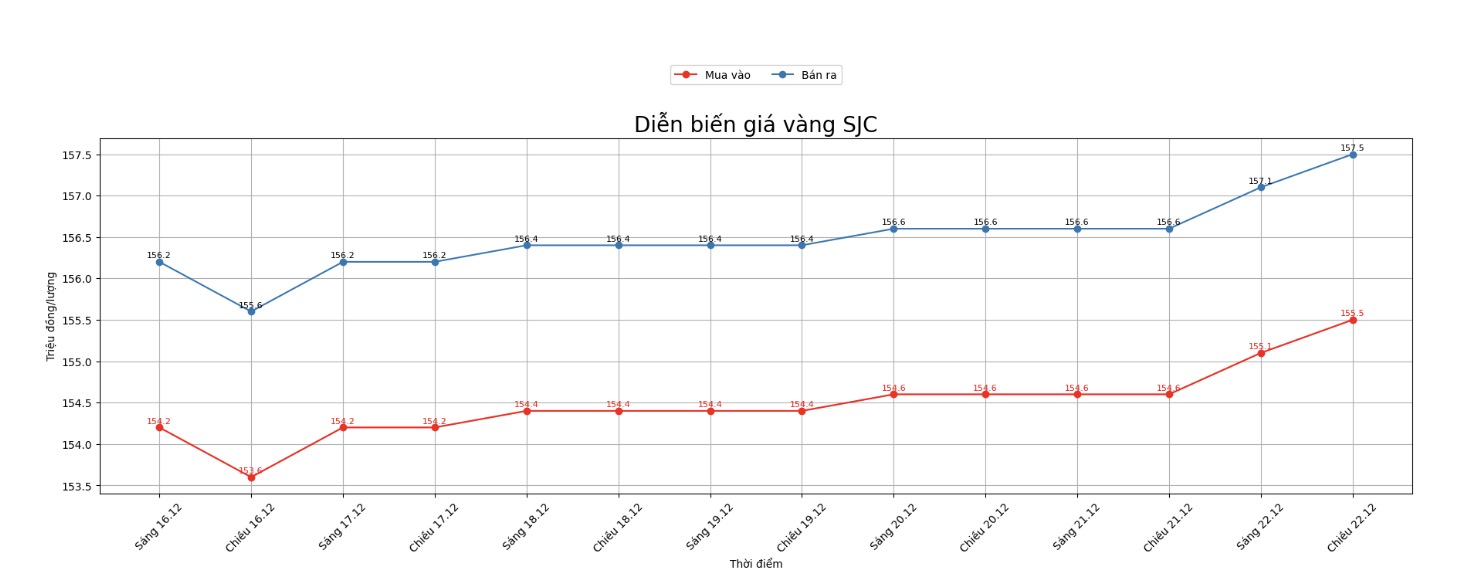

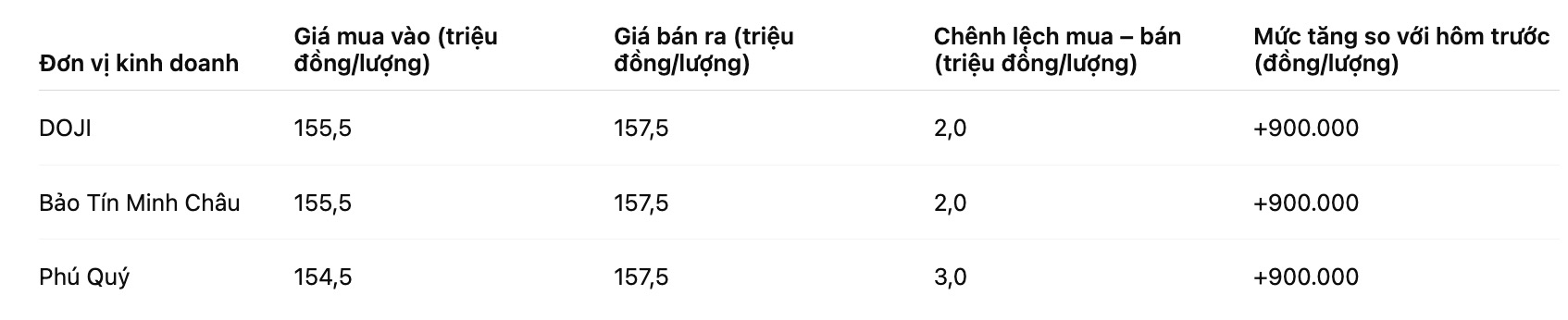

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND155.5-157.5 million/tael (buy in - sell out), an increase of VND900,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 155.5-157.5 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 154.5-157.5 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

