Using funds from bond issuance for the wrong purpose

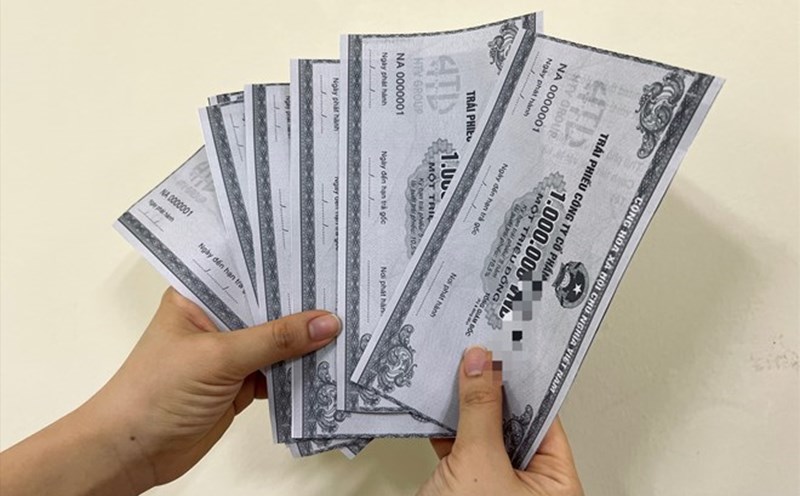

The Government Inspectorate has just published Inspection Conclusion No. 276/KL-TTCP on compliance with legal policies on the issuance of individual corporate bonds (CIs) and the use of funds from individual CIs, period January 1, 2015 to June 30, 2023.

In this conclusion, the Government Inspectorate said that the use of capital from bond issuance must comply with the issuance plan approved by competent authorities, the content of information disclosure to investors and in accordance with the provisions of law.

Through inspection, there were 3 issuing organizations, namely Bac Ha Energy Joint Stock Company (JSC), Ho Chi Minh City Infrastructure Investment Joint Stock Company and Hai Phat Investment Joint Stock Company, using money from issuing corporate bonds for the wrong issuance purpose.

Bac Ha Energy Joint Stock Company used 100/100 billion VND of bonds coded BHB2021 (issued date: February 27, 2009) and 65.157/100 billion VND of bonds coded BHH20 2002 (issued date: February 27, 2020) to restructure the debt at VDB Bank, not in accordance with the issuance purpose in the issuance plan " Increasing the scale of operating capital to serve the structure of the Company's medium and long-term capital and supplement capital for Nam Phang B Project", not complying with the provisions of Clause 3, Article 5 and Clause 2, Article 35 of Decree No. 163/2018/ND-CР.

Ho Chi Minh City Infrastructure Investment Joint Stock Company used the amount of VND 8.8 billion out of VND 1,150 billion from the issuance of corporate bonds with code CII.012029G (issued on January 31, 2019) for the wrong purpose, not in accordance with the provisions of Clause 3, Article 5 and Clause 2, Article 35 of Decree No. 163/2018/ND-CP.

Hai Phat Investment Joint Stock Company has used 250/450 billion VND from issuing bond codes HPXH212201183; 103.968/400 billion VND from issuing 3 bond codes HP- BOND2020/RL01, HP-BOND2020/RL02, HP-BOND2020/RL0384; 100/100 billion VND from bonds coded HPXH212200285; 104.248/300 billion VND from bonds coded HPXH222400186; 51.941 and 1.987550/2 billion VND from bonds coded HPX212400987 not approved for issuance by the Board of Directors, not in accordance with the provisions of Clause 3, Article 5 and Clause 2, Article 35 of Decree No. 163/2018, Clause 2, Article 5 and Clause 2, Article 34 of Decree No. 153/2020/ND-C.

Failure to fulfill capital management responsibilities from bond issuance

The Government Inspectorate also said that through inspection, An Gia Company and Ho Chi Minh City Infrastructure Investment Joint Stock Company used corporate bond capital for cooperation and business; however, they did not fulfill their responsibility to "manage capital from bond issuance in accordance with the bond issuance plan approved by competent authorities" as prescribed in Article 35 of Decree No. 163/2018/ND-CP, leading to partners using corporate bond capital for the wrong purpose and not fulfilling their contractual commitments.

Accordingly, An Gia Company did not fulfill its capital management responsibility, leading to the parties receiving the cooperation money being Phuoc Loc Tourism Construction Investment Joint Stock Company using 170/400 billion VND (bond code AGG_BOND_2020_3.4); Gia An Consulting Joint Stock Company using 200/600 billion VND (bond code AGG_BOND_2020_3.4); Dong Nam Construction and Trading Service Company Limited using 8.842/17.7 billion VND; Vinh Nguyen Management and Investment Company Limited using 2.604/17.7 billion VND (bond code AGGH2224002) incorrectly, unable to prove the purpose and content agreed upon by both parties in the Business Cooperation Contract.

Ho Chi Minh City Infrastructure Investment Joint Stock Company did not fulfill its capital management responsibility from issuing 550 billion VND worth of bonds coded CII-H2023-006, leading to the receiver of the cooperation money being Bac Thu Thiem Area One Member Co., Ltd. using 300 billion VND to pay bank debt; 244 billion VND transferred to Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company for short-term loans is not in accordance with the content and purpose agreed upon by both parties in the Business Cooperation Contract.