The development of digital financial products has become an inevitable trend in the process of moving towards sustainable economic growth. The demand for these products has encouraged financial institutions to exploit data and enhance their analytical capabilities to improve decision-making processes and optimize business.

Financial institutions are leveraging big data and artificial intelligence (AI) to deliver efficient services, optimize customer experience, and ensure transparency. At the same time, new data protection regulations place strict compliance requirements.

At the seminar on "Data products and data analysis for financial institutions" organized by FiinGroup, the International Finance Corporation (IFC) and the Vietnam Banks Association (VNBA) on the afternoon of November 20, Mr. Jinchang Lai, Chief Expert, Head of Financial Infrastructure Group, Financial Institutions Advisory Department, Asia Pacific Region, IFC expressed his opinion: When making credit decisions, it is necessary to combine the use of commonly used company data, plus other data to make better decisions. Outside the company, there is often a need for other big data and it is necessary to base on the purpose of using the data to exploit the data appropriately.

Meanwhile, Mr. Neli Munroe, representative of the Business Information Association (BIIA), said that accuracy, relevance and transparency are the three main and most important keywords in the use of data. At the same time, in ensuring the accuracy of data, there needs to be a mechanism to ensure this.

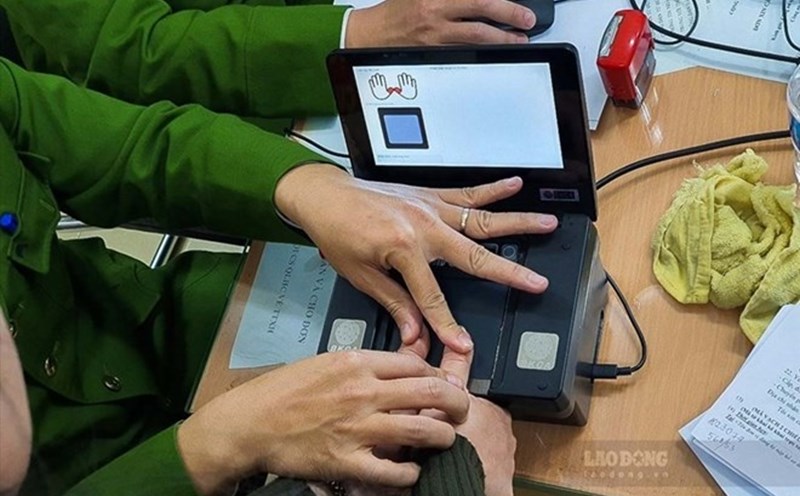

Regarding the challenges that financial institutions face in using data, Mr. Doan Thanh Hai - Deputy Director of the Information Technology Department of the State Bank of Vietnam (SBV) said that keeping data clean and accurate is very important. SBV has had requirements for cleaning data as per the Government's Project 06. In fact, at banks, during the long period of using data, data about personal bank accounts has been infiltrated and exploited by criminals, often out of control.

Currently, banks have also actively implemented data cleaning, account cleaning, and customer records, and this is quite effective when criminals exploiting bank data have significantly decreased.

Mr. Hai also said that according to the new Law on Personal Data being drafted, there are expected to be many regulations to protect personal data more strictly. Among them, it is required that if a bank wants to share personal data with another party, it must have the consent of that individual. This is very beneficial for the people. However, this is also a challenge for banks because the working process and data processing will be interrupted.

Discussing the solution to this problem, Mr. Jinchang Lai said that if everything relies on the consensus of all parties, the efficiency in using data will not be high.

“Therefore, it is necessary to decentralize data protection. Rank data into levels 1, 2, 3, 4 to exploit it appropriately depending on the sensitivity of the data. Such as personal data, classify personal data, financial data, sensitive data…”, the expert shared.