According to Resolution 198/2025/QH15, from January 1, 2026, millions of business households across the country will no longer pay taxes under the contract method but will switch to self-declaration, self-calculation and self-payment of taxes based on actual revenue.

At the same time, from 2026, business households with a revenue of VND 200 million/year or more will have to pay tax, instead of the current VND 100 million threshold (Articles 17 and 18 of the Law on Value Added Tax 2024).

On October 6, 2025, the Ministry of Finance issued Decision 3389/QD-BTC in 2025 approving the Project "Converting tax management models and methods for business households when eliminating contract tax" (Project).

According to the content of the Project, tax management for households and individuals doing business based on revenue when eliminating contract tax from 2026 will be divided into 3 models:

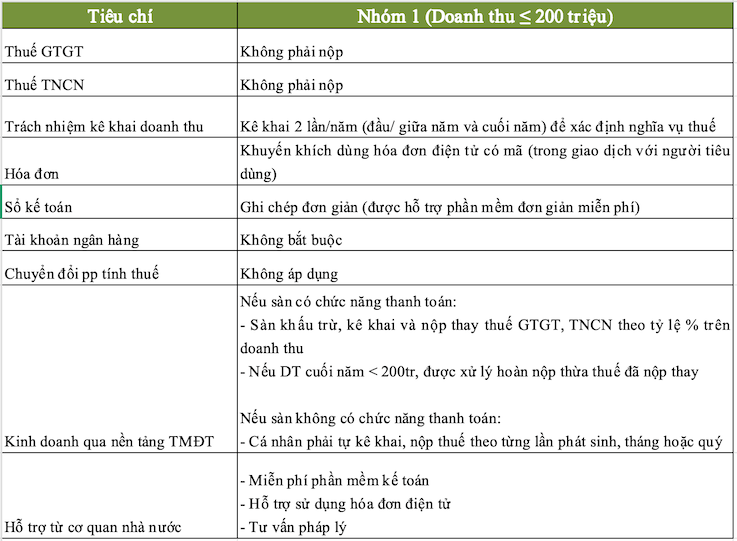

- Group 1: Revenue ≤ 200 million

- Group 2: 200 < million Revenue ≤ 3 billion VND/year

- Group 3: Revenue > 3 billion VND/year

In particular, the tax management model for business households with a revenue of less than VND 200 million/year from 2026 is regulated as follows:

Thus, business households are required to declare revenue twice a year to determine tax obligations.