In September, 12 banks adjusted their deposit interest rates up. This is the least number of banks increasing interest rates in the past 5 months.

In the first days of October, the interest rate market recorded that no bank adjusted its interest rate. It can be said that the interest rate level is rarely so "quiet".

The increase in commercial banks last September was mainly recorded for short-term deposits of 1-6 months. In contrast, deposits of long-term deposits were mostly listed unchanged. Not only that, some banks that were previously leading in interest rates recorded a decrease in savings interest rates, for example, ABBank (reduced interest rates for 18-16 months from 6.2%/year to 5.7%/year).

This took place in the context of inflationary pressure and systemic liquidity pressure easing after intervention efforts of the State Bank.

Despite the many adjustments to deposit interest rates at banks, the average 12-month term interest rate of commercial banks only increased slightly by 6 basis points compared to the beginning of the year, to 4.9%. In contrast, the interest rate of state-owned joint-stock commercial banks remained stable at 4.7%, 26 basis points lower than the beginning of the year.

Where is the best place to send money?

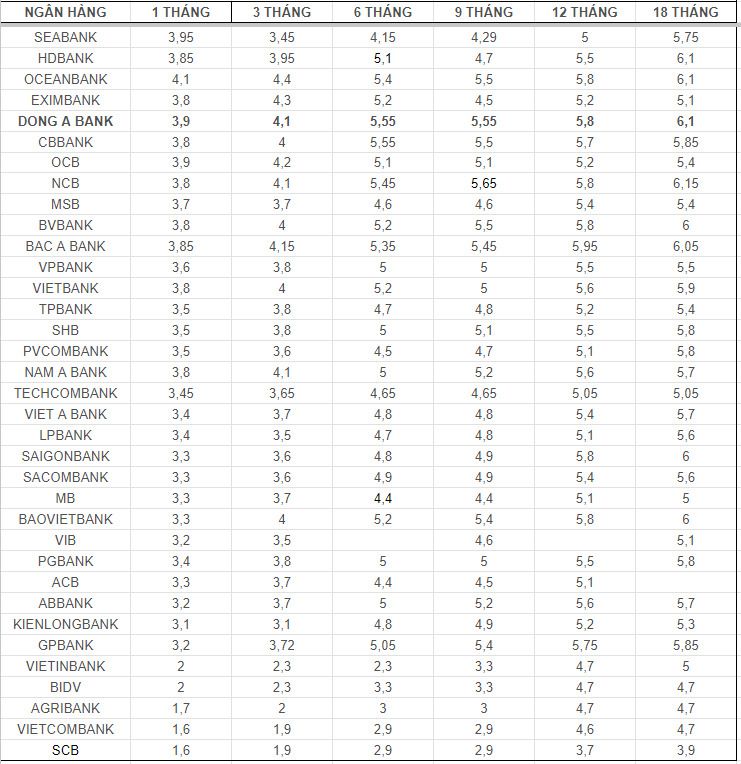

According to Lao Dong, at the 1-month term, the highest deposit interest rate currently belongs to OceanBank with an interest rate of 4.1%/year.

At the 3-month term, the highest interest rate is 4.4%/year currently listed by OceanBank.

At term 6, CBBank leads with interest rate of 5.55%/year.

At 9-month term, the highest interest rate is 5.65%/year at NCB.

At the 12-month term, the leading bank with the highest interest rate is Bac A Bank with an interest rate of 5.9%/year.

PVCombank applies the highest interest rate in the market, up to 9.5%/year for customers depositing for 12-13 months with an amount of 2,000 billion VND or more.

DongA Bank maintains a "special interest rate" at 7.5%/year for a 13-month term, 2.2%/year higher than the normal interest rate, with a balance of VND200 billion or more.

MSB pays an interest rate of 7.0%/year to customers with a minimum balance of VND500 billion, deposited for a term of 12-13 months. In addition, MSB also has a preferential interest rate policy for regular customers, 0.3-0.5% higher than online interest rates.

HDBank listed interest rates of 8.1%/year for 13-month terms and 7.7%/year for 12-month terms, applied to deposits of VND500 billion or more, with interest rates 2.3%-2.5%/year higher than counter interest rates.

(See more high interest rates HERE)

Details of deposit interest rates at banks, updated on October 3, 2024