17:00: Mr. Bui Hoang Hai - Vice Chairman of the State Securities Commission - assessed that today's workshop took place in a serious, frank and constructive working atmosphere. We have reviewed the efforts in the process of perfecting the Vietnamese stock market, and shared initiatives and proposals to remove bottlenecks, take advantage of opportunities and aim for the goal of upgrading the market in a practical and sustainable way.

The opinions presented not only reflect the in-depth professional perspective of experts, financial institutions, businesses and investors, but also demonstrate the sense of responsibility, companionship and great expectations for the role of the stock market in the country's socio-economic development process. This is an important source of motivation for management agencies to continue to improve policies, improve the investment environment and create a modern, transparent, effective and integrated market ecosystem.

The Vietnamese stock market today is no longer at the starting line. We have a relatively complete legal foundation, a dynamic business community, an increasingly mature investor, the active participation of professional intermediary organizations and strong political determination from the Government. However, to overcome the "door to upgrading", we must be steadfast in structural reforms, synchronizing policies, technology, infrastructure, corporate governance, and even improving the capacity of investors themselves.

The upgrade is not an ultimate goal but an important step forward for the Vietnamese stock market to integrate more deeply into the global capital market, expand access to high-quality medium and long-term capital flows, and affirm Vietnam's position as an attractive, stable and reliable investment destination in the region and the world.

The State Securities Commission is committed to continuing to make every effort, closely coordinating with ministries, branches, market members and the business community to promote the market upgrade process. The State Securities Commission focuses on implementing solutions to improve information transparency, improve corporate governance standards, enhance investor protection, reform administrative procedures, accelerate digital transformation and strengthen compliance supervision to ensure healthy and effective market development.

Mr. Bui Hoang Hai believes that, with high political determination, close coordination between stakeholders and continuous efforts to innovate, the Vietnamese stock market will reach new heights - becoming an important capital mobilization channel for the economy, contributing to building a strong national financial system, a safe and sustainable investment environment.

16:38: Responding to the second question: From the perspective of institutional investors, how does the Fund evaluate the attractiveness of the current Vietnamese market in attracting long-term capital flows?, Mr. Tran Hieu - representative of Mirae Asset Fund Management Company Limited (Vietnam) - shared: From the perspective of fund management, Vietnam's stock market is very attractive for investment in the short and long term. In the long term, the Government sets a GDP target of 8% and in the coming years, the growth rate will reach double digits, the Vietnamese population will increase in the golden population period and the middle-class period, so the need for domestic economic development is very attractive.

In addition to solutions for technical infrastructure and legal corridors, we also want to focus on improving domestic economic capacity. Currently, Vietnam also relies on the scale of foreign FDI capitalization, foreign investors will wait for many more IPO deals as well as listing them so that they can disburse tens of millions, hundreds of millions of USD at once.

I also propose additional solutions to educate the market, invest long-term through open-end funds so that investors can make long-term profits so that investors can make sustainable profits.

When the market is upgraded, for our company, we will focus on investing in enterprises with business models, healthy financial capacity, the ability to create strong cash flow, a leadership board capable of steering enterprises, and fair treatment of shareholders and investors.

16:35: Opportunity to attract capital when stocks are upgraded: What should businesses prepare for?

Reporters from Tuoi Tre Thu Do Newspaper have raised questions about key conditions for businesses to be able to welcome capital flows when the Vietnamese stock market is upgraded. Representatives of investment funds and listed enterprises shared practical information from the perspective of investors as well as stock issuers.

Mr. Dang Ngoc Truong - Deputy Head of Finance and Accounting Department, Vietnam Airlines - said: "In the past time, the Government, the Ministry of Finance and the State Securities Commission have made efforts to promote the process of upgrading the stock market. This is a great opportunity for many businesses, including Vietnam Airlines".

According to Mr. Truong, to take advantage of that opportunity, there need to be three key factors:

The legal framework and institutions must be synchronous: Not only at the macro level, but also internally, businesses need to be transparent and comply with international standards.

2. Business potential: This is a factor that foreign investors are top concern about when deciding to invest.

3. Market liquidity: A vital factor to ensure capital circulation and increase the attractiveness of stocks.

The representative of Vietnam Airlines emphasized that this enterprise is continuously improving its governance capacity and fully fulfilling its tax obligations to the State. "We are transparent in all information, including recruitment and financial plans," Mr. Truong affirmed.

In the first 6 months of 2025, Vietnam Airlines' business operations recorded results far exceeding the target. Based on this active platform, the national airline plans to carry out two increases in charter capital: the first phase with a scale of VND9,000 billion, the second phase with VND13,000 billion.

"We believe that this information not only attracts the attention of domestic investors but also creates a strong attraction for foreign investors," Mr. Truong expressed.

16:30: Reporter Viet Linh (Tien Phong Newspaper) asked: "After being upgraded, the important thing is not only to attract capital flow, but also to maintain confidence in stability and long-term. So what should the Vietnamese stock market do to strengthen the operating platform, improve transparency, protect investors and develop finance in accordance with market demand? The promotion will help liquidity improve, recently exceeding 3 billion USD. How do you evaluate this issue? ".

Mr. Nguyen Son - Chairman of the Board of Members of Vietnam Securities Depository and Clearing Corporation (VSDC) - replied: Our strive to upgrade is to attract foreign investors. But more importantly, it is to maintain market stability. Upgrading and then being relegated is normal. Many countries after being upgraded have increased capital flows rapidly, but have not been able to maintain it, leading to re-relegation. Therefore, maintaining stability after upgrading is the key.

Recently, many experts have shared the need to create stable supply and demand to absorb capital flows. In the past 2-3 years, the scale and quality of goods on the market have not been large. I agree with considering allowing foreign-invested enterprises (FDI) to float to raise capital. They need to be treated equally as domestic enterprises. Previously, more than 10 FDI enterprises were listed, but recently this progress has been slowed down.

