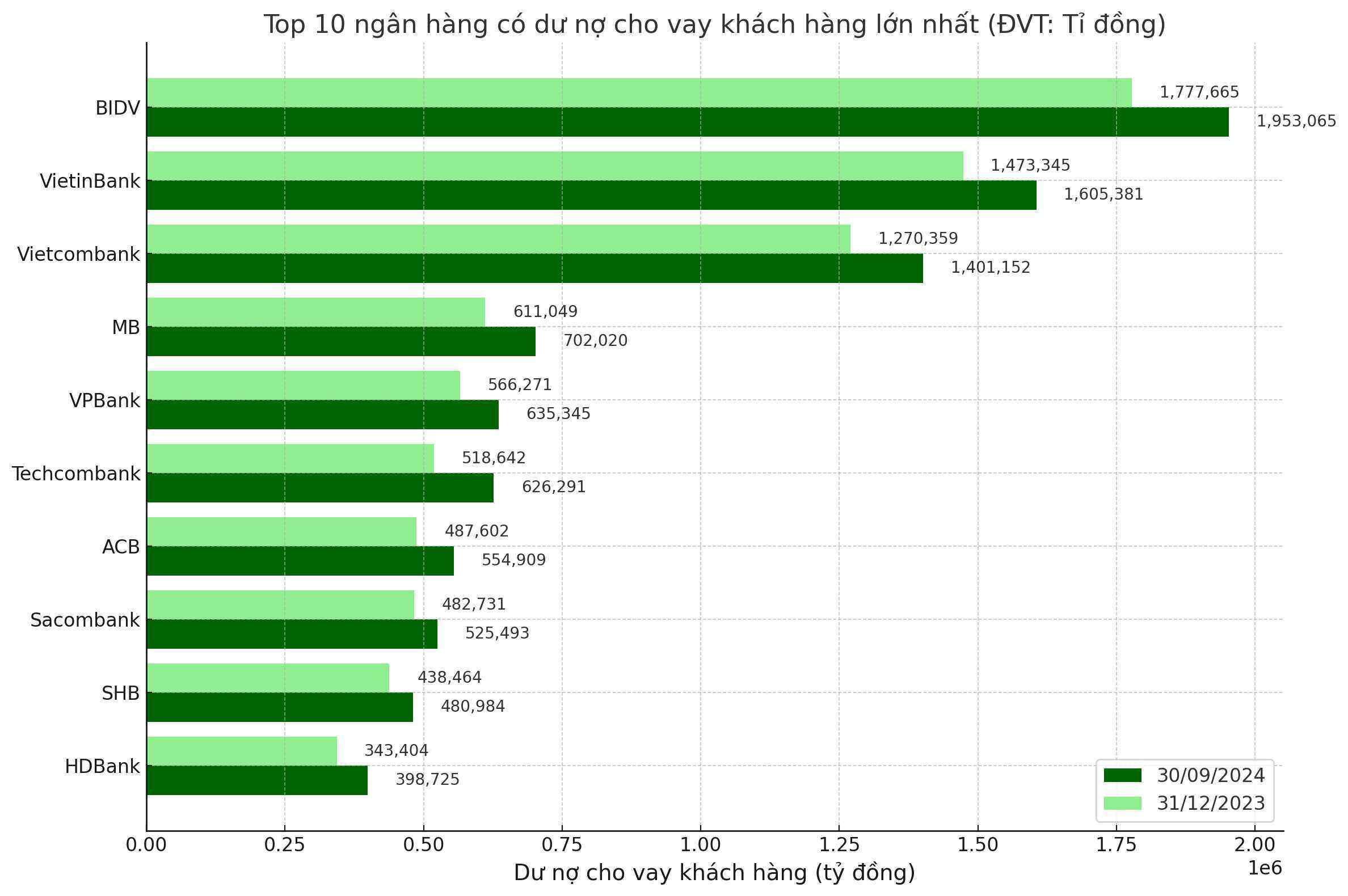

To date, 27 banks (except Agribank) have announced their financial reports for the third quarter of 2024. Notable among them is BIDV with outstanding credit balance reaching approximately VND 1.96 million billion.

This is the bank with the largest outstanding loans in the system. Compared to the end of 2023, BIDV lent an additional 175,400 billion VND.

