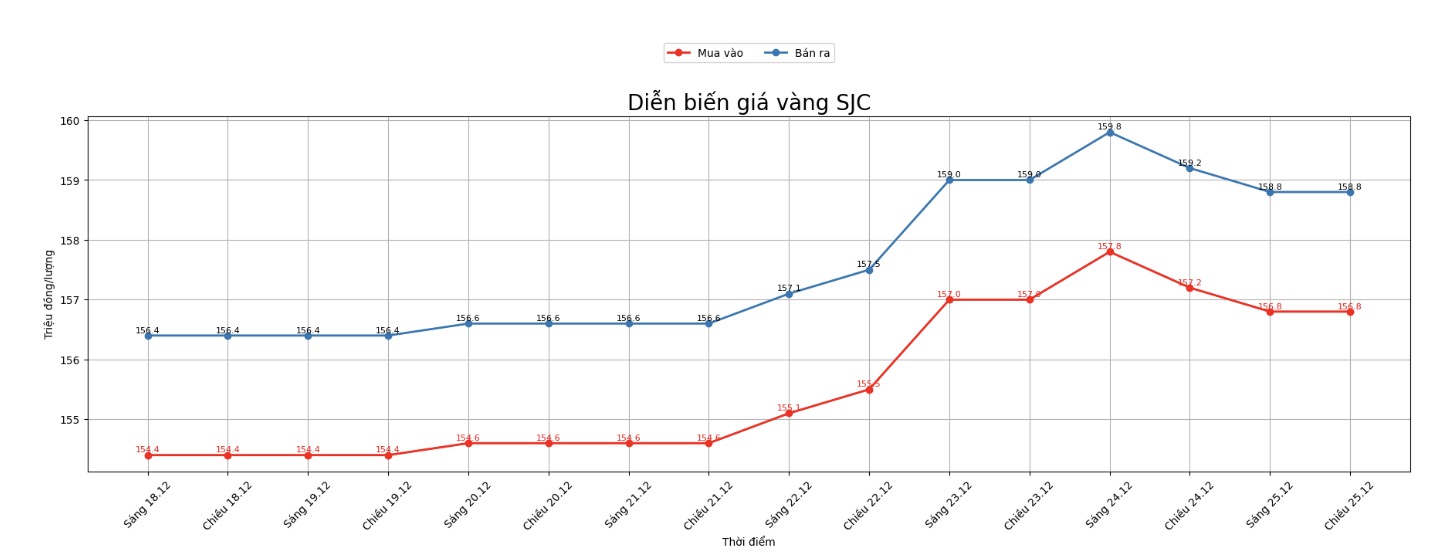

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 156.8-158.8 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 156.8-158.8 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 155.8-158.8 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

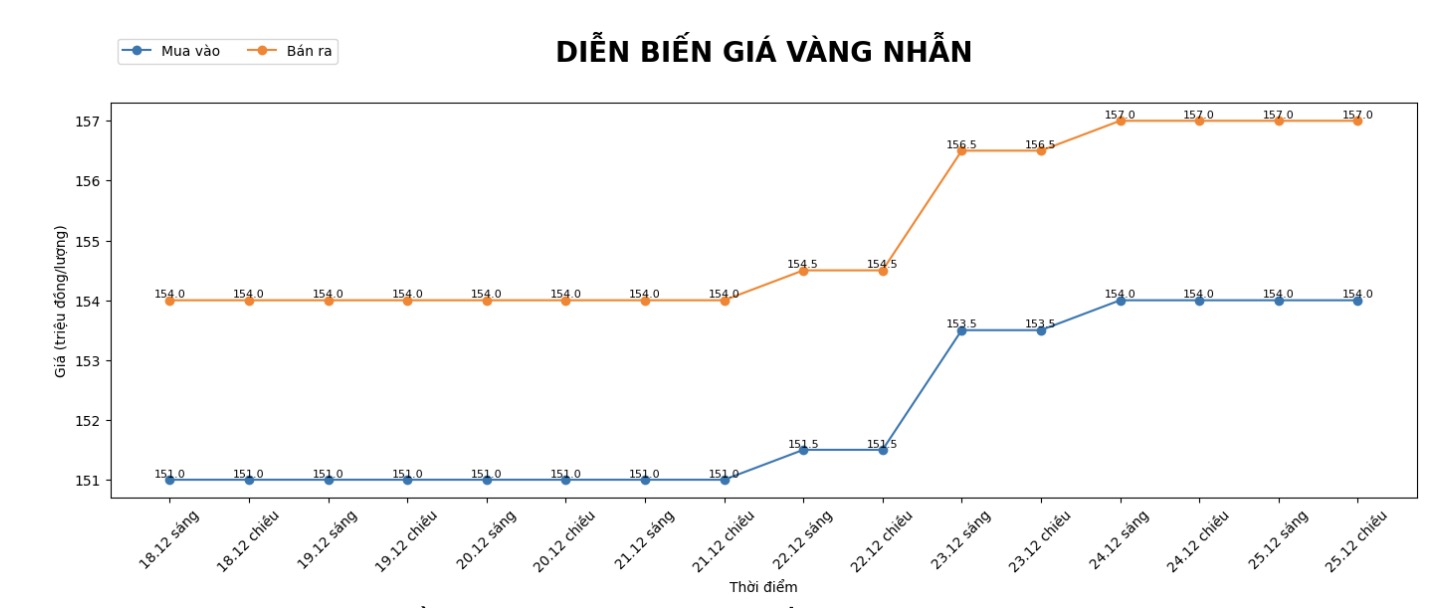

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 154-157 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.3-158.3 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 154.5-157.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