New growth of enterprises and strategic investors on the stock exchange are positive signals. We need to promote the role of private enterprises. This will create a large supply. On the other hand, foreign investment flows will create stable investment demand.

Currently, we have over 10 million securities accounts, with about 7 million investors. More than 99% are individual investors, so they are likely to impact the market large, easily affected by crowd psychology.

We need to focus on developing financial institutions such as investment funds, insurance, etc. to create a balance between institutional and individual investors.

In addition, there should be more risk prevention products. There may be many fluctuations in the coming time; if the foreign exchange rate increases, it will be a big concern for investors. Therefore, we need risk protection tools. Developing derivatives will help create a "sharing" for investors when participating in the Vietnamese market in the long term.

We also need to promote transparency and development of green finance and ESG products, not just stocks. For example, infrastructure bonds, corporate bonds. When foreign capital flows into the market, it is necessary to amend regulations to suit. For example, currently, transaction codes for foreign investors have been issued online. We recommend that functional units such as the State Bank as well as state management agencies need to coordinate more synchronously in the coming time.

16:35: Mr. Nguyen Quang Huy - CEO of the Faculty of Finance - Banking, Nguyen Trai University asked:

1. In the context that international rating organizations are considering the possibility of upgrading the Vietnamese market, how will foreign investment capital shift in the coming time? Can Vietnam expect a new wave of capital allocation from global investment funds? What should we do to attract cash flow from these investment funds more?

2. If upgraded, what will be the most obvious positive impacts that the Vietnamese stock market can record from foreign capital? Which groups of stocks, industries or areas are expected to attract strong cash flow from foreign investors?)

Mr. Pham Luu Hung - Chief Economist and Director of the Investment Analysis and Consulting Center, SSI Securities JSC replied: At this time, many foreign investors are quite confident in Vietnam being upgraded to FTSE Russell. Although Vietnam has not yet been upgraded to the emerging market group, in reality, it has attracted strong attention from many foreign investors. Investment funds, although bound by portfolio allocation regulations, often reserve 5 10% for "unupgraded" markets that they assess as having potential, in which Vietnam is often in the priority group. If Vietnam is upgraded, the capital from these funds will certainly increase. However, the increase will depend on specific domestic developments, especially in market reform, policies and information transparency.

To take advantage of this opportunity, an important solution is to increase Vietnam's share in international indicators. If the proportion is too small (for example 0.3 - 0.4%), funds can ignore not buying because it does not greatly affect the performance of their portfolios. Therefore, the increase in the number of listed enterprises, especially from UpCOM to the HOSE and HNX exchanges, along with expanding the room for foreign investors. Moreover, to attract foreign capital, Vietnam needs to promote information transparency and reform the legal corridor, especially reducing account opening procedures for foreign investors and allowing transactions through international brokers. International indicators such as MSCI and FTSE are very important for investors, so Vietnam having a clear upgrade roadmap that meets MSCI's criteria will be the deciding factor. Completing requirements on transparency, foreign ownership and exchange rate risk prevention will help Vietnam easily attract large capital flows.

Mr. Bui Hoang Hai - Vice Chairman of the State Securities Commission said that the first thing to clarify is that this upgrade not only helps attract passive funds but also opens up greater opportunities from active funds, which can bring a much larger amount of investment capital.

The upgrade does not stop at FTSE Russell's standards because many of Vietnam's solutions have now surpassed FTSE Russell. For example, the information is published in English - a request from MSCI.

Another important factor is the foreign ownership ratio. This is not a hard criterion for FTSE Russel, but it is a criterion for MSCI. To upgrade, MSCI will evaluate negatively if the regulation on foreign ownership ratio affects more than 10% of the total number of stocks on the market. Currently, Vietnam's regulations on foreign ownership are still complicated. The Ministry of Finance is also very determined to handle this issue. In addition, to meet MSCI's standards, we also need to have exchange rate risk hedging tools to facilitate investors. All of these issues are being actively addressed, and it is hoped that we will soon make important strides, thereby being able to upgrade the market to a higher level.

Mr. Le Duc Khanh - Director of phan tich of VPS Securities Corporation (VPS) said that recently, some events such as Techcombank or some large private funds in the world have highly appreciated Vietnam's prospects. Previously, we have also made statements related to the forecast of the amount of investment capital from foreign investors and organizations if Vietnam is upgraded. Currently, we are collecting data from ETFs, but we have not been able to measure active funds and international private funds. However, when Vietnam moves to emerging markets, the interest from international investors will certainly increase. This is an unknown that can create a big impact in the upcoming transformation period. I believe that the prospects for the Vietnamese market are very large and will attract strong attention from international investors in the coming time.

15:56: Received interested opinions from readers of Lao Dong Newspaper and the investor community sent to the program within the framework of the live broadcast of the workshop, one of the most interested contents related to market access opportunities for foreign investors.

The question is as follows: "Currently, many foreign investors expressed their hope to access the Vietnamese market more equally, especially related to increasing ownership ratio in listed enterprises. So, how will the upcoming legal mechanism be adjusted to meet this expectation, and what are the specific steps to make the Vietnamese stock market more attractive in the eyes of foreign investors? ".

Responding to this question, Ms. Pham Thi Thuy Linh - Head of the Securities Market Development Department, UBCKNN - replied as follows: We have made policy changes such as requiring businesses to publish information in bilingual so that investors can access business information on par with domestic investors. At the same time, for the corporate income tax rate, the goal of increasing the corporate income tax rate at public companies sets out the required solutions, listed companies must clearly announce the corporate income tax rate so that investors can grasp their investment plans.

According to current regulations, for enterprises operating in sectors that are not within the scope of limited access, they can open a 100% state ownership ratio (SHNN), unlimited. However, in reality, there are many foreign enterprises and listed companies with low SHNN rates, reaching only about 50%. There are even enterprises and companies listed at 0% because the activities of enterprises are diverse in industries, not operating in those industries, but some professional activities are limited in reach.

