Asia Joint Stock Commercial Bank (ACB) recently issued a press release informing about the conclusion of the Government Inspectorate (GIA) regarding the bank's operations.

This unit said that it had completed all the remedial contents as requested by the authorities and submitted a report on the implementation results on September 24, 2025.

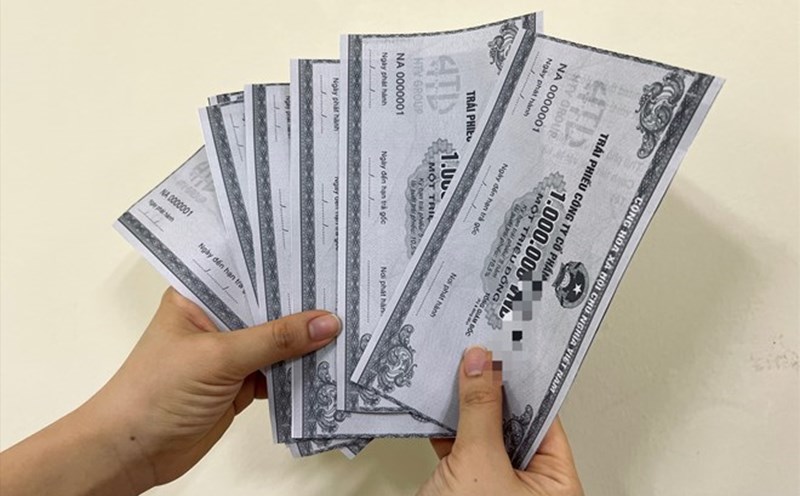

Previously, according to the conclusion of TTCP, the two bond lots issued by ACB in 2018 and 2019 had the purpose of using the capital stated in the plan to lend for medium and long term.

However, TTCP pointed out that during the inspection process, the reported data at some times did not match the time and included short-term loans. From there, the inspection agency has issued a request for review and remediation according to regulations.

Regarding remedial measures, ACB said it has adjusted and supplemented the plan to issue corporate bonds (CPDN); adjusted inaccurate and incomplete information in information publications (CPTT).

At the same time, ACB has taken measures to rectify and improve the CBTT process, ensuring that information is published fully, accurately, and on time to investors and competent authorities.

This bank also rectify capital management from corporate bonds, including transferring capital to a subsidiary to implement the project; ensuring full and accurate payment of principal and corporate bond interest to bondholders; coordinating transaction registration to ensure compliance with regulations.

The ACB also said that it has determined personal responsibility for the violation, reported to the competent authority for consideration and handling.

The bank affirmed that these contents have been fully implemented according to the instructions of the inspection agency and committed to continue maintaining control and supervision measures to comply with, while complying with financial management and transparency standards.