Flexible monetary policy, supporting the financial system

The financial market is speculating about the possibility that the State Bank of Vietnam (SBV) may adjust OMO interest rates to support liquidity. However, up to now, the SBV has not made any official announcement about the interest rate reduction on the open market.

Reducing OMO interest rates ( Open Market Operations) helps credit institutions (CIs) access capital at lower costs, thereby expanding credit and supporting borrowers.

In parallel with the adjustment of OMO interest rates, the SBV has continuously offered to buy securities with many different terms, including terms of up to 91 days to supplement long-term liquidity for the banking system. This is considered one of the important solutions to help stabilize capital flows, avoiding liquidity stress in the interbank market.

In addition, the SBV also gradually reduced the bond issuance interest rate from 4.0% to 3.1%/year before deciding to completely stop issuing bonds from March 5, 2025. This is considered a strong signal, clearly demonstrating the policy of maintaining low interest rates, creating favorable conditions for the market.

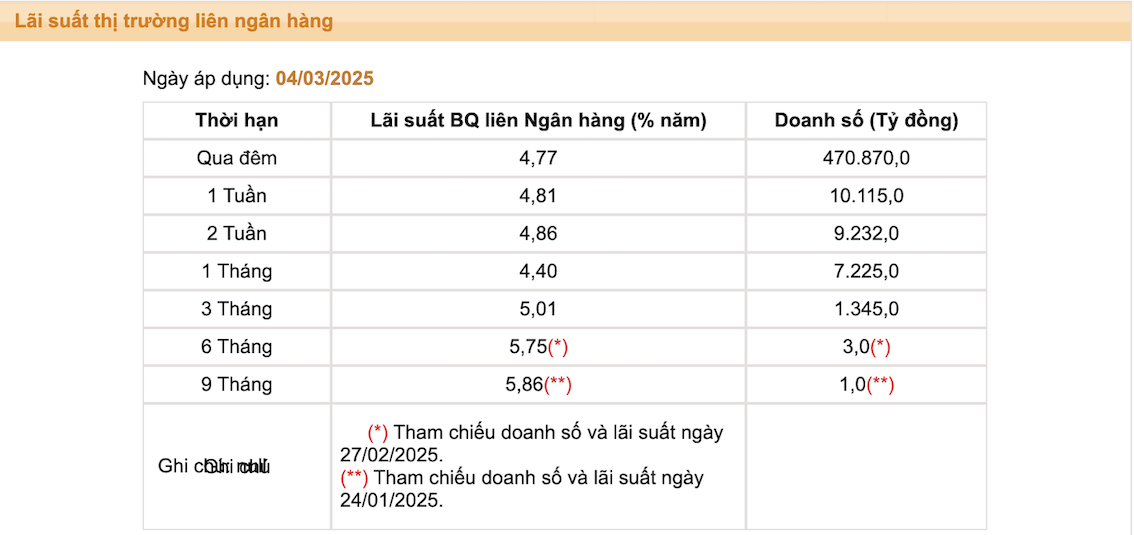

Interest rate level tends to decrease

Adjustments from the SBV have had a clear impact on the market. Interbank interest rates tend to decrease, with short terms now around 4.0%/year. In market 1, a series of commercial banks have also adjusted their deposit interest rates down.

On the afternoon of March 5, at the regular Government press conference in February 2025, Permanent Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu answered questions from the press about the situation where many banks have increased interest rates in early 2025, which could increase input costs for businesses.

Regarding interest rates, according to Mr. Dao Minh Tu, at the end of 2024, the banking industry has proactively reduced the average interest rate compared to 2023, the average interest rate reduction of the banking system is 1.1%. In particular, some state-owned commercial banks have lowered interest rates to 1.6%.

However, Mr. Dao Minh Tu admitted that recently, "honestors" in the early stages of the year after Tet have had many depositors, so 8 banks have increased deposit interest rates for some terms.

In the lending direction, many banks have implemented preferential credit packages, especially for individual customers and small businesses. In particular, many banks are focusing on implementing consumer loan and social housing support programs.

At many major conferences, the SBV said that the agency will continue to closely monitor market developments to flexibly adjust policies. The goal is to both ensure liquidity for the bank and maintain the stability of the financial system, while supporting businesses and people to access capital at reasonable costs.