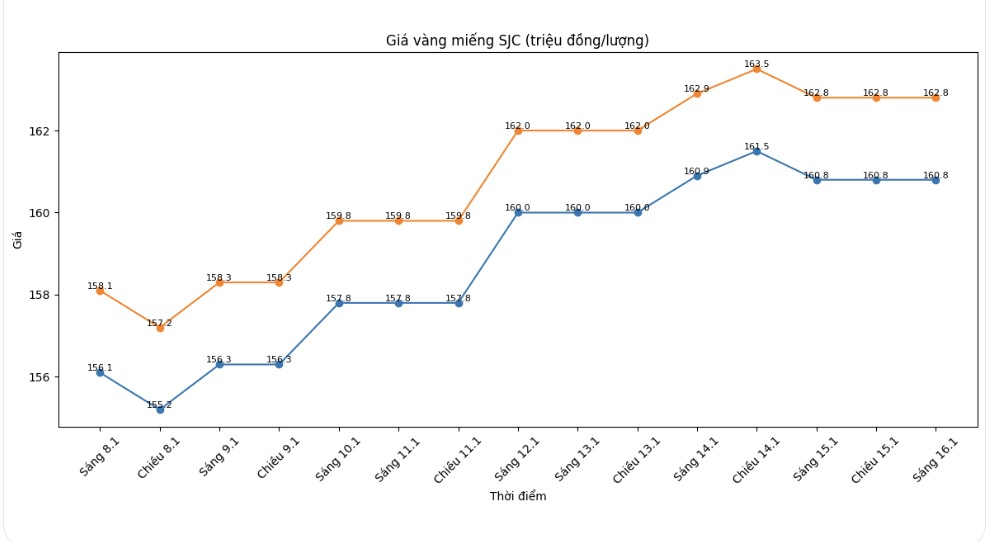

SJC gold bar price

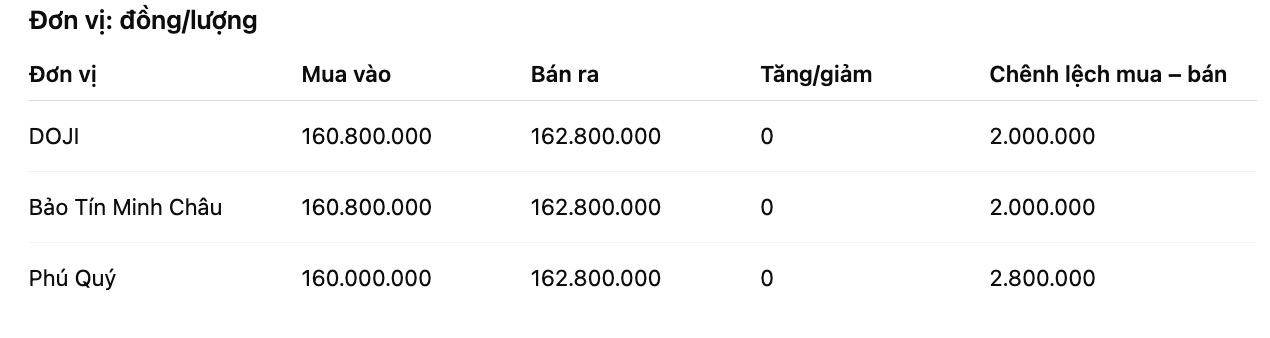

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 160.8-162.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 160.8-162.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 160-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling price difference is at 2.8 million VND/tael.