In the coming time, the State Securities Commission will coordinate with units in the Ministry of Finance and relevant ministries to review business lines in the direction of expanding the SHNN ratio for industries that do not really have limitations, expanding the scope of participating investors.

From a business perspective, businesses also need to proactively review to focus on the main business line. For businesses with limited access, businesses also need to adjust business registration certificates and industry codes to increase the SHNN ratio, attract capital from foreign investors, increase management and governance experience, and bring benefits to businesses themselves.

1.52: Stock market: How to promote quality goods and IPO effectively?

At the workshop, a reporter from Tuoi Tre Newspaper raised a series of questions about the development of goods on the stock market, as well as the situation of issuing stocks to the public for the first time (IPO).

The reporter raised the issue: "For the market to develop sustainably, it is necessary to increase output and quality of goods. Is the reason for the lack of goods due to the strictness of the Securities Commission, or due to market factors? What is the current number of businesses promoting IPO? And how to bring goods from large enterprises to the market in the context that many enterprises have not been able to list? ".

Comply with regulations, link IPO with listing

Responding to the above question, Ms. Pham Thi Thuy Linh - Head of the Stock Market Development Department, State Securities Commission - said that the current listing of enterprises must comply with legal regulations. Recently, the management agency has implemented the policy of linking IPO with stock listing - considered a solution that is in line with the expectations of businesses.

divestment of state capital is also one of the options to increase the supply of stocks to the market. However, there are still many enterprises that have listed but the state capital ownership rate is still high.

Integrating IPO and listing processes to shorten liquidity

In addition, Mr. Bui Hoang Hai - Vice Chairman of the State Securities Commission - shared that from the early days of market building, legal regulations for IPO have been designed according to international standards such as requiring businesses to have clear financial reports, profitable business activities...

However, previously, the IPO and capital listing process was separate, making it impossible for investors' cash flow to circulate immediately after the IPO, reducing attraction. Therefore, the Committee has amended Decree 155 to integrate these two processes, helping investors to be able to trade stocks within 1-2 weeks after IPO.

Integrating IPO and listing is necessary. We are also studying and amending additional unfavorable points to improve market flexibility, said Mr. Hai.

Market conditions are still a key factor

According to the representative of the Securities Commission, the number of IPOs has decreased recently due to unfavorable market conditions. The general context of the global picture, with the policy of tightening foreign currencies in many countries, also reduces the attractiveness of IPOs - not only in Vietnam but also in many other countries.

Regarding the issue of state capital divestment, Mr. Hai said that this is a policy under the general policy of the Government. Currently, in many large enterprises such as banks, the state ownership ratio is still high. "These are important enterprises, but they do not necessarily have to maintain a high state ownership ratio," said Mr. Hai, affirming: "In the coming time, as a state management agency, we will have solutions to promote the more effective implementation of bringing quality state-owned stocks to the market".

15:51: Mr. Nguyen Duc Thanh - Deputy Editor-in-Chief of Lao Dong Newspaper - said that Lao Dong Newspaper has received many questions and opinions from readers and the investor community sent to the program. In particular, one of the most concerned contents is related to foreign market access opportunities.

Readers asked the following question: Currently, many foreign investors have expressed their hope of accessing the Vietnamese market more equally, especially the extension of ownership ratio in listed enterprises. So, how will the upcoming legal mechanism be adjusted to meet this expectation? What are the specific steps to make the Vietnamese stock market more attractive in the eyes of foreign investors?

15:49: Session 2 - Ready to welcome long-term capital flows

According to Mr. Nguyen Duc Thanh - Deputy General Director of Lao Dong Newspaper, at the first session, experts and guests agreed that the goal of upgrading the stock market will open up important opportunities for the next development phase of the market, contributing to increasing scale, improving capital mobilization and use efficiency; thereby actively supporting the country's economic growth.

In session 2, with the theme "Ready to welcome long-term capital flows", we will discuss practical issues arising when the market operates as an emerging market, from the perspective of managers, businesses, operating organizations and experts.

15:25: Mr. Pham Luu Hung - Chief Economist and Director of SSI Investment Analysis and Consulting Center (SSI Research) - said that Vietnam sets a double-digit growth target. To achieve this, Vietnam's capital demand is huge. Looking back at the indicators in the first 6 months of the year, Vietnam needs to make more efforts.

Regarding the stock market after 25 years of formation, it is time for us to upgrade the market. Looking at countries in the region such as Thailand, Singapore, Malaysia... Vietnam's transactions are very large, there is a chance to be upgraded.

