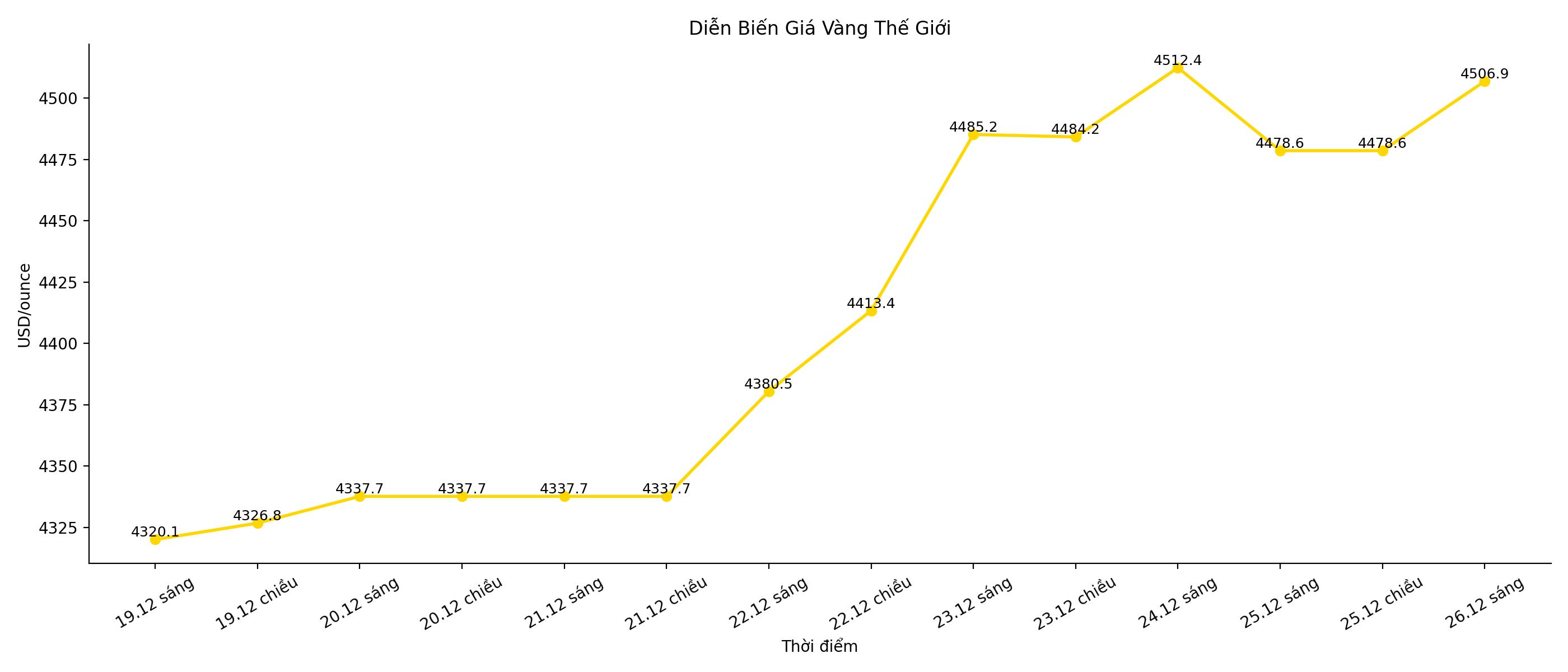

Gold and silver prices simultaneously hit a historic peak amid escalating geopolitical tensions and a strong weakening of the US dollar, prolonging the record rally of the precious metals market.

Spot gold had a time to surpass $4,530/ounce, up more than 1% in the session, as demand for shelter increased after a series of hot developments in Venezuela and Africa. The US's increased pressure on the Trump administration of President Nicolas Putin, along with military moves against the armed group in Nigeria, have raised concerns about global geopolitical risks.

At the same time, silver prices continued to break out strongly when they increased for the fifth consecutive session and for the first time exceeded the 75 USD/ounce mark. This increase was driven by increased speculative cash flow, tight supply and negative feedback from the short-squeeze in October. During that period, many investors who bet on lower prices were forced to buy back to cut losses when the market reversed, thereby pushing silver prices to skyrocket in a short time and creating a foundation for the uptrend that continues to the present.

The weak USD further fuels the precious metal. The Bloomberg Dollar spot Index fell 0.8% for the week its biggest decline since June, making gold and silver more attractive to global investors.

