According to Lao Dong, since the beginning of the year, the market has recorded 7 banks simultaneously increasing savings interest rates, including: Agribank, Bac A Bank, NCB, MBV, Eximbank, KienlongBank, VietBank. Notably, KienlongBank and Eximbank increased interest rates twice in a row in the month. Of which, Eximbank's interest rate is the highest at 6.8%/year.

Deposit interest rates at banks have started to increase slightly since mid-2024 and this trend has spread to longer terms. However, the differentiation between banking groups is quite clear. Small banks often apply interest rates 1% to 3% higher than large banks for the same term. Currently, the highest deposit interest rates are concentrated on 12- and 18-month terms, exceeding 6%/year at some banks.

Vietcombank Securities Company (VCBS) predicts that interest rates for medium and long-term deposits will increase slightly by 0.2 - 0.3 percentage points by the end of 2024, then remain stable in 2025. Lending interest rates are expected to increase by 0.5 - 0.7% as credit demand increases thanks to economic recovery, especially when businesses begin to expand production and business activities after the period affected by the pandemic.

In addition, the USD - VND exchange rate has remained high since the end of October last year, fluctuating around 25,400 VND/USD, putting pressure on interest rates. According to experts' forecasts, the average deposit interest rate may increase by about 0.5% in 2025, from the current 5.2% to about 5.7%. However, this increase is not expected to have too much of an impact on lending rates.

Where is the best place to deposit money right now?

1 month term:

Eximbank is currently leading with the highest interest rate, reaching 4.5%/year (weekend). Second place is MBV, KienLongBank with 4.3%/year. Bac A Bank and OCB are in third place, applying an interest rate of 4.0%/year.

3 month term:

Eximbank continues to lead with the highest interest rate of 4.75%/year (weekend). MBV ranks second with 4.6%/year. Bac A Bank and NCB rank third, with interest rates of 4.2%/year and 4.3%/year, respectively.

6 month term:

CBBank stands out with the highest interest rate, reaching 5.85%/year, followed by KienLongBank with an interest rate of 5.8%/year. Bac A Bank ranks third with 5.55%/year. MBV and NCB follow, both applying an interest rate of 5.5%/year.

9 month term:

CBBank continues to lead with an interest rate of 5.85%/year. MBV ranks second with 5.6%/year. Bac A Bank ranks third, with an interest rate of 5.45%/year.

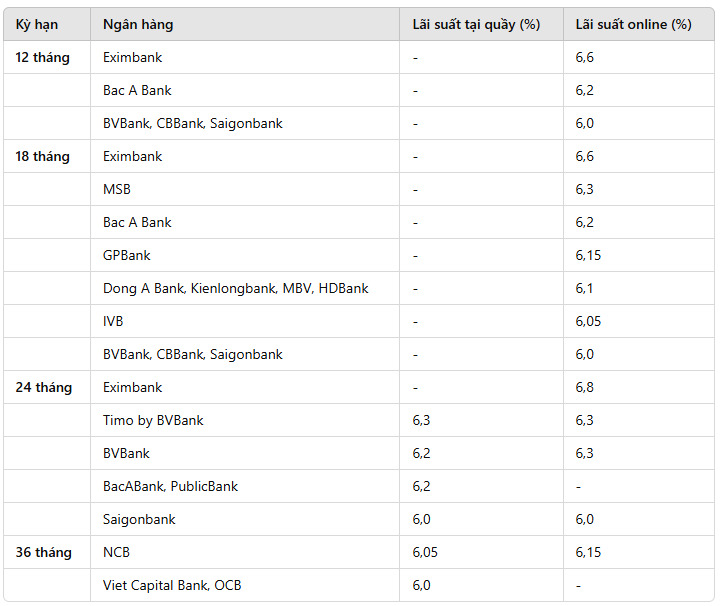

12 month term:

MBV and Gpbank lead with interest rates of 6%/year. Bac A Bank ranks second with 5.8%/year. CBBank ranks third, also with 6.0%/year.

18 month term:

Eximbank leads the long-term with an interest rate of 6.6%/year. Bac A Bank follows with an interest rate of 6.2%/year. MBV, Oceanbank, and KienLongBank are ranked third, with an interest rate of 6.1%/year.