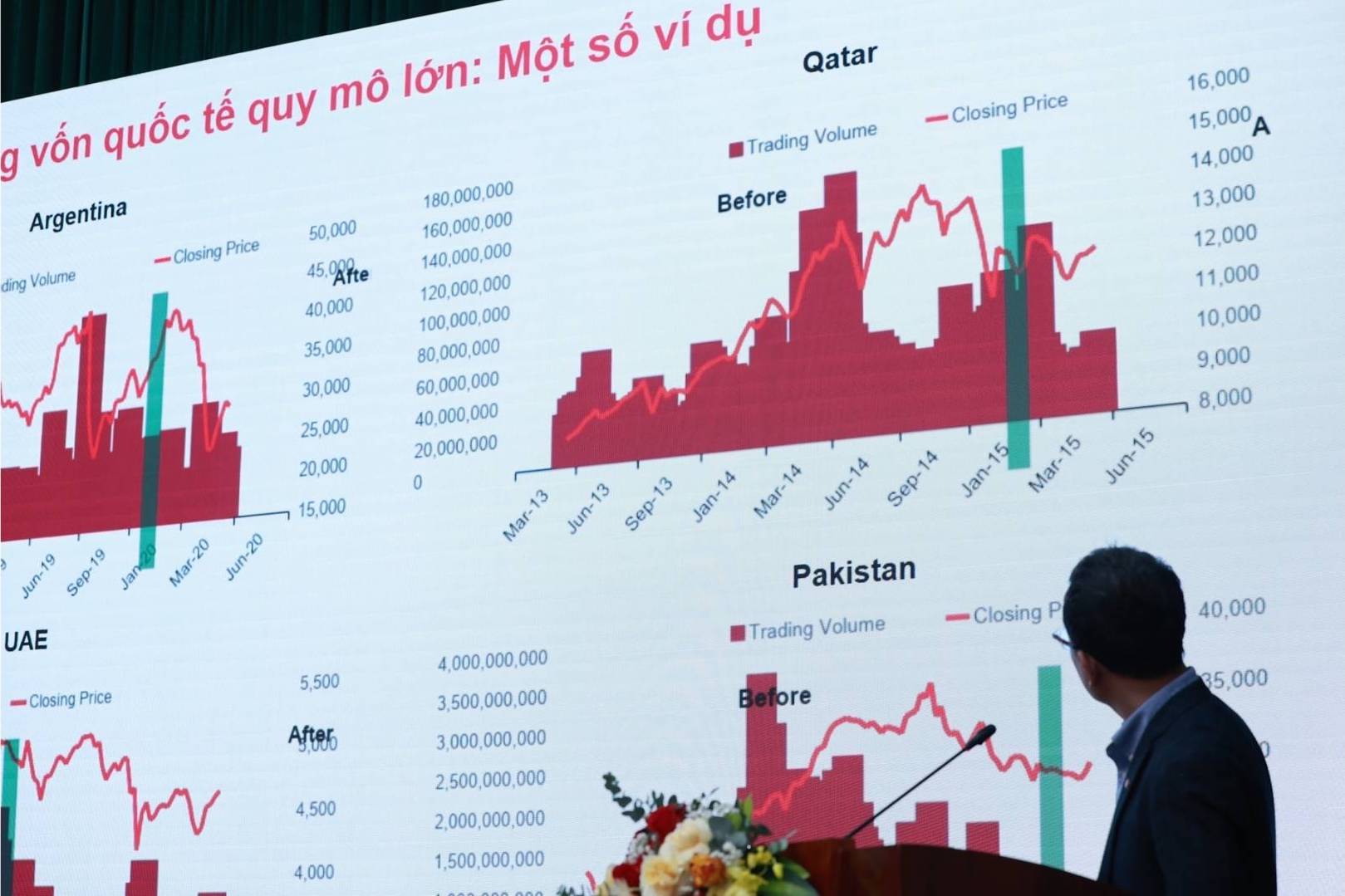

However, upgrading not only has opportunities but also challenges. Looking at countries in the world such as Pakistan and the UAE, when upgraded, they did not achieve the expected growth. In the world, many countries have reduced their foreign capital attraction when upgrading. For example, Greece was upgraded from emerging to developing, not achieving expectations.

Another country quite similar to Vietnam is Saudi Arabia. When upgraded, the national market will grow well. This shows that, to achieve good results, Vietnam needs to do a lot of work after the upgrading.

Some proposed recommendations: Later upgrading: Continue the process of reforming and developing the capital market after the upgrading period, towards higher and more comprehensive goals (MSCI: needs a specific roadmap): Market structure/ mark approach: Dreight, open.

More effective stock valuation (Price discovery): The participation of qualitative investment funds, hedge funds... is a buffer to minimize fluctuations in speculative activities in a market with a high proportion of individual investors.

Loosening regulations on stock listing (profit conditions for 2 consecutive years, no accumulated losses) to help enterprises in the technology industry, startups, and innovation to participate in the capital market.

Opportunities for the bond and derivatives market (examples of domestic-current government bond indexes - FTSE EMGBI, JPMorgan GBI-EM Global Diversified, Bloomberg EM Local Currency Government Index...).

15:05: Deploying the central clearing mechanism (CCP) and the new transaction mechanism after operating the KRX system

Mr. Nguyen Son - Chairman of the Board of Directors of Vietnam Securities Depository and Clearing Corporation - said that on May 5, 2025, the KRX information technology system, including the trading system of the two securities exchange offices (SGDCK) and the registration, storage, and clearing payment system of Vietnam Securities Depository and Clearing Corporation (VSDC) officially came into operation after nearly 10 years of implementation.

The system provides an integrated and synchronized technology platform for the entire Vietnamese stock market, helping to improve the competitiveness of the domestic market with international stocks as well as contributing significantly to the successful implementation of the Vietnamese stock market development strategy to 2030.

Up to now, after nearly three months of operation, the KRX system has initially operated stably, without any serious errors affecting market operations.

On the VSDC side, the connection between VSDC's system and the system of 2 SGDCKs, payment banks and depositors and clearing members has basically been ensured to be continuous, smooth, without information interruptions and accuracy in time and process.

Regarding the clearing, payment, clearing and payment method according to the Central Counter Party (CP) model, it is a popular method applied by many SGDCKs due to the superiority in risk management of this model.

Especially on derivatives with the characteristics of using high financial leverage, large contract scale, long payment time and high risk of partner inability to pay, this model plays a very important role because it is equipped with a multi-layered multi-layered risk management system.

In this model, through the positioning mechanism, CCPs become the subject standing between the transaction parties, the seller of all buyers and the buyer of all sellers, accordingly, CCPs ensure payment for transactions even in cases where one party in the initial transaction (original transaction) cannot fulfill payment obligations.

For Vietnam's stock market, the CCP model has been successfully deployed for derivatives since August 10, 2017 when Vietnam's derivatives stock market officially came into operation with the first product being the VN30 stock index. After nearly 7 years of operation, the CCP model has contributed to the rapid growth of derivatives, promoting its role as a risk-off channel, contributing to the stable development of grassroots CCPs.

On the basis of successfully implementing the CCP model for derivatives exchange rates and implementing the direction of the management agency, since 2019, VSDC has researched and built a CCP model for clearing and settlement of securities transactions based on the functions of the KRX system as well as in accordance with the legal characteristics of Vietnam.

