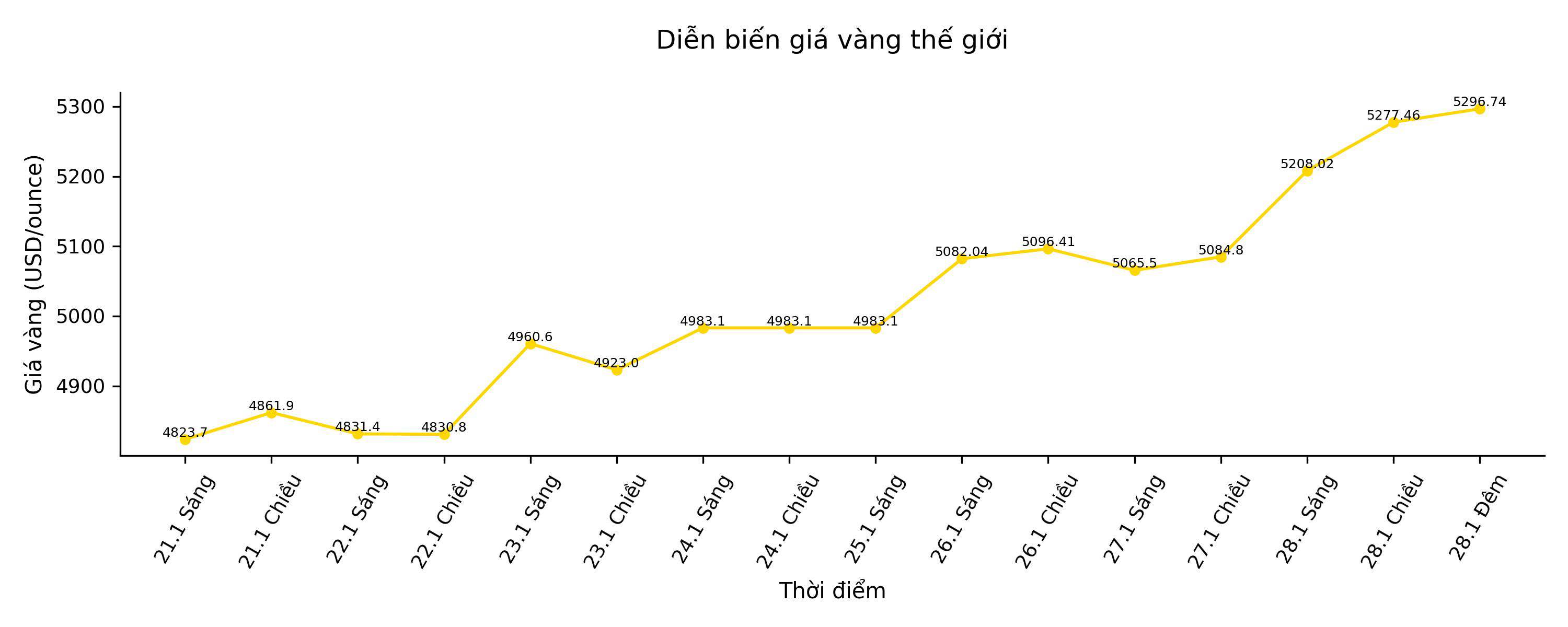

Gold prices soared to a record level, exceeding 5,300 USD/ounce, extending the rapid increase fueled by the weakening USD and the wave of fleeing bonds and currencies.

Spot gold prices rose by 2.5%, following a 3.4% breakthrough on Tuesday - the strongest increase in a day since April. President Donald Trump declared he was not worried about the decline of the USD - the factor that pulled the world's leading reserve currency to its lowest level in nearly 4 years.

This decline, along with increased geopolitical risks and capital flight from both US currencies and Treasury bonds, has triggered a strong buying wave into precious metals. Since the beginning of the year, gold has increased by about 22%, exceeding the 5,000 USD/ounce mark for the first time this week. At the same time, silver has increased by nearly 60%.

A massive sell-off on the Japanese bond market became the latest example of concerns related to large fiscal spending, while speculation that the US may intervene to support the yen continues to put pressure on the USD, making precious metals cheaper for most buyers.

Mr. Trump told reporters in Iowa on Tuesday that the USD "is still stable", and he expects currency fluctuations to be normal. When asked if he was concerned about the greenback's decline, he replied: "No, I think it's very good." The USD strength measurement index fell 1.1% in the session - the strongest day's decline since April.

The White House's moves from threatening to annex Greenland, the possibility of military intervention in Venezuela, to attacking the independence of the US Federal Reserve (Fed) have also caused market instability in recent weeks. The US President also pledged to increase import tariffs on Korean goods, and impose a 100% tariff on Canada if Ottawa reaches a trade agreement with China.

Meanwhile, bond traders are increasingly betting on the Fed's early easing of policy, after expectations that Rick Rieder - Investment Director of BlackRock Inc will succeed Jerome Powell as chairman. This veteran manager supports a strong interest rate cut. The low-interest environment is a positive catalyst for gold, which does not generate yields.

According to Ms. Suki Cooper, Head of Commodity Research at Standard Chartered Plc, expectations for a more moderate and less independent Fed, coupled with geopolitical risks, "are accelerating capital flows into gold, led by individual investors". She emphasized: "Without short-term corrections, rising price risks still prevail.

Even "crypto giants" are participating in the race: Tether Holdings SA is currently the largest gold holding organization in the world besides banks and nationals, becoming an important player in the global market in the past year. The company holds about 140 tons of gold, mostly Tether's own reserves, according to CEO Paolo Ardoino shared with Bloomberg News.

Silver prices rose by 3.6%, approaching a record level of 117 USD/ounce achieved on Monday after weeks of fierce fluctuations, before cooling down. CME Group will increase the margin for trading Comex silver contracts from the end of Wednesday's session, while China's only silver fund has temporarily stopped trading during the day. UBS SDIC Silver Futures Fund LOF also stopped receiving new registrations, after repeated warnings that the current price difference compared to silver contracts on the Shanghai Commodity Exchange is "unsustainable".

Amid rising global precious metal prices, the government of Shenzhen city (China) has established a special working group to monitor the operation of a gold trading platform, after investors encountered difficulties withdrawing money, leading to protests.

Spot gold increased by 1.6%, to $5,297.74/ounce in last night's trading session. Silver almost went sideways at $112.19/ounce. Platinum stable, palladium slightly increased. Bloomberg Dollar Spot index increased by 0.3%.