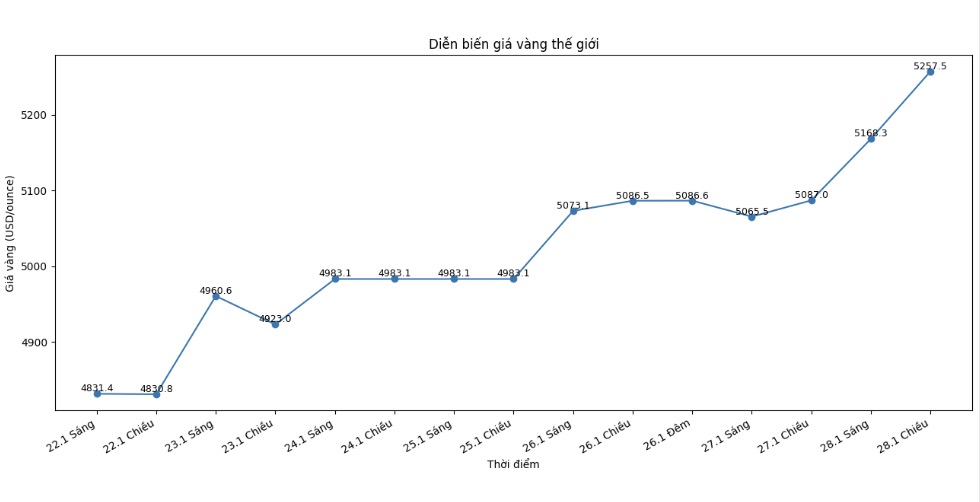

World gold and silver prices soared in the latest trading session, in which gold played a leading role when continuously setting record highs. This development clearly reflects the safe-haven sentiment of investors in the context of the strong weakening USD and the global market waiting for the conclusion of the monetary policy meeting of the US Federal Reserve (Fed).

On the Comex exchange, April gold futures price at one point jumped to $5,345/ounce - the highest level in history. At the end of the session, this contract increased by $181.6, to $5,303/ounce.

Silver prices also increased sharply no less, with March futures increasing by 6.668 USD, to 112.60 USD/ounce. The strong increase of the two precious metals took place in the context of the USD depreciating rapidly, making gold and silver more attractive to global investors.

Faced with the fierce volatility of the market, CME Group said it would raise the margin level for silver contracts on the Comex exchange. This move is to control risks after silver prices rose to record levels last week.

According to CME, the adjustment was made after a market fluctuation review process to ensure the safety level of margin assets. Not only silver, margins for platinum and palladium contracts will also be increased.

Another important factor driving gold prices is the weakening of the USD. The USD Index fell to its fourth-year low and recorded its sharpest decline since the announcement of major tariff measures last year.

US President Donald Trump's recent statement further fluctuated the currency market when he said that the weak USD is beneficial for US businesses and does not believe that the currency is weakening excessively. These statements are said to have added fuel to the upward trend of gold prices.

The focus of market attention today is still the two-day monetary policy meeting of the Fed, expected to end this afternoon US time (early morning January 28 Vietnam time).

Analysts are almost certain that the Fed will keep interest rates unchanged, but policy statements and President Jerome Powell's press conference are expected to reveal more important signals about monetary policy orientation in the coming time, especially the Fed's stance on inflation. This is also the reason why gold and silver investors are in a state of "holding their breath", waiting for every message sent from the world's largest central bank.

In related markets, crude oil prices edged up slightly and traded around the threshold of 62.75 USD/barrel, while the yield on US 10-year government bonds stood at about 4.24%. The USD continued to bear downward pressure, thereby maintaining a favorable environment for hedge funds such as gold.

Technically, the upward trend of gold prices is still assessed as very strong. Buyers are clearly dominant as the next target is the resistance zone of 5,500 USD/ounce, while the important support zone is determined around the 5,000 USD/ounce mark. According to the Wyckoff scale, the gold market is currently at a level of 10 points, showing that the upward momentum is in a very strong state.