According to this model, VSDC, through the positioning mechanism, will participate in transactions and establish many risk-off layers for grassroots securities in accordance with general practices and current legal regulations, thereby attracting the attention of domestic and foreign investors as well as creating a sense of security and protecting the rights of investors when participating in the market.

In addition, through the deposit mechanism when implementing the CCP and TVBT models, the deposit collection level for investors is decided based on the results of the credit assessment, the market expects to thoroughly resolve the pre-funding barrier, aiming to upgrade and increase liquidity for Vietnam's stock market.

Regarding implementation preparation, legally, this CCP mechanism has been regulated and specified in legal documents in the field of securities, Securities Law 54; Law amending and supplementing 56 and guiding documents (Decree 155/2020/ND-CP, Circular 119/2020/TT-BTC and a number of other related documents).

At the same time, the technical guidance contents will also be completed by VSDC in the coming time.

In terms of system functions, clearing and settlement activities for securities transactions will continue to be carried out on the KRX system with certain adjustments in the system's configuration and parameters to comply with this mechanism.

On July 17, 2025, the State Securities Commission also announced a plan to deploy the CCP mechanism for grassroots exchange-traded exchanges with the goal of putting this mechanism into operation from the first quarter of 2027.

According to the plan, in the coming time, VSDC will continue to closely coordinate with the State Securities Commission and related units to carry out assigned work contents such as reviewing, amending and supplementing to complete the legal framework; establishing a subsidiary of VSDC to perform the function of CCP to accommodate risks arising when implementing the CCP mechanism for the entire exchange, ensuring safety for professional activities of registering and storing securities for investors at VSDC; training and propaganda...

Recently, there have been 2 products that have been mentioned a lot, which are transactions on the day, selling stocks waiting to return. To successfully deploy any new product or business in the market, it is necessary to ensure the readiness in terms of system functions not only of VSDC but also of market members, the completion and synchronization of mechanisms and policies, especially the mechanism to allow relevant parties to handle and overcome risks that may arise during the implementation process.

For day-to-day transactions and stock sales, there are currently legal regulations in Circular 120/2020/TT-BTC, and in terms of system functions, the KRX system is also being integrated.

However, the biggest issue that management agencies are currently concerned about is the ability to manage risks on the market members' side when annual statistics show that there are still many cases that need to correct errors after transactions and handle errors. There are even cases where payment deadlines have to be delayed or payments must be eliminated due to poor control of customer deposits (according to current regulations, securities companies (TSCs) must ensure that customers have enough money before receiving a trading order, except for stock purchase transactions that do not require enough money when placing orders from foreign investors as organizations) and the above cases are also not excluded for the leading securities companies in Vietnam today.

That reality shows that the risk of potential payment loss when implementing transactions on the day, selling securities waiting to return is present and needs to be carefully considered when comparing with the benefits brought by day transactions. This also requires market members to build a serious and strict risk management process as well as ensure resources to fulfill payment obligations on behalf of customers in case of poor risk control. For management agencies, it is also necessary to continue to improve the monitoring mechanism and handle possible risks. In addition, sanctions are also needed for securities exchanges that do not comply with or do not comply well with regulations on risk management for transactions during the day.

In terms of international experience, implementation practices in other stock exchanges show that day-to-day trading has many potential risks for investors and the market if not well controlled. As in the US stock market, despite setting high financial and experience requirements for investors, only over 10% of investors make a profit when making these transactions.

The practical experience of international markets is a valuable lesson for the Vietnamese market and the time of trading implementation on the day will not be an immediate decision, and will be carefully considered by the management agency based on the most favorable calculations for the market when conditions allow.

With the expected roadmap, after the KRX IT system comes into stable operation, new features will be upgraded to meet the market's rapid growth requirements when Vietnam is upgraded from a frontier market to an emerging market, the consideration of putting the stock-opening application into operation will be considered first, followed by stock trading on the day.

The implementation of applications to conduct transactions through the noon is also a content in the post-golive plan of the KRX IT system, putting them into operation through the noon allows investors to have more trading time, share the pressure to increase orders at the beginning of the day and also in line with international practices.

In the coming time, we will also build platforms related to carbon credits and other products outside the foundation of our KRX system with the technology-built Securities Exchanges.

The system structure still has many features for new products but requires time to implement.

14:50: Mr. Nguyen Quang Huy - CEO of the Faculty of Finance - Banking, Nguyen Trai University - presented a paper with the content: "ESG - an indispensable part in the future IR story".

ESG - The key to shaping the IR future

Mr. Nguyen Quang Huy affirmed that ESG (Environment - Society - Governance) is not only a global trend but also a vital condition in modern corporate governance and investor relations (IR).

In the context of the world facing climate change, inequality and a crisis of confidence, ESG (Environment - Society - Governance) is becoming a set of fundamental criteria to help orient smart, sustainable capital flows. For listed enterprises, this is no longer a voluntary choice but a prerequisite for survival and access to international investors.

ESG - The indispensable identity of the future IR

In the era of sustainable development, IR is no longer simply a financial information provider, but has become a responsible storyteller, connecting the companys ESG commitment with the expectations of global investors.

Instead of just presenting financial indicators, IR must convey a transparent ESG data ecosystem, from emissions, renewable energy use to human resource governance and anti-corruption. In a market where confidence and non-financial transparency determine long-term capital flows, IR is the bridge that shapes reputation and sustainable valuation for businesses.

Mr. Nguyen Quang Huy further clarified the issue: From index to life value: When global investors prioritize sustainable development, financial indicators are no longer enough to build confidence. Instead, investors are looking for a comprehensive ESG data system, reflecting the long-term development capacity and social responsibility of the enterprise.

ESG information transparency - from carbon emissions, renewable energy to human resource and community policies - has become a necessary condition for accessing quality capital flows. In the market upgrade roadmap, IR must proactively lead the game with standard ESG data and consistent transmission, instead of just responding to market requirements.