Since the beginning of the year, gold has increased by about 70% while silver has increased by more than 150%, aiming for the strongest increase since 1979. The main driver comes from the US Federal Reserve (Fed) continuously lowering interest rates, cash flow flow into ETFs and large-scale gold purchases by central banks.

According to the World Gold Council, gold holdings in ETFs have increased steadily this year, with the SPDR Gold Trust recording an increase of more than 20%. For silver, physical supply remains tight, while the US is considering strategic mineral import control measures - a factor that could continue to push prices up.

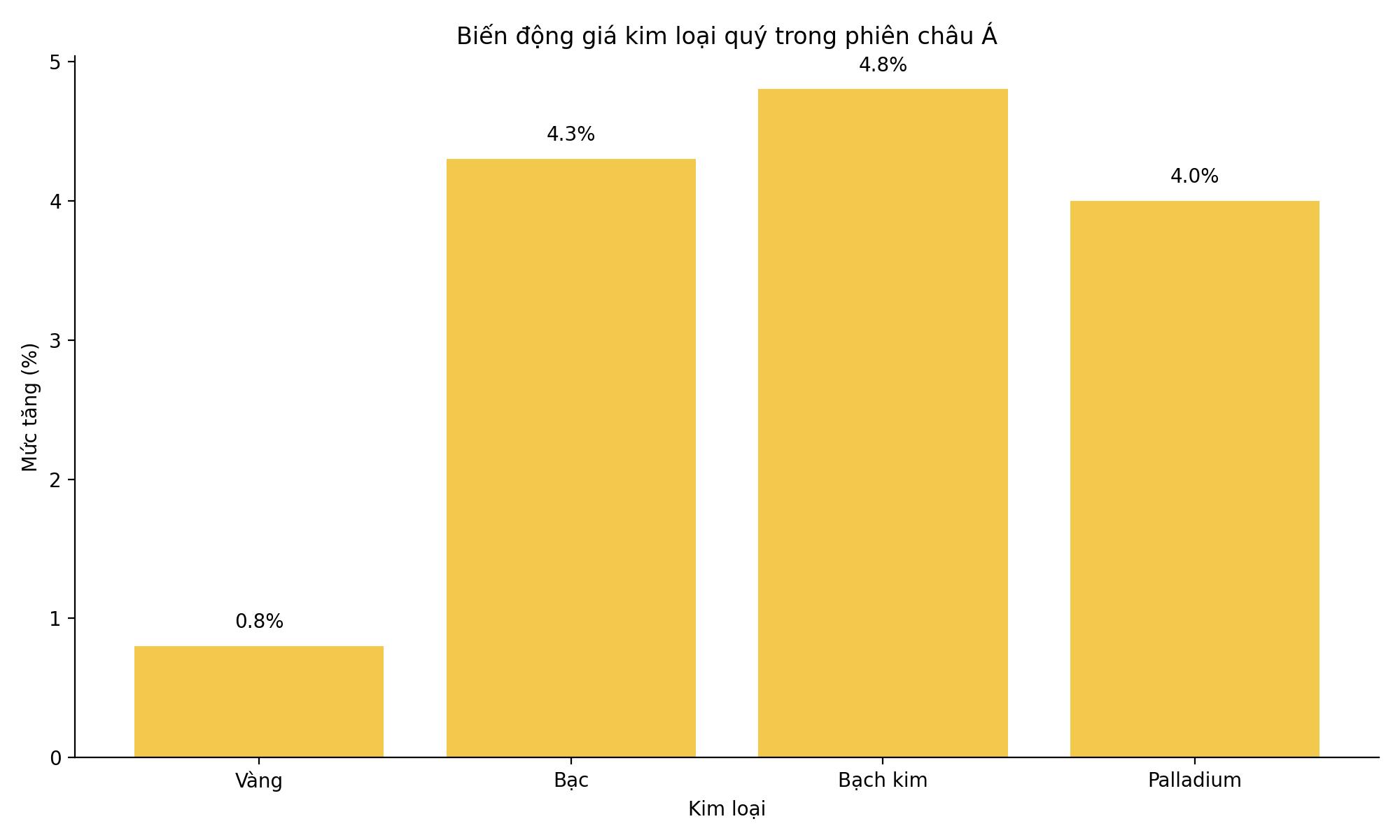

In the trading session in Asia, gold prices increased by 0.8% to 4,516.70 USD/ounce at 9:25 am Singapore time. Silver prices increased by 4.3% to 74.94 USD/ounce. platinum rose 4.8%, approaching $2,381.53, the highest level since Bloomberg began collecting data in 1987. Palladium also increased by about 4%.