3 methods of ticket distribution

According to the draft Decree replacing Decree 06/2017/ND-CP on the business of horse racing, dog racing and international football betting that the Ministry of Finance has just announced, enterprises that want to be granted a Certificate of eligibility to do business in international football betting will have to have a minimum charter capital of VND 1,000 billion, in which the ownership ratio of foreign-invested legal entities does not exceed 49% and is not higher than the ownership ratio of domestic legal entities.

According to the new draft decree, businesses are allowed to distribute betting tickets through 3 methods: selling directly to players via terminal devices, via phone and via the internet.

Revenue is estimated at nearly VND40,000 billion in 5 pilot years

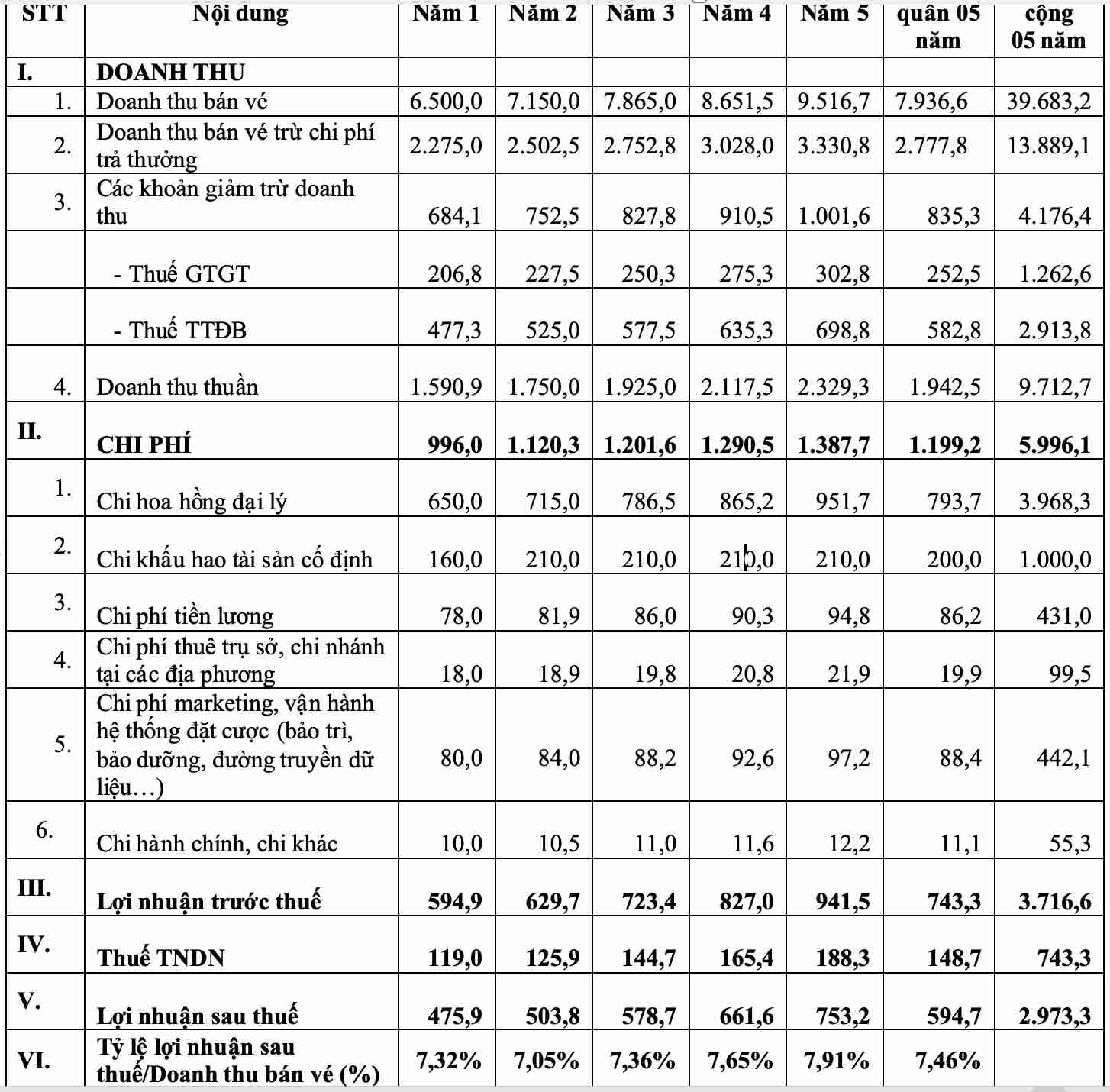

The Ministry of Finance assumes that in the first year of business, ticket sales for betting via terminal devices reached VND6,500 billion (similar to Vietlott's revenue in the first year of business nationwide via terminal devices and phones). Revenue will increase by 10% per year, bringing the average revenue in the 5 pilot years to VND 7,936.6 billion, a total of VND 39,683.2 billion.

With the assumption of a reward rate of 65% of ticket sales revenue, the cost of paying bonuses is estimated at VND 4,225 billion in the first year. After deducting bonuses, the revenue for tax calculation reached VND 2,275 billion in the first year; an average of VND 2,777.8 billion per year for 5 years; a total of VND 13,889.1 billion.

Regarding expenses, for commissions, the average dealer fee rate is expected to be 10% of ticket sales. The amount of agency commissions spent in the first year is: 650 billion VND; the average in 5 years is 793.7 billion VND; the total in 5 years is 3,968.3 billion VND.

Regarding fixed cost of asset depreciation, the draft Decree stipulates that the minimum project investment capital is 1,000 billion VND, mainly to invest in betting systems (including servers, terminal equipment, business software, security software, etc.) to meet the technical conditions for betting according to regulations.

