Three real estate enterprises mobilized nearly VND16,000 billion in bonds in 2 days

On October 13 and 14, three real estate enterprises including Hung Phat Invest Hanoi Co., Ltd. (IHPC), Hai Dang Real Estate Investment and Development Co., Ltd. (HDRC) and Truong Minh Real Estate Investment and Development Co., Ltd. (TRMC) mobilized a total of VND 15,950 billion from bonds, with interest rates ranging from 8.959.8%/year.

According to statistics from the Hanoi Stock Exchange (HNX), IHPC issued a bond lot IHP12501 worth VND 7,650 billion, with an 18-month term, interest rate of 9%/year, maturing on April 14, 2027. HDRC issued a batch of HDR32501 worth VND3,800 billion, for a 12-month term, with an interest rate of 8.95%/year, maturing on October 13, 2026. TRMC issued lot TRM12503 worth VND4,500 billion, term of 36 months, interest rate of 9.8%/year, maturing on October 14, 2028.

The above bonds all have collateral and are registered and deposited by the same securities company. Of which, IHP12501 is the only bond lot of Hung Phat Invest Hanoi currently listed on HNX.

For Hai Dang Real Estate, this is the third bond lot, in addition to the two lots HDRCB2426003 (2,800 billion VND) and HDRCB2427002 (1,200 billion VND) still circulating on HNX, issued in 2024 with interest rates of 9.8% and 10%/year, maturing in January 2026 and March 2027, respectively.

Truong Minh Real Estate previously mobilized VND 5,500 billion from two bond lots TRM32501 (VND 2,500 billion) and TRM32502 (VND 3,000 billion), with an interest rate of 8.95%/year and a term of 12 months.

Thus, this group of three enterprises currently has a total bond value of up to VND 25,500 billion, with issuance interest rates in the high group in the market.

