Gold prices fell more than 1% on Friday as investors took profits after a recent peak streak, amid signs of de-escalation geopolitical tensions continuing to weaken the safe-haven demand for precious metals.

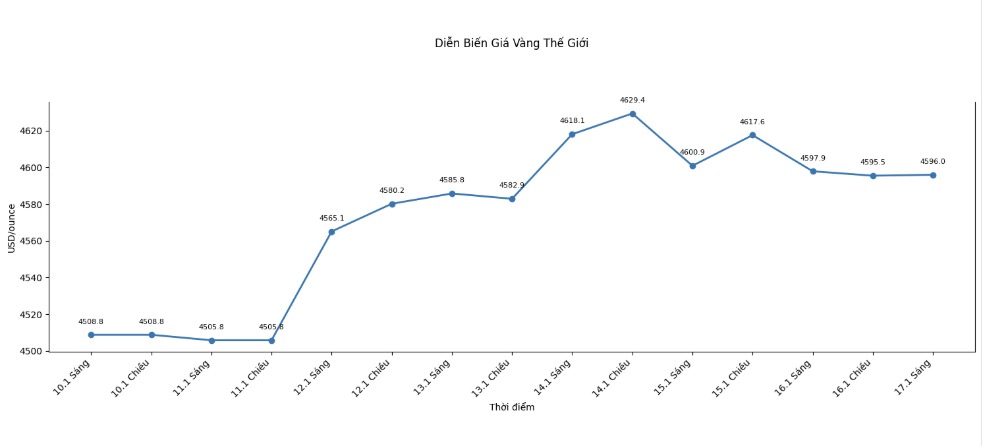

Spot gold prices fell 0.5%, to 4,596.34 USD/ounce in this morning's trading session, before that at one point falling to 4,536.49 USD in the session.

However, the precious metal is still heading for its second consecutive week of gains, about 1.9%, after hitting a historic peak of 4,642.72 USD/ounce on Wednesday. The US gold futures for February delivery closed down 0.6% to 4,595.40 USD.

The general commodity level is showing a correction after weeks of heated gains, accompanied by profit-taking activities. Cooling down tensions in the Middle East has also caused gold and other metals, especially silver, to lose their'geopolitical insurance premiums'," said expert Edward Meir of Marex.

Geopolitical tensions eased as protests in Iran subsided; US President Donald Trump appeared cautious, while Russian President Vladimir Putin sought to mediate to de-escalate the situation.

Meanwhile, the US Federal Reserve (Fed) is expected to maintain interest rates unchanged in the first half of the year, with the first 25 basis point cut expected in June, according to LSEG data.

Gold – traditional safe-haven assets often benefit in the context of geopolitical and economic instability, as well as when interest rates are low.

I still think gold has a chance to reach the 5,000 USD/ounce mark this year, although strong corrections will appear on the way" - Mr. Meir added.

Spot silver prices fell 2.9% to 89.65 USD/ounce, but still aimed for an increase of more than 12% in the week, after hitting a historic high of 93.57 USD in the previous session.

J.P. Morgan in a report released on Friday warned that silver is facing a series of major risks: loose US external supply, ETF capital outflows, weakening industrial demand, and tighter trading controls in China – factors that could cause silver to adjust sharply.

Spot platinum fell 3.3% to 2,330.67 USD/ounce, although it still went up weekly; palladium lost 0.6% to 1,790.78 USD/ounce.