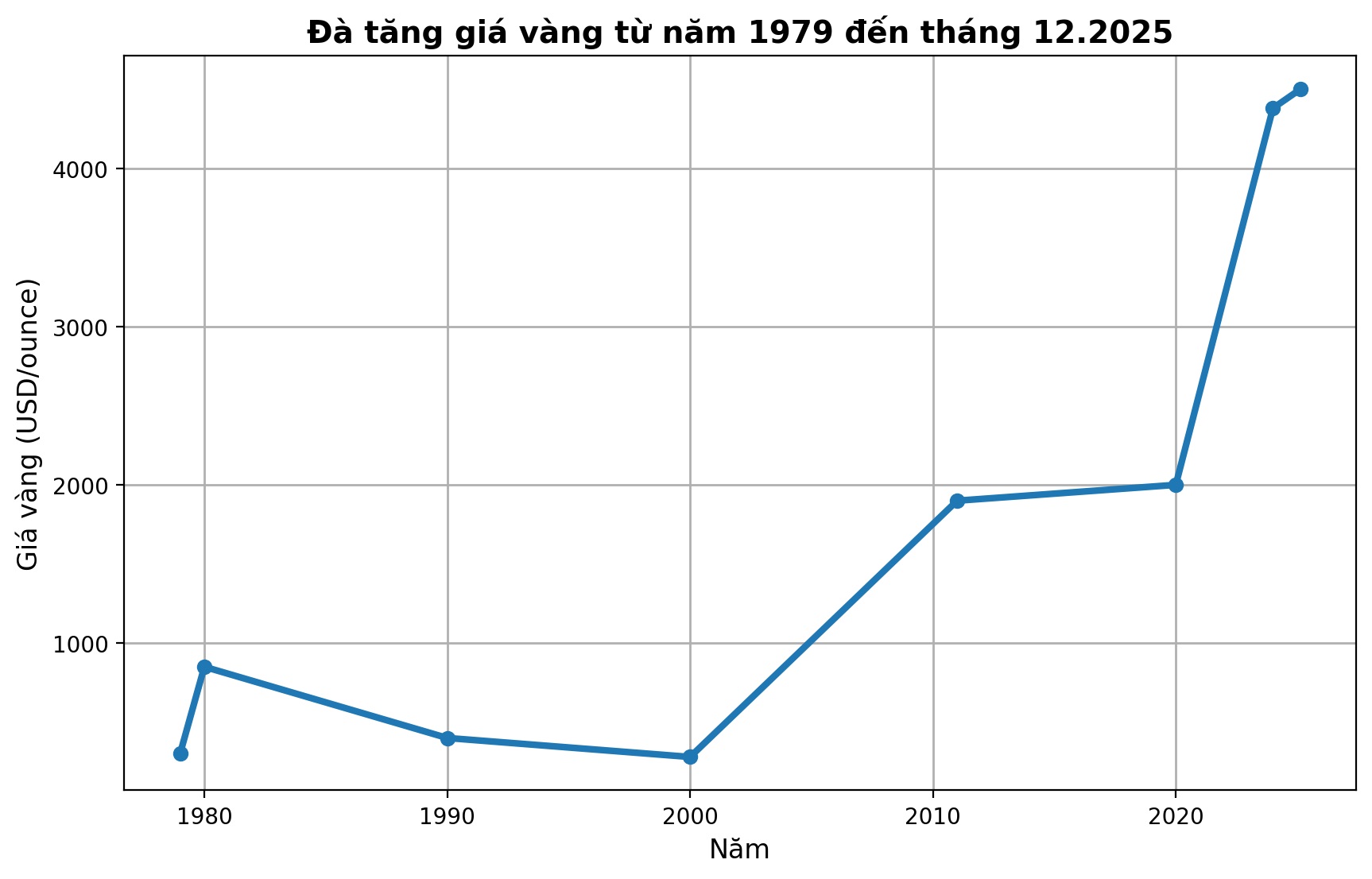

Gold and silver prices both hit a historic peak, marking the precious metal's strongest year of increase in more than 40 years, in the context of escalating geopolitical tensions and expectations of the US continuing to make increasingly clear interest rate cuts.

In the latest trading session, gold prices increased by 2.4%, surpassing the record of 4,381 USD/ounce set in October. Silver prices also broke out strongly, sometimes approaching the $70/ounce mark. Both metals are on track to record their strongest annual gains since 1979.

The main driver of the rally comes from expectations that the US Federal Reserve (Fed) will cut interest rates twice in 2026, along with the view of US President Donald Trump in favor of a looser monetary policy. Low interest rates continue to be an important supporting factor for non-yielding precious metals.

Rising geopolitical tensions also strengthen the safe haven role of gold and silver. The US has increased oil blockades against Venezuela, while the Russia-Ukraine conflict has seen new developments in the Mediterranean region.

Since the beginning of the year, gold prices have increased by about 67%, thanks to the persistent buying power of central banks and strong cash flow into gold ETFs. The trend of withdrawing capital from government bonds and pre-matter bonds, in the context of increasing concerns about public debt, continues to make gold a priority destination for investors.

Not only gold and silver, other precious metals also recorded impressive increases. Palladium surged to its highest level in nearly three years, while platinum surpassed the $2,000/ounce mark for the first time since 2008 and more than doubled since the beginning of the year.

After a brief correction in October, gold prices quickly recovered and many major financial institutions are forecasting to maintain an upward trend in 2026, in the context of limited physical supply and continued expansion of investment demand.