From compliance to creating standards

No longer a passive reaction to requirements, ESG today needs to be proactively integrated by businesses into strategies, products, governance and culture - as a core part of sustainable development.

IR plays a central role in this process: Being the one to convey the ESG philosophy from the leadership to the market, and at the same time designing a new standard system to help businesses not only meet but also lead the expectations of investors with consistent commitments and long-term value.

From defense to competitive advantage

ESG is not only a new requirement, but an opportunity to reposition businesses in the eyes of investors. When implemented systematically, ESG helps businesses shift from defense to proactive positions, expand long-term capital access, raise valuations and reduce capital costs thanks to lower risks.

In particular, ESG has become a "passport" in developed markets such as the EU, the US, and Japan. In this process, IR is the pioneer in leading businesses to transform ESG into a sustainable competitive advantage.

Mr. Nguyen Quang Huy said that ESG is not communication - that is the nature of the business. ESG is not a "beautiful shirt" for businesses to communicate to the outside, but a core that reflects internal values. In the age of transparency, IR is not only a spokesperson, but also a reliable reflection of the commitments and actions of businesses.

ESG is not a part of a single part, but must be integrated into the entire strategy - from products, human resources to operating culture. That is the nature of daily operations, not a short-term solution for coping.

Mr. Nguyen Quang Huy also analyzed ESG in products, people, systems and culture.

Products: Enterprises need to design environmentally friendly products, extend their life cycle, increase recyclability and ensure fairness in the supply chain. This is not only a consumer expectation but also a key criterion for ESG investment funds.

People: ESG requires fair recruitment, diversity of leadership, development of human resources capacity and protection of workers' rights. Quality and responsible human resources are a sign of the ability to create sustainable value.

System: ESG must be integrated into the internal management system through control, monitoring and risk assessment policies. Without a clear implementation mechanism, businesses will be eliminated from the list.

Culture: ESG must be absorbed into organizational culture, becoming a code of conduct at all levels. It is this internal consistency that creates trust - a core asset that helps businesses overcome challenges and conquer the global capital market.

ESG decides cash flow: ESG is becoming a core criterion for global capital flow orientation. By 2025, more than 50% of investment assets will be directly affected by ESG standards. Major funds such as BlackRock, Vanguard and Norges Bank have all eliminated enterprises without sustainable commitments.

Mr. Nguyen Quang Huy said that in Vietnam, ESG has shifted from "voluntary" to "mandatory", when the Ministry of Finance and the State Bank actively integrated ESG into appraisal and credit policies. In the market upgrade roadmap, ESG is not only a condition for accessing international capital, but also a measure of financial maturity and long-term attractiveness of businesses.

Vietnam and opportunities - challenges in global ESG flows

In the wave of global capital shift towards sustainable development, Vietnam is emerging as an attractive destination in Asia. ESG is not only a measure of responsibility, but also a strategy to help businesses integrate into the international value chain and access global capital markets.

A great opportunity comes from the positive assessment of financial institutions such as ADB, IFC, HSBC of Vietnam's sustainable financial potential, especially in the context of market upgrading. The young, flexible business ecosystem and young population platform, rapid urbanization, and digital economy development are significant advantages.

However, Vietnam still lacks a standardized ESG data system, a reputable independent ranking organization and a long-term mindset in enterprises. For ESG to spread, it is necessary to have multi-party coordination from the state, businesses, investors to the media and academia, in which the legal framework, financial incentives and internal capacity play a key role.

IR - a bridge to make ESG a real value

In the ESG era, IR is not only a reporter, but a person who connects ESG data throughout the business, transforming it into easy-to-understand economic value language for investors and opposing the phenomenon of "greenwashing". They monitor ESG progress, respond to market expectations, and create a cycle of continuous improvement.

Today's IR team needs to have a strategic mindset, understand ESG - finance - legality, have communication skills to orient and be "architect of trust" between businesses and the market.

14:22 Ms. Pham Thi Thuy Linh - Head of the Stock Market Development Department, State Securities Commission (SSC) - presented a paper on "Implementing solutions to meet the criteria for upgrading the stock market and orientation in the coming time".

With the goal of upgrading the Vietnam Stock Market (TSK) stated in Decision No. 1726/QD-TTg of the Prime Minister approving the Vietnam Stock Market Development Strategy to 2030 and the Government's guiding documents, in the recent past, the Ministry of Finance (MOF) has been urgently reviewing and recommending amendments and supplements to legal documents to gradually remove bottlenecks in considering upgrading according to the criteria of international organizations, while actively coordinating with relevant ministries and branches to resolutely implement solutions to meet the criteria of market rating organizations towards the goal of upgrading Vietnam's TSK from frontier to emerging market.

Regarding the consideration of upgrading by the FTSE Russell rating agency, according to practice, in March and September every year, the FTSE Russell rating agency will announce a list of exchange rates that are upgraded, downgraded and countries on the monitoring list. FTSE Russell's upgrading review process includes an assessment according to FTSE Russell's market quality matrix, which includes 9 criteria for secondary emerging markets. Up to now, legally, the Ministry of Finance has issued solutions to fully meet the 9 criteria of the FTSE Russell rating organization. In addition to the assessment criteria of FTSE Russel, we also need feedback from foreign investors participating in Vietnam's stock market.

However, the experience and positive feedback from foreign investment institutions on the Vietnam stock market is one of the important bases for FTSE to consider upgrading the stock market.

Accordingly, the State Securities Commission is actively implementing solutions to help foreign investment institutions participate in the Vietnamese stock market.

Regarding the completion of the legal framework and policies to meet the upgrading criteria: For the 2 criteria Vietnam was assessed as not meeting at the September 2024 assessment period, the Ministry of Finance issued Circular No. 68/2024/TT-BTC and then issued Circular 18/2025/TT-BTC to handle 2 criteria that were assessed as not meeting. The first is the criterion " Payment cycle (DvP)" and the second is the criterion "payment - costs related to failed transactions". Accordingly, the new mechanisms have operated effectively and stably.

