023.

Not only central banks, demand from the investor sector is also forecast to remain positive. In the financial market, investors' gold futures contract position is still leaning towards a net buying trend, reflecting expectations of gold prices having room to increase.

J.P. Morgan estimates that capital flows into gold ETFs in 2026 could reach about 250 tons, while demand for gold bars and coins is expected to continue to exceed 1,200 tons per year.

Gold price prospects until 2027

In addition to traditional demand sources, J.P. Morgan also mentioned the possibility of new buyers, which could contribute to expanding the " drive" for gold ownership in the future.

In the context of slow supply of gold mining and difficulty reacting quickly to high prices, while demand remains at a large level, J.P. Morgan believes that market risks are currently leaning towards the scenario of gold prices reaching higher levels earlier than expected.

According to J.P.'s forecast. Morgan Global Research believes that gold prices will average $5,055/ounce in the fourth quarter of 2026 and could continue to increase to around $5,400/ounce by the end of 2027, strengthening gold's role as an important long-term store and diversification channel for assets.