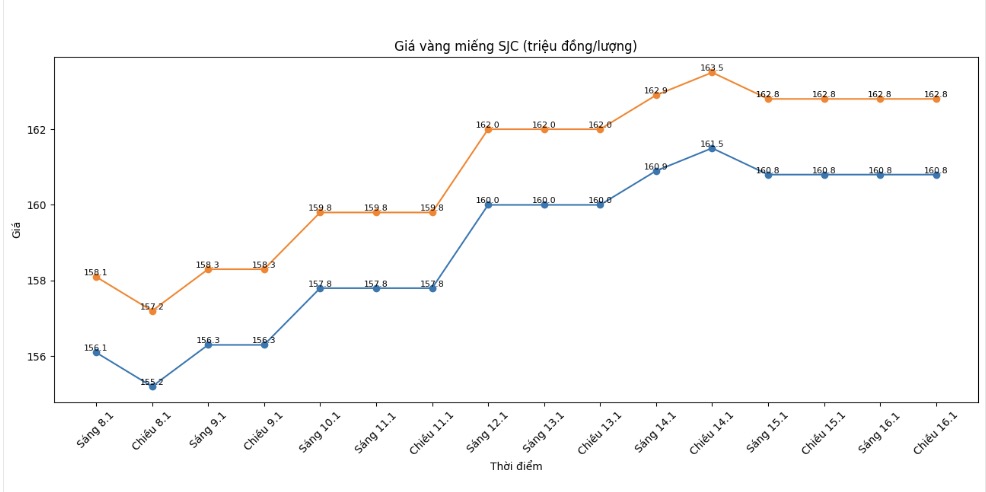

SJC gold bar price

As of 6:00 AM on January 17, SJC gold bar prices were listed by DOJI Group at the threshold of 160.8-162.8 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 160.8-162.8 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 160-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling price difference is at 2.8 million VND/tael.

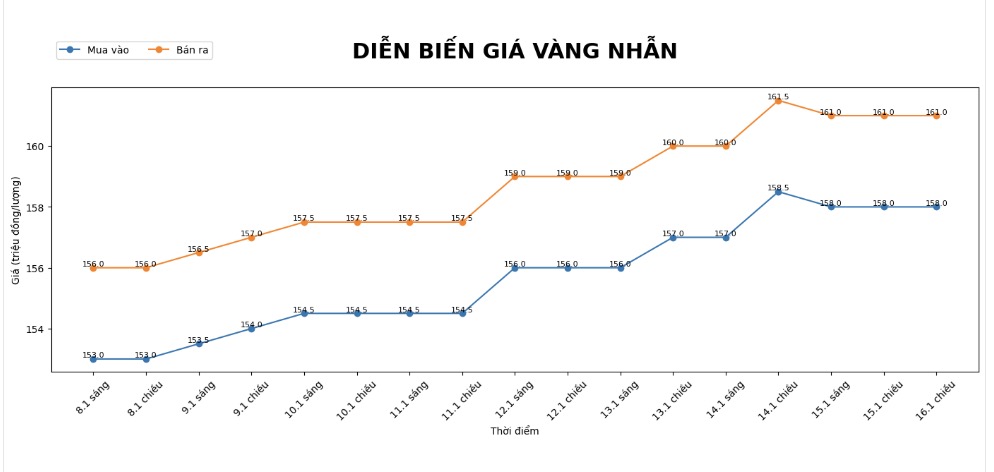

9999 gold ring price

As of 6:00 AM on January 17, DOJI Group listed the price of gold rings at 158-161 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

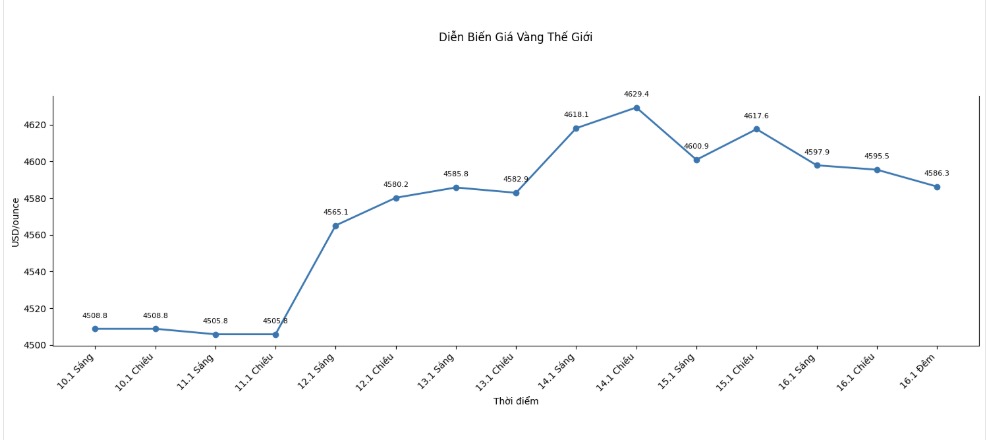

World gold price

Spot world gold price listed at 23:50 on January 16 at the threshold of 4,586.3 USD/ounce, down 34.7 USD.

Gold price forecast

In the context of domestic gold prices hovering in a very high zone, the international market is again witnessing technical adjustments after the precious metal continuously set historical peaks.

According to analysts, this development is not too surprising as short-term investors tend to take profits before the long holidays in the US, while the psychology of risk avoidance in the global financial market has somewhat cooled down.

World gold prices fell in the most recent session also under pressure from the recovery of the USD. The USD Index at one point reached its highest level in about 6 weeks, reflecting expectations that the US Federal Reserve (Fed) will be more cautious with the monetary policy easing roadmap.

Recent US economic data, especially the labor market and manufacturing sector, are generally more positive than forecast, raising questions about the Fed's ability to cut interest rates soon.

Speaking recently, Mr. Jeff Schmid - Chairman of the Kansas City Fed branch - said that current interest rates still need to be maintained at a certain level to create pressure on the economy to ensure inflation continues to cool down.

According to him, further interest rate cuts may not solve the structural problems of the labor market, thereby strengthening the view that the Fed will not rush to relax.

However, from a medium and long-term perspective, many major financial institutions still maintain positive assessments of gold. ANZ Bank believes that the precious metal still has room to increase significantly in the context of global investors continuing to seek shelter assets from economic and geopolitical risks. ANZ said that the $5,000/ounce mark is no longer too far if the Fed starts the interest rate reduction cycle in the second half of the year.

Sharing the same view, Standard Chartered assesses that gold will continue to play a key asset role in the global investment portfolio. According to this bank, persistent purchasing power from central banks, especially in emerging markets, along with the risk of increased macroeconomic instability will be factors that support the long-term trend of gold prices.

In the short term, gold prices may still fluctuate and appear adjustments due to profit-taking pressure and fluctuations of the USD. However, the current high price level shows that the main upward trend has not been broken. With the domestic market, SJC gold and gold ring prices are likely to continue to move sideways, closely following international developments, while the buying - selling difference is maintained at a high level, reflecting the caution of gold businesses.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...