Specifically: For the NPF mechanism (ie not required to have enough money at the time of transaction for foreign investors): To date, there are 10 foreign-invested enterprises and 10 banks with deposits that have implemented NPF for foreign investors (FDI) as organizations.

Since the implementation of the KRX system, the total number of NPF transactions has been more than 90,000 transactions with a total value of more than VND20,000 billion (average of more than 6,000 transactions/day, equivalent to VND1,400 billion/day), about 3 times the number of transactions, about 2 times the transaction value compared to the pre- KRX period. The transaction value of NPF currently accounts for about 50% of the total purchase value of the foreign-invested enterprise in the market.

Regarding the second criterion of FTSE Russell on failed transaction processing mechanisms, we also note the effective failed transaction processing mechanism. Up to now, out of hundreds of thousands of NPF transaction orders, only 4 have failed and have all been handled safely and effectively, through the provisions of Circular No. 18 and Circular No. 68.

Also in Circular No. 68, the requirement for simultaneous information disclosure in Vietnamese and English for listed companies and public companies is set out. Currently, according to our records, listed companies have periodically published information in English.

Regarding the implementation of the KRX system, after nearly 3 months of implementation since May 5, we have recorded the KRX information technology system operating smoothly, stably and safely. The implementation of the KRX system opens up many opportunities in implementing the central clearing mechanism (CCP), new products and services such as waiting-in stock trading, day trading, new derivatives such as day-back deposit securities trading, new regenerated products and products associated with listed bonds. These are necessary factors for the stock market to increasingly meet international market standards.

Thirdly, we have built a system for exchanging information between notary banks (NHLK) and securities companies (CTCK) to serve securities trading activities of investors opening deposit accounts in NHLKs (STP systems). This system has also been deployed since March 2025 through the electronic communication portal. In the coming time, SWIFT also plans to upgrade, creating the most favorable conditions for investors as well as commercial banks and securities companies.

Fourth, we have also established a consulting dialogue group on capital market development to speed up the process of considering upgrading the market. Currently, the consulting dialogue group on capital market development ( IAG group) has 33 members divided into 3 working groups on trading market development and after-transaction. We also regularly have direct exchanges between management agencies, market members and expert groups to update practical experiences in the process of investors participating in the market and investors' difficulties when participating in Vietnam's stock market.

Fifth, we also closely coordinate with the State Bank of Vietnam (SBV) in developing Circular 03/2025/TT-NHNN (replacing Circular 05/2014/TT-NHNN) thereby amending a number of contents related to opening and using accounts in Vietnamese Dong to conduct foreign indirect investment activities in the Vietnam stock market (effective from June 16, 2025). This is considered a change to simplify procedures to facilitate the participation of foreign investors in Vietnam's stock market.

In the recent past, we have also organized conferences, seminars, and investment promotion groups to increase contact, exchanges with investors, and introduce to foreign investment organizations, which is an opportunity for us to have a structure in investment activities so that investors have the best experience when participating in the market.

On the side of the stock market, we will continue to implement solutions to make the market operate stably and sustainably. At the same time, we also have focused solutions to achieve the goal of upgrading the market according to the strategy by 2030.

The State Securities Commission also proposed a number of key solutions. The first is about increasing the foreign ownership ratio of public units and listed companies. When foreign investors in the Vietnam stock market are upgraded, we need to have capacity so that investors can participate in transactions and investments. With such an aim, in the Draft Decree amending and supplementing a number of articles of Decree 155/2020/ND-CP, we are also submitting to the Government to include a number of solutions such as requiring businesses and public companies to fully announce the maximum foreign ownership ratio in businesses so that investors can grasp their investment activities.

In the coming time, the State Securities Commission also proposed solutions to implement the central clearing counterparty (CCP) mechanism. Basically, our central clearing partner mechanism for the derivatives market has been implemented since the market came into operation in 2017. In terms of legal basis, we have sufficient legal basis from the decree to the guiding circular. Recently, the Ministry of Finance also approved the SPP, and the SPP has announced a specific roadmap for implementing the CCP mechanism in early 2027.

Another content related to the State Bank of Vietnam (SBV)'s field in opening payment accounts, we also closely coordinate with the SBV in contributing opinions with Circular 17/2024/TT-NHNN regulating the opening and use of payment accounts at payment service providers to simplify payment account opening, closing and using procedures, meeting regulations on anti-money laundering, and at the same time creating more favorable conditions for foreign investors to participate in the Vietnam exchange.

In the coming time, when the upgrade target is set, solutions to increase market depth and diversify financial products on the market will also be the focus in the coming time. Therefore, the State Securities Commission will also implement a number of solutions such as: Strengthening the development of new products, enhancing the mobilization of listed companies in sustainable development trends such as ESG, green bonds, construction bonds serving infrastructure investment and construction; Promoting the equitization of state-owned enterprises, divesting from state capital; Linking IPO activities with listing, shortening the stock listing process after IPO to attract enterprises; Putting enterprises that are public companies with FDI roots up for listing/registering transactions; Researching, developing and implementing new market segments according to international practices such as carbon credit exchanges, capital trading markets for startups to innovate and diversify supply in the market.

We also assigned the Vietnam Stock Exchange, Ho Chi Minh City Stock Exchange (HOSE), Hanoi Stock Exchange (HNX) to work with rating organizations to build a set of indexes to strengthen the positioning of Vietnamese stock market on global stock market.

Another task we will implement in the coming time to strengthen market monitoring and management is to build a comprehensive information technology and data system. Thereby, improving the transparency of the market, contributing to strengthening the confidence of domestic and foreign investors.

14:09: Mr. Bui Hoang Hai - Bui Hoang Hai - Vice Chairman of the State Securities Commission (SSC) - delivered the opening speech at the workshop.

Mr. Bui Hoang Hai said that today's workshop is a very meaningful opportunity for us to look back on efforts in institutional reform, perfecting technical infrastructure, and at the same time affirming Vietnam's determination to implement solutions to upgrade the stock market (TSK).