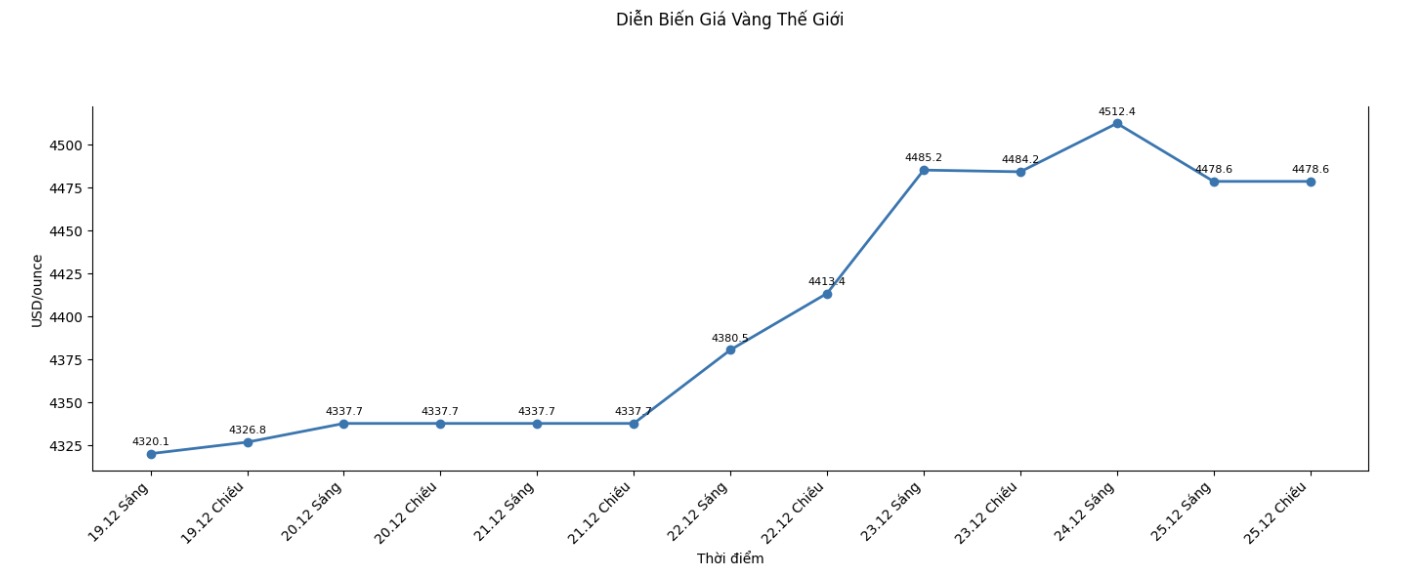

World gold price

The world gold price was listed at 6:00 a.m. at 4,478.6 USD/ounce, unchanged from a day ago.

Gold price forecast

The world gold market has just gone through the Christmas holiday, so trading is quiet, prices are almost flat.

International financial institutions and market research agencies are making many notable forecasts about the outlook for gold prices in 2026, with the common point being the expectation that this precious metal will maintain a high price level in the context of many unstable global economies and geopolities. Despite the different levels of optimism, most scenarios see gold continuing to play an important role as a safe haven asset and a long-term risk hedge.

In the group of positive forecasts, J.P. Morgan Global Research believes that gold prices could average around $5,055/ounce in the fourth quarter of 2026. The organization has even given a more optimistic scenario, where gold prices could approach $5,400 an ounce if investment demand continues to increase strongly and central banks maintain buying activities.

According to J.P.'s analysis. Morgan Global Research, the prolonged instability of the world economy along with geopolitical risks are key factors driving cash flow to gold.

Sharing the same view on the uptrend, Goldman Sachs predicts that gold prices could reach around $4,900/ounce by December 2026. Goldman Sachs stressed that the global monetary policy cycle is approaching an easing phase, causing the opportunity cost of holding gold to fall. In addition, the organization said that although inflation tends to cool down, it is difficult to return to a sustainable low in the short term, thereby continuing to support the attractiveness of gold.

From a cyclical perspective, the World Gold Council believes that 2026 could be a period of strong gold price fluctuations, with a larger increase - decrease range than previous years. According to the World Gold Council, the interweaving of supporting factors such as shelter demand and pressuring factors such as the possibility of a global economic recovery will cause the gold market to not follow a direct increase, but to have many significant corrections.

Some other market analysts and groups have more moderate forecasts, saying that gold prices in 2026 may fluctuate commonly in the range of 4,500 4,800 USD/ounce. These scenarios reflect the view that, although gold is still supported by investment demand and net buying from central banks, the increase could be somewhat held back if the USD strengthens or global economic growth improves significantly.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...