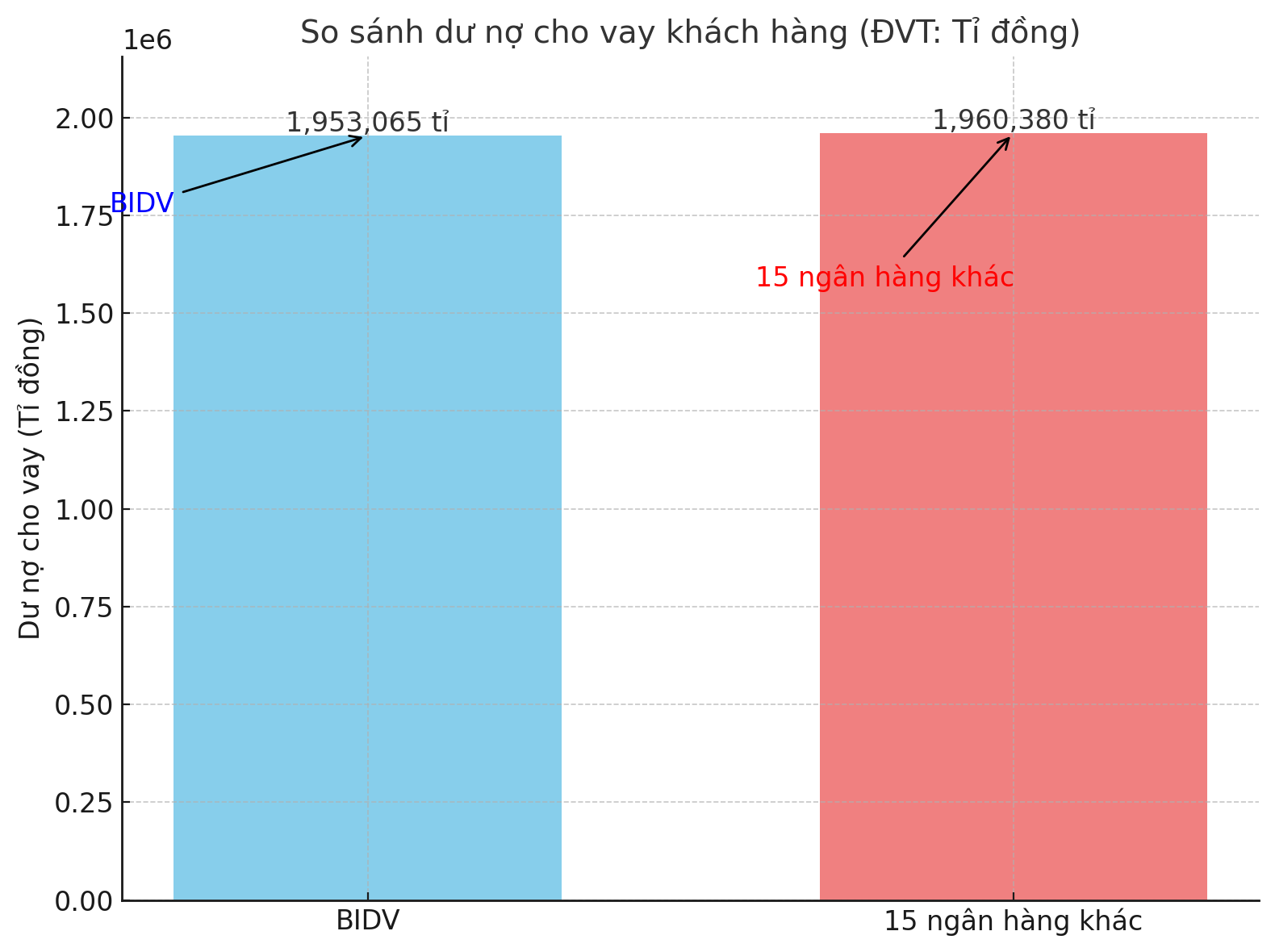

Comparing this "huge" loan balance of BIDV with the remaining banks in the system, BIDV's customer debt balance is equal to the debt balance of 15 small and medium-sized commercial banks combined.

If including the following banks: VIB (VND 297,550 billion); TPBank (VND 234,722 billion); SeABank (VND 196,890 billion); MSB (VND 170,620 billion); Nam A Bank (VND 163,780 billion); Eximbank (VND 159,484 billion); OCB (VND 157,877 billion); Bac A Bank (VND 103,625 billion); ABBank (VND 98,768 billion); VietBank (VND 91,953 billion); VietABank (VND 77,267 billion); NCB (VND 64,081 billion); BVBank (VND 64,081 billion; KienlongBank (VND 59,275 billion); Saigonbank (VND 20,407 billion).

After BIDV, VietinBank recorded total outstanding customer debt at VND1,605 trillion, up 9% compared to the beginning of the year.

Ranked third is Vietcombank with total outstanding loans as of the end of September reaching more than 1,401 trillion VND, an increase of 10.3%.

In the joint stock group, MB and VPBank are the two banks with the highest customer loan scale, reaching VND 702,020 billion and VND 635,345 billion, respectively, up 14.9% and 12.2% compared to the beginning of the year.

Meanwhile, despite being ranked 6th, Techcombank had the highest growth rate, up to 20.8%. Helping total outstanding loans increase to VND626,291 billion.