Budget revenue far exceeds estimates

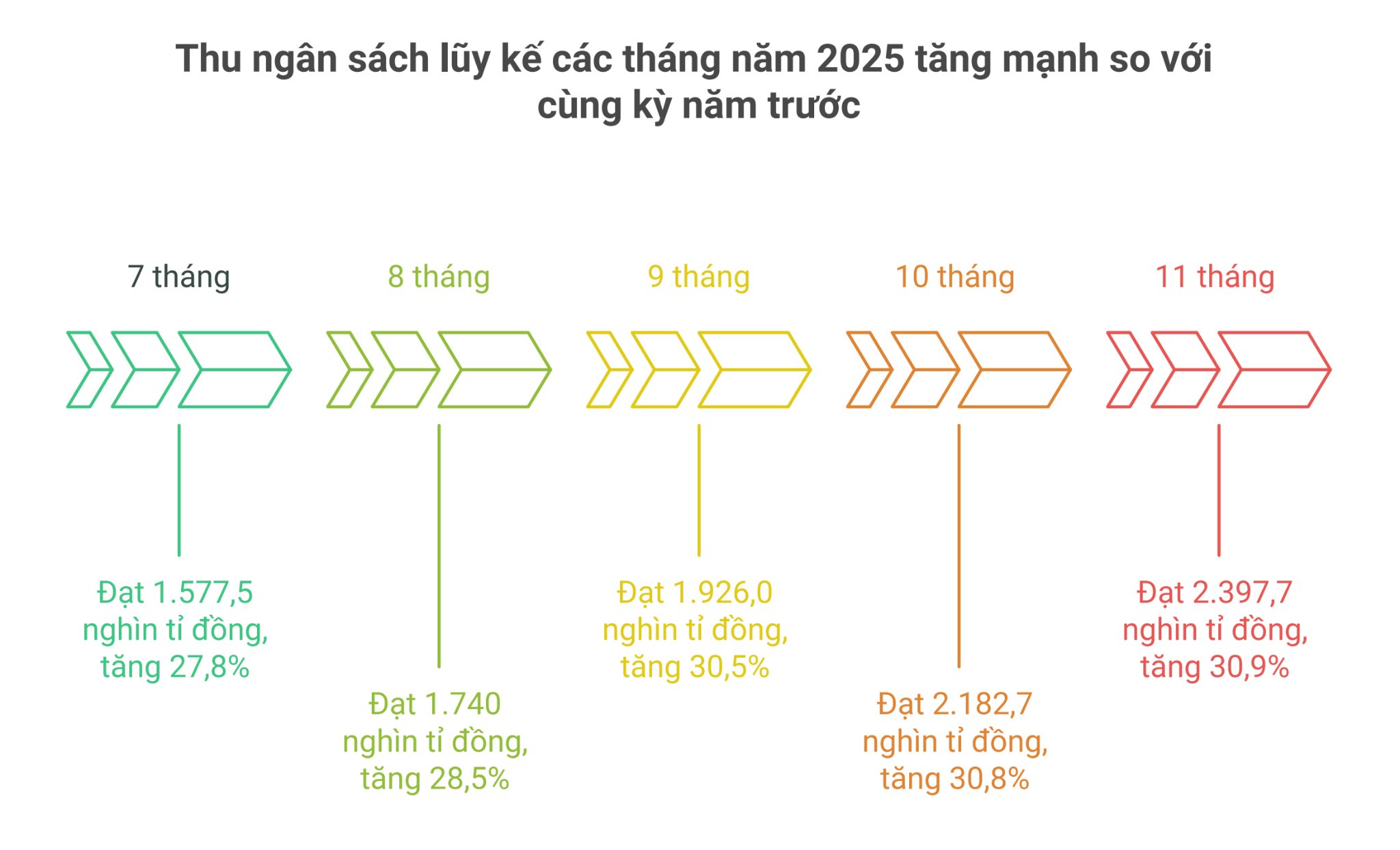

According to information from the Ministry of Finance, in the first 11 months of 2025, the total state budget revenue reached VND 2,397.7 trillion, equal to 121.9% of the annual estimate and increasing by 30.9% over the same period last year. In November alone, total revenue is estimated at 201,500 billion VND.

In the domestic revenue and revenue structure in November, it reached VND 171,600 billion; the accumulated 11 months reached VND 2,059.5 trillion, equal to 123.4% of the annual estimate and up 35.2% over the same period. crude oil revenue in November reached nearly VND3,000 billion; accumulated 11 months reached VND43,700 billion, equal to 82.2% of the annual estimate and down 16.7%.

Budget balance revenue from import-export activities in November reached VND26,700 billion; accumulated revenue for 11 months reached nearly VND293,000 billion, equal to 124.7% of the annual estimate and up 15.1%.

This result is recorded in the context that localities have completed the arrangement of administrative units and operated according to the 2-level local government model from July 1, 2025. The budget collection process shows that the increase has been maintained continuously through the months after the merger.

In July, the total state budget revenue was about 242.1 trillion VND; the accumulated 7 months of 2025 reached 1,577.5 trillion VND, equal to 80.2% of the annual estimate and up 27.8% over the same period last year.

In August, total revenue reached about 158.8 trillion VND; accumulated for 8 months reached nearly 1,740.0 trillion VND, equal to 88.5% of the annual estimate and up 28.5%.

In September, total revenue was about 181.1 trillion VND; accumulated for 9 months reached nearly 1,926.0 trillion VND, equal to 97.9% of the annual estimate and increasing by 30.5%.

In October, total revenue was about 231.2 trillion VND; accumulated for 10 months reached 2,182.7 trillion VND, equal to 111.0% of the annual estimate and up 30.8% over the same period.

According to the Ministry of Finance, the budget collection results achieved thanks to focusing on directing the strict implementation of the Tax Laws and budget collection tasks from the beginning of the year. The financial sector strengthens inspection, examination, and strict handling of violations and fraud in tax declaration and refunds; at the same time, promotes administrative procedure reform, digital transformation, modernization, and the application of information technology in tax management.

The expansion of the provision of electronic tax services to taxpayers, the implementation of the eTax Mobile application for individuals and business households, along with the operation of the Tax Payment Portal for foreign suppliers without permanent establishments in Vietnam, continue to promote the effectiveness, contributing to strengthening budget collection discipline and improving the sustainability of revenue.

Budget expenditure increased by more than 32%, ensuring adequate tasks

Along with the results of state budget revenue and expenditure in the first 11 months of 2025, the increase of 32.5% over the same period, meeting the needs of socio-economic development, national defense, security, state management, payment of due debts and timely payment to subjects according to regulations.

Total state budget expenditure in November is estimated at 213.3 trillion VND; accumulated for 11 months reached 2,049.7 trillion VND, equal to 79.5% of the annual estimate and up 32.5% over the same period last year. Of which, regular expenditure reached VND 1,398.0 trillion, equal to 87.5% of the estimate and increasing by 32.4%; development investment expenditure reached VND 553.3 trillion, equal to 70.0% of the estimate and increasing by 39.2%; interest payment reached VND 92.2 trillion, equal to 83.4% of the estimate and increasing by 0.8%.