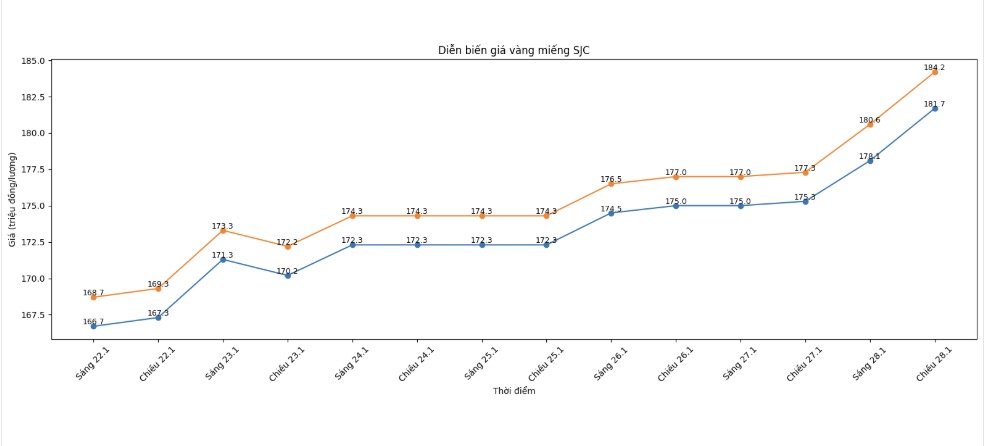

SJC gold bar price

As of 6:40 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 181.7-184.2 million VND/tael (buying - selling), an increase of 6.4 million VND/tael on the buying side and an increase of 6.9 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 181.7-84.2 million VND/tael (buying - selling), an increase of 6.4 million VND/tael on the buying side and an increase of 6.9 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 180.1-183.2 million VND/tael (buying - selling), an increase of 5.6 million VND/tael on the buying side and an increase of 6.2 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3.1 million VND/tael.

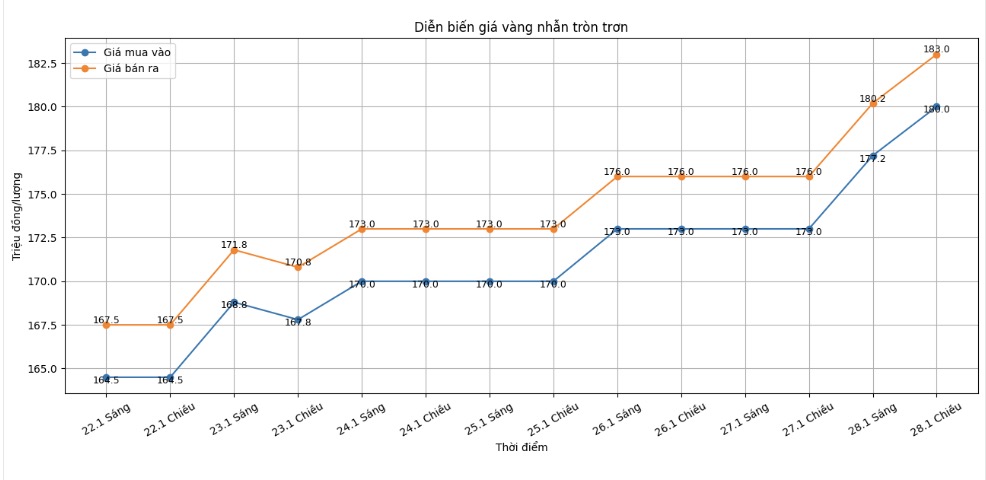

9999 gold ring price

As of 6:00 PM, DOJI Group listed the price of gold rings at 180-183 million VND/tael (buying - selling), an increase of 7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 180-183 million VND/tael (buying - selling), an increase of 6.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 179.9-182.9 million VND/tael (buying - selling), an increase of 6.4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

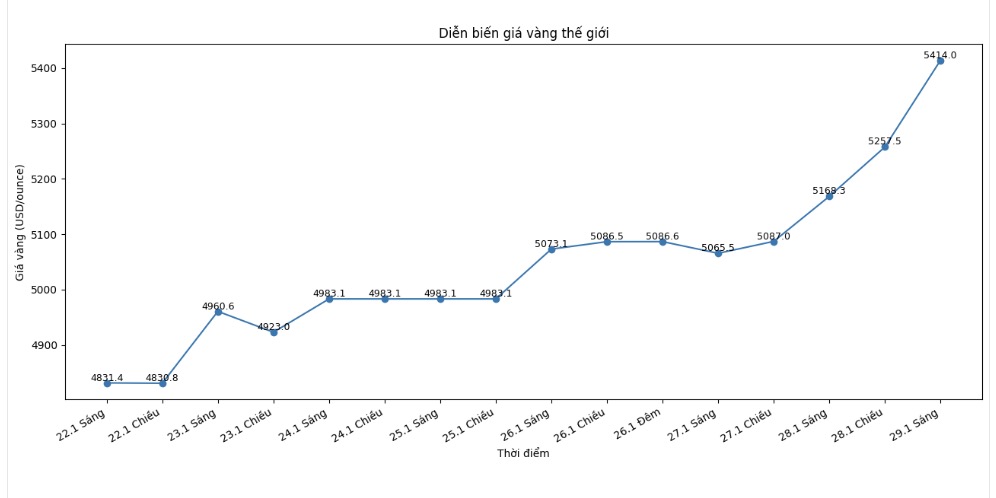

World gold price

At 5:15 am, the world gold price was listed around the threshold of 5,414 USD/ounce, jumping to 246.1 USD.

Gold price forecast

The world gold market recorded an impressive increase, breaking the peak of 5,400 USD/ounce in the context that the US Federal Reserve (Fed) continues to maintain operating interest rates at 3.5-3.75%. This shows that the precious metal is following its own dynamics, instead of directly reacting to monetary policy messages as before.

At a press conference after the policy meeting at the beginning of the year, Fed Chairman Jerome Powell said that the strong increase in gold did not reflect the Fed's loss of operating credibility. He emphasized that inflation expectations indicators are still under control and the Fed does not pay too much attention to price fluctuations of individual assets.

However, the market does not seem to be much affected by this view, as spot gold prices still maintained their upward momentum and approached the 5,400 USD/ounce mark.

According to analysts, the Fed's maintenance of a neutral stance, while acknowledging that economic risks remain high, has created a favorable environment for gold. In addition, the strong weakening of the USD in recent times, along with prolonged geopolitical instability, continues to strengthen the safe haven role of the precious metal.

Mr. Nitesh Shah - Head of Commodity and Macroeconomic Research at WisdomTree said that the gold market is looking further than the Fed's current decisions. "It is highly likely that Mr. Powell will be replaced in the near future by a personnel who tend to support monetary policy easing. This is exactly what the gold market is expecting," Mr. Shah said. According to this expert, expectations of interest rate cuts in the second half of the year are still a key factor supporting gold prices.

Technically, analysts believe that the upward trend of gold is still dominant. If shelter sentiment continues to be maintained and the USD cannot sustainably recover, gold prices are likely to move towards the next resistance zone around the 5,500 USD/ounce mark.

Conversely, in the event of stronger tightening signals from the Fed, gold may be under adjustment pressure, but the support zone around 5,000 USD/ounce is assessed as quite solid in the short term.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...