Interest rates reflect credit risks

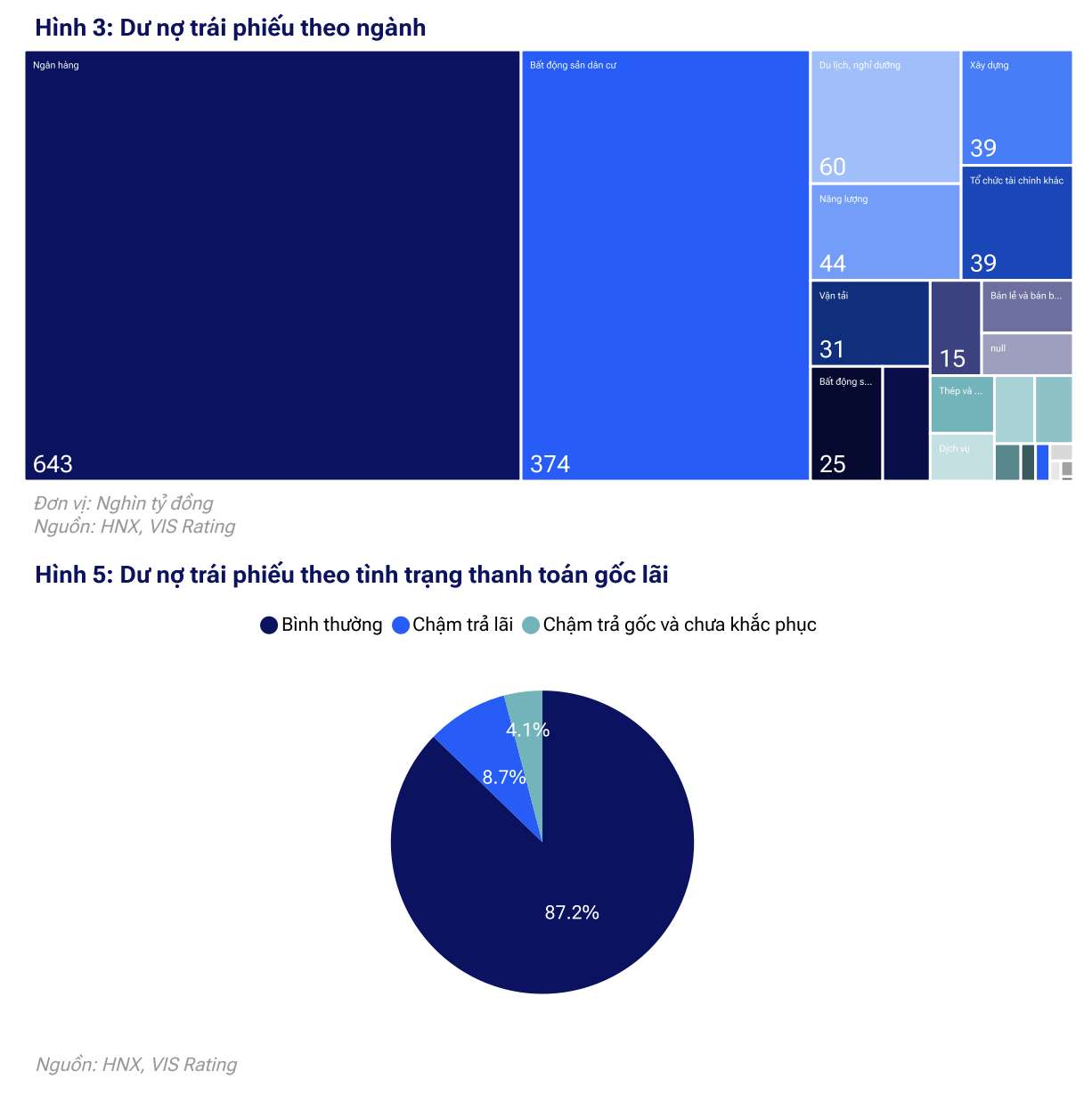

According to information from VIS Rating, in September 2025, 25 issuing institutions mobilized a total of VND50,000 billion through new bond issuances. Issuing activities are mainly focused on the banking industry (accounting for 70% of total value), followed by real estate (26%).

Bonds with a term of 35 years account for the largest proportion (more than 50% of the total issuance value), while short-term bonds with a term of 13 years are on the upward trend, reaching 32%. There are 7 institutions issuing 2-year bonds with initial coupon interest rates from 5.85% to 11%/year.

According to Mr. Nguyen Dinh Duy, CFA Director - Senior Analyst of VIS Rating, the difference in interest rates reflects the level of risk differentiation between issuing institutions, showing that credit and risk factors have been assessed by the market and reflected more clearly in prices.

Financial institutions issuing bonds without collateral have lower interest rates, about 5.857.5%/year. Meanwhile, real estate businesses issuing bonds with assets guaranteed to pay significantly higher interest, from 9% to 11%/year, demonstrating investors' cautious stance towards the credit risk of this group, even if they already have mortgaged assets.

Cash flow is stable, the rate of late payment decreases sharply

Regarding the new issuance, VIS Rating said that the total value of bonds issued in the first 9 months reached VND4255,000 billion, up 35% over the same period in 2024, continuing to maintain high growth momentum in recent months. In September, there was only one public offering, with a total value of VND 500 billion, issued by Thanh Thanh Cong - Bien Hoa Joint Stock Company, a 1-year bond with a fixed interest rate of 9.5%/year.

In the secondary market, trading activities remained stable. The average trading value in September reached about VND5,000 billion per day, equivalent to the average of the first 9 months of the year, showing that cash flow is still regularly circulating among institutional investors. Ho Chi Minh City Development Joint Stock Commercial Bank is the issuer with the most bonds traded since the beginning of 2025, with a total transaction value of VND 112,000 billion, an average of nearly VND 600 billion per day.

Regarding late payment of principal and interest, in September, the market recorded 4 cases of bonds with initial payment delays with a total face value of VND 1,700 billion. Since the beginning of 2025, there have been 26 cases of late bond payments, of which 11 cases have not paid principal, corresponding to a late payment rate of about 1% on the total market scale. Compared to the same period in 2024, this rate has decreased significantly.

Regarding handling late payment, Hung Thinh Land is the most active unit in restructuring late payment bonds, with a total value of VND 141.8 billion handled through the form of exchanging assets with bondholders of 5 bonds. However, the recovery rate of these 5 bonds has only reached 5.820%, significantly lower than the overall market rate of late payment of about 38%.

As of September 30, 2025, out of the total VND 276,000 billion in late payment of bond denominations (including principal and interest), issuing institutions have paid about VND 105,000 billion.