On July 28, 2025, the State Securities Commission solemnly held a ceremony to celebrate the 25th anniversary of the opening of the stock market. Looking back 25 years, the Vietnamese stock market has made remarkable progress. Over the past 25 years, we have narrowed the gap with countries in the region.

Currently, there are more than 10 million investors participating in the Vietnam stock market. Regarding liquidity, the liquidity of Vietnam's stock market is at the highest level in the region, higher than that of markets with development from 70-100 years.

As of July 21, 2025, the VNIndex reached 1,485.05 points, up 7.9% compared to the end of the previous month and up 17.2% compared to the end of 2024. The market capitalization of the three-chassis stock exchange HOSE, HNX and UPCOM on July 21, 2025 reached VND 8,214.67 trillion (USD 328.5 billion), up 14.5% over the end of the previous year, equivalent to 71.4% of estimated GDP in 2024.

This shows that stock investment is gradually affirming its role as an important investment channel and increasingly attracting widespread participation from the public. The number of investor accounts increased from 3,000 accounts in 2000 to more than 10 million accounts, reflecting the increasingly large participation of people in this high-end financial market.

In recent years, the bond market has also grown remarkably. As of the end of June 2025, the listed value reached VND 2,503 trillion ($100 billion), equivalent to 21.7% of estimated GDP in 2024.

The above figures show that the Vietnamese stock market has developed strongly, not only a popular investment channel but also an increasingly effective medium- and long-term capital mobilization channel for the economy, in addition to the traditional role of the commercial banking system.

With such an important role, upgrading the stock market from frontier to emerging market not only has the meaning of improving the national image, but is also a strategic solution to attract long-term capital flows, raise market standards, and promote institutional reform.

The Government has clearly identified this orientation in the "Stock market development strategy to 2030" issued with Decision 1726/QD-TTg, in which the goal of upgrading Vietnam's stock market in 2025 is set. Implementing the direction of the Government, in recent times, the Ministry of Finance and the State Securities Commission have been urgently reviewing and recommending amendments and supplements to legal documents to gradually remove bottlenecks in considering upgrading according to the criteria of international organizations, while actively coordinating with relevant ministries and branches to resolutely implement solutions to meet the criteria of market rating organizations towards the goal of upgrading Vietnam's stock market from frontier to emerging market and have achieved remarkable results.

Today's workshop will be a valuable opportunity for management agencies, businesses, investors and experts to exchange, discuss and share practical solutions for the process of upgrading and sustainable development of Vietnam's stock market.

Mr. Bui Hoang Hai said that the workshop will focus on the following key contents:

First, assess the market situation, implemented reforms and further solutions towards the upgrading goal.

Second, analyze opportunities, challenges and propose solutions to help Vietnam not only be upgraded, but also effectively exploit long-term capital flows after achieving this goal.

Third, share international experience and initiatives from businesses and investors, contributing to improving policies and enhancing the competitiveness of the Vietnamese stock market.

14:05: Mr. Nguyen Duc Thanh - Deputy Editor-in-Chief of Lao Dong Newspaper - said that the Vietnamese stock market is getting closer than ever to the goal of upgrading from a frontier market to an emerging market. It is expected that in September, the international rating agency will announce important information related to the possibility of approving the upgrading of the Vietnamese stock market. This is the result of a long process of efforts to reform, perfect institutions, modernize the system and improve the quality of market operations.

Resolution No. 68 of the Politburo on private economic development clearly stated the viewpoint: "urgently upgrading and restructuring the stock market to improve quality and expand stable capital mobilization channels and low costs for the private economy".

This workshop was organized by Lao Dong Newspaper in coordination with the Ministry of Finance with the theme "Upgrading the stock market, expanding capital mobilization channels for the economy" as a forum for management agencies, securities trading organizations, listed companies and the investor community to discuss and remove bottlenecks to contribute to economic development, bringing Resolution 68 into life.

14:00: MC Minh Anh said that upgrading the Vietnamese stock market is no longer a distant goal. With many synchronous reforms in institutions, techniques and operational infrastructure, the market is approaching the criteria of the emerging market group. However, to proactively seize opportunities and effectively welcome long-term capital flows after upgrading, we need early preparation from many sides. Therefore, today's workshop was held with the goal of: collectively recognizing, evaluating and carefully preparing for the post-upgrade period - when the Vietnamese stock market officially enters the emerging market group and faces the opportunity to attract long-term capital flows from global investment institutions. This is an important time for management agencies, businesses, investment organizations and stakeholders to exchange, share orientations, experiences and action solutions, in order to be ready to operate effectively in the context of the market being upgraded.

The seminar on "Upgrading the stock market, expanding capital mobilization channels for the economy" organized by Lao Dong Newspaper in coordination with the Ministry of Finance, took place at 2:00 p.m. on July 30, 2025, at the headquarters of Lao Dong Newspaper (No. 6 Pham Van Bach, Cau Giay, Hanoi). The program was broadcast live on Lao Dong Electronic Newspaper (www.laodong.vn) and Lao Dong Newspaper's Fanpage.

The program was attended by representatives of the Ministry of Finance, the State Securities Commission, leaders of Vietnam Securities Depository and Clearing Corporation (VSDC), representatives of securities companies, investment funds, listed enterprises and financial experts.

Market upgrading has been identified as a major policy of the Party and State. Resolution No. 68-NQ/TW of the Politburo on private economic development clearly states the viewpoint: "urgently upgrade and restructure the stock market to improve quality and expand stable and low-cost capital mobilization channels for the private economy".

In the context of the Vietnamese stock market approaching an important moment in the upgrade roadmap, identifying opportunities associated with international capital flows after upgrading, orientations and solutions to help the market operate stably, meeting increasingly high requirements from global institutional investors is an urgent requirement, a step of strategic significance, opening up the ability to attract large-scale, stable and long-term international investment capital flows.