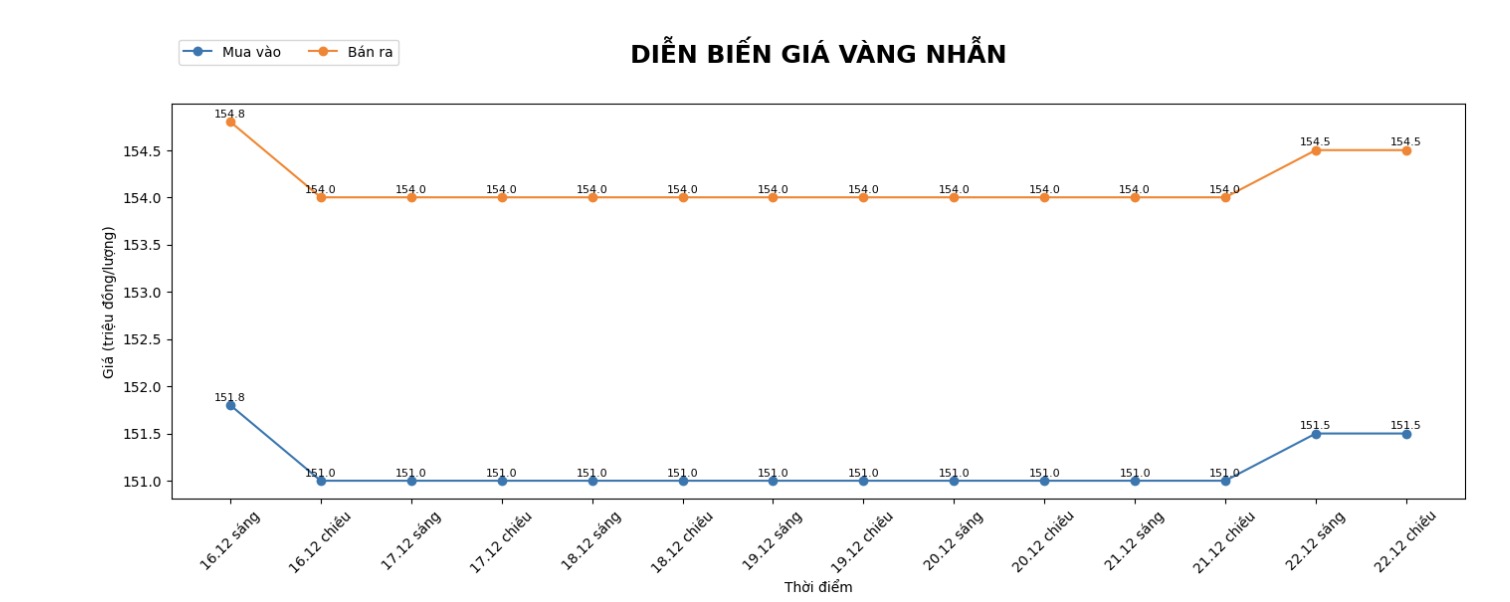

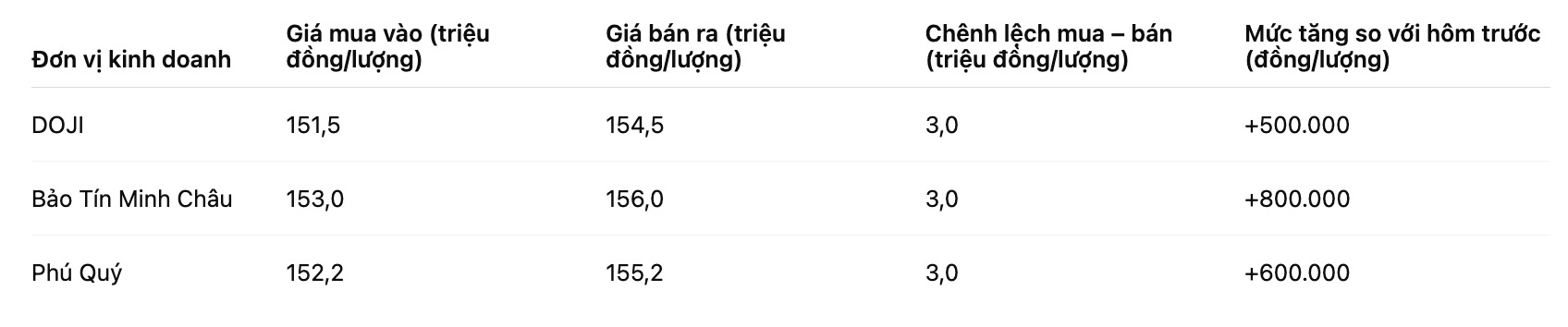

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 153-156 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 152.2-155.2 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