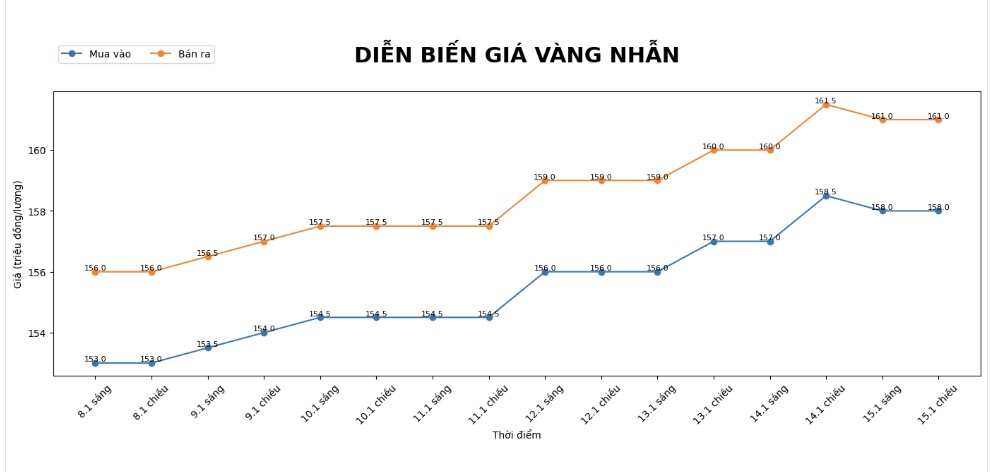

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

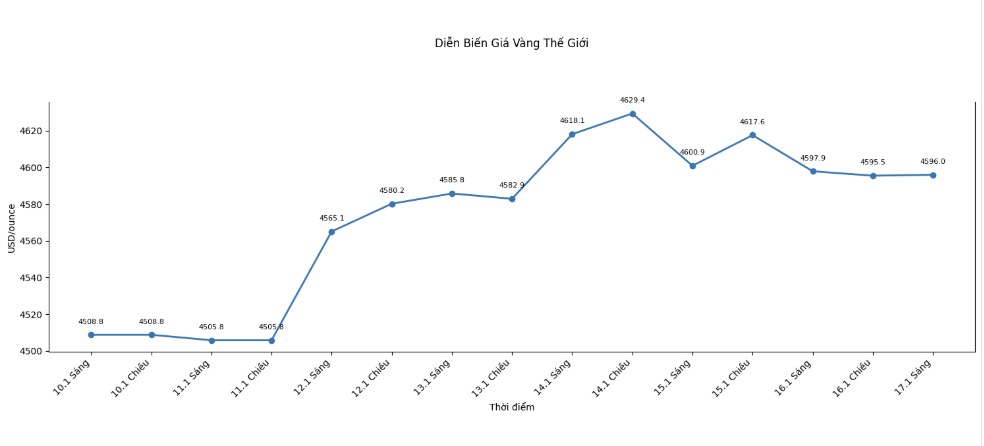

World gold price

At 9:00 AM, the world gold price was listed around the threshold of 4,596 USD/ounce USD/ounce, down 1.9 USD compared to the previous day.

Gold price forecast

In the context of domestic gold prices almost "staying still" at record highs, the world gold market is entering a stage of correction and accumulation after a long streak of strong increases. This development is assessed by analysts as quite normal, as investors tend to take short-term profits, especially before the long holidays in the US and when geopolitical risks temporarily cool down.

International gold prices around the threshold of 4,600 USD/ounce show that the market is in a stalemate. According to Neil Welsh - Head of Metals at Britannia Global Markets, the fact that gold maintains a high price range reflects a period of "rebalancing" rather than a sign of weakening. "This is not a market that has run out of momentum, but a typical accumulation period after a year of strong growth, when cash flow is rotating to find new momentum for the next wave" - he commented.

Another important factor dominating gold prices is the monetary policy of the US Federal Reserve (Fed). Recent US economic data, especially labor and manufacturing markets, are generally more positive than expected. This makes the possibility of the Fed early cutting interest rates in the first quarter assessed as very low. The USD then recovered, creating more short-term pressure on gold prices.

However, many experts believe that the current corrections are mainly technical and have not changed the long-term trend. Mr. Lukman Otunuga, senior market analyst at FXTM, said that the foundation supporting gold prices remains intact. "Fear about monetary policy, trade tensions and persistent buying pressure from central banks continue to be a support for gold in the medium and long term" - he said. However, he also noted that correction risks may appear if prices fall sustainably below some important technical thresholds.

From a commodity perspective, geopolitical tensions in the Middle East are temporarily subsided and expectations that the Fed will maintain interest rates in the first half of the year also make gold lack momentum to break through immediately. However, many major financial institutions still maintain a positive view, believing that the precious metal still has room to increase as the interest rate reduction cycle begins in the second half of the year and shelter demand increases.

Notable economic data in the coming week

US market holiday Martin Luther King Jr., Annual World Economic Forum opens

US President Donald Trump speaks at WEF, US announces data on houses waiting for sale

US announces Q3 GDP (last figures), PCE index, weekly jobless claims

US S&P's preliminary PMI index of manufacturing and services

Gold price data is compared to the previous day.

See more news related to gold prices HERE...