Assuming the project investment capital is 1,000 billion VND, divided into 2 phases including: 800 billion VND in the first year of business and 200 billion VND in the second year. The fixed period of asset depreciation is 5 years. The fixed cost of asset depreciation is allocated evenly according to the direct line depreciation method in 5 years of business.

With the above assumption, the fixed depreciation of assets in the first year is: 160 billion VND; from year 2 to year 5: 210 billion VND.

Regarding salary costs, the assumption of the number of employees of the enterprise is 200 people, the average salary is 25 million/person/month. The number of business managers is 5 people, the average salary is 300 million/person/month. Workers' wages have increased by 5% over the following years, following the increase in the consumer price index (CPI). The salary cost for employees in the first year is: 78 billion VND.

In addition, there are also costs for renting headquarters, branches, representative offices; costs for marketing, operating betting systems (maintenance, maintenance, data transmission lines...); administrative and other expenses...

After deducting costs, the after-tax profit of the enterprise in the 5 pilot years is estimated at VND 2,973.3 billion.

Enterprises estimated profit of about VND 1,584.4 billion in 5 years

International football betting business activities can be considered a state-owned business sector (similar to lottery business conducted entirely by state-owned enterprises). This is a field that can bring high profits, if the State gives businesses the right to do business, there needs to be a mechanism for sharing benefits between businesses and the State to use resources for socio-economic development goals...

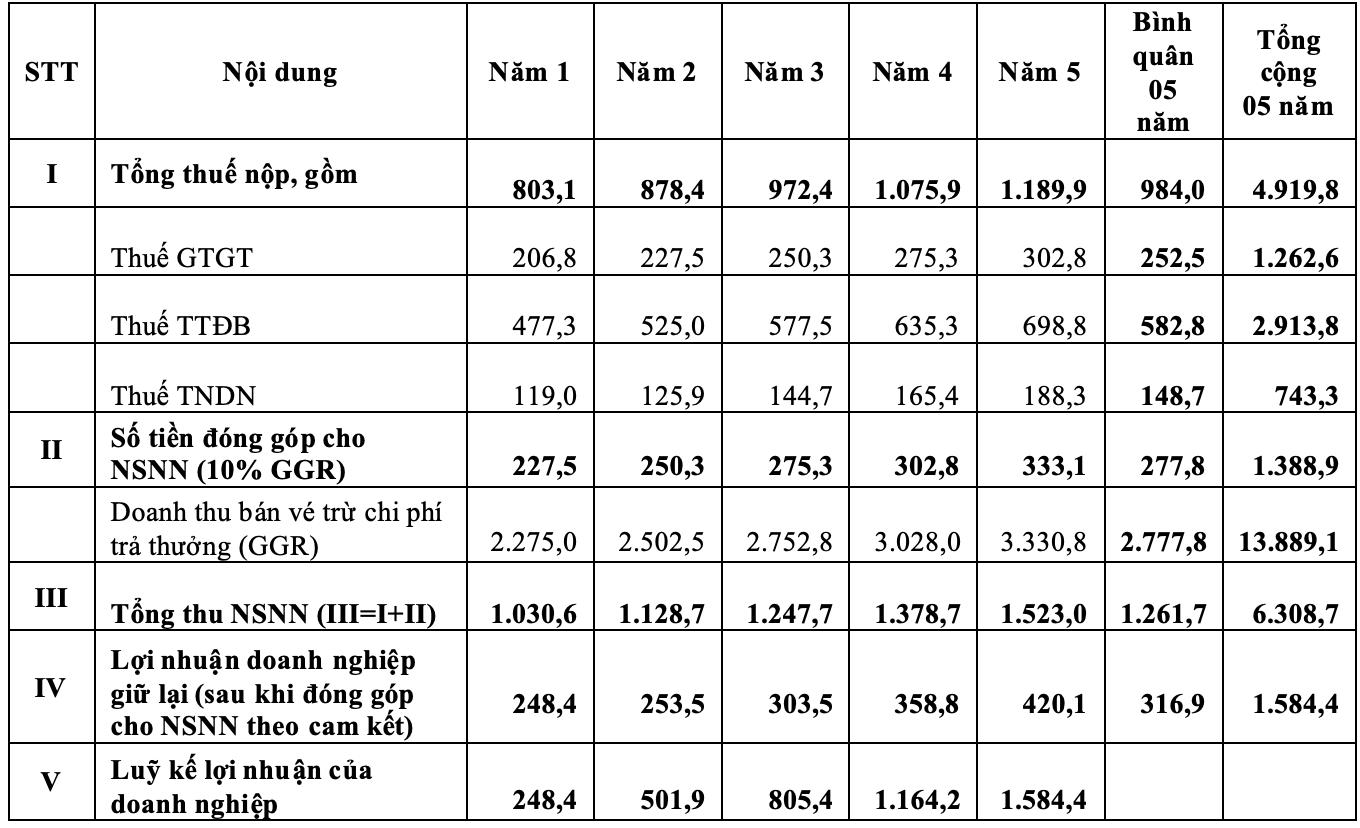

Accordingly, in addition to tax obligations, enterprises must contribute at least 10% of ticket sales revenue after deducting bonuses. With the hypothetical plan, the total budget revenue in 5 years will reach VND 6,308.7 billion, including: VND 1,262.6 billion in value added tax, VND 2,913.8 billion in special consumption tax, VND 743.3 billion in corporate income tax and VND 1,388.9 billion in additional contributions.

Calculations show that businesses can start making a profit after more than 3 years and 10 months of operation. Total profit in 5 years is estimated at VND 1,584.4 billion, with a profit margin on investment capital of about 158%.