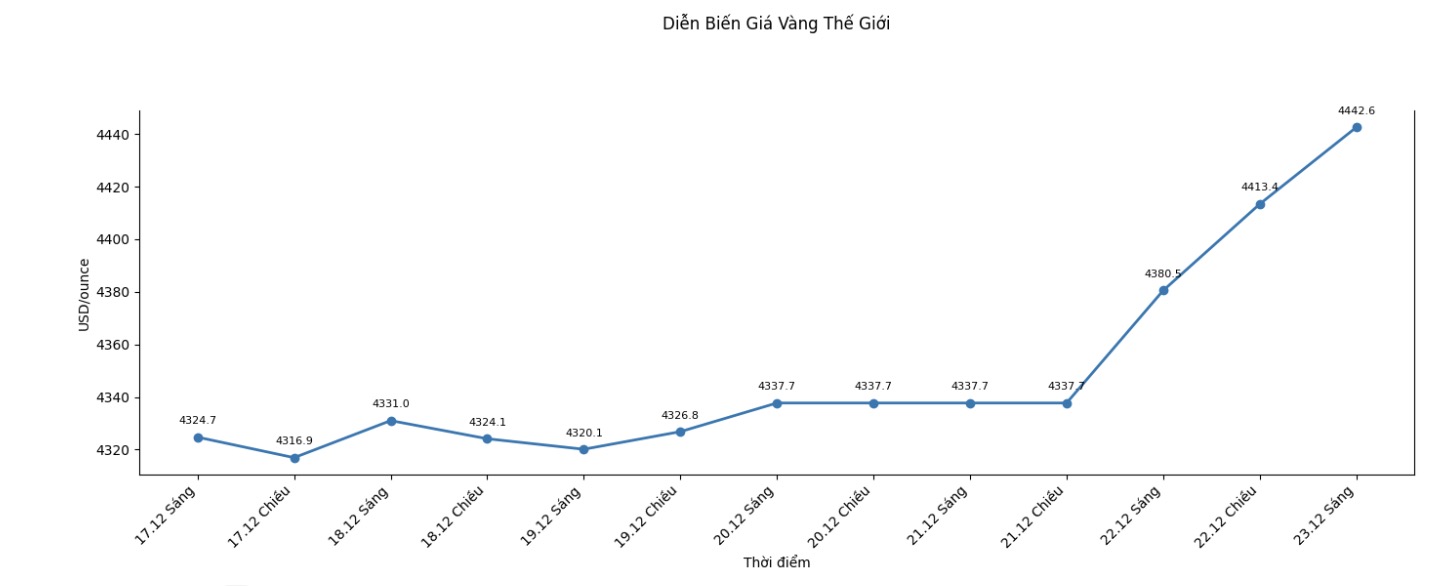

World gold price

The world gold price was listed at 5:24, at 4,442.6 USD/ounce, up 104.9 USD/ounce compared to a day ago.

Gold price forecast

Gold and silver prices increased sharply and simultaneously set record highs as safe-haven cash flow increased in the context of the market entering a shortened trading week due to the holiday. Positive developments in external markets also contributed to supporting precious metal prices.

February gold contract increased by 84 USD, to 4,471 USD/ounce. During the session, gold prices had a time when they jumped to a new record high of 4,477.7 USD/ounce. March delivery silver price increased by 0.91 USD, to 68.43 USD/ounce and also recorded a historic peak for the day at 69.525 USD/ounce.

The precious metals market was supported by a weakening of the US dollar, while crude oil prices increased and US government bond yields decreased slightly.

The declining USD Index makes gold and silver more attractive to investors holding other currencies. At the same time, crude oil prices are trading around 57.75 USD/barrel, while the yield on the 10-year US Treasury note is around 4.16% - factors considered beneficial for non-interest-bearing assets such as gold.

According to analysts, investors' risk-off needs are still high in the final period of the year, when market liquidity tends to decrease and large funds adjust their portfolios. This contributes to the amplification of gold and silver price increases.

Technically, the upward trend of February gold delivery is still clearly dominating. The next bullish target is to get the closing price above the strong resistance level at 4,500 USD/ounce. On the other hand, the key support zone is around $4,400/ounce and deeper at $4,250/ounce. Wyckoff's market assessment index is currently at 9.0, showing a strong uptrend advantage.

Experts say that in the short term, gold and silver prices are likely to continue to fluctuate strongly, depending on the developments of the USD, the energy market and the defensive psychology of global investors.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...