According to Article 85 of the Law on Tax Administration 2019, cases eligible for tax, late payment, and fine cancellation are as follows:

Enterprises and cooperatives declared bankrupt have made payments according to the provisions of the law on bankruptcy without any assets to pay taxes, late payment fees, and fines.

Individuals who have lost or been declared by the Court to have passed away, lost civil act capacity without assets, including assets inherited to pay taxes, late payment fees, and outstanding fines.

Tax debts, late payment fees, and fines of taxpayers not falling under the provisions of Clause 1 and Clause 2, Article 85 of the Law on Tax Administration 2019, but the tax authority has applied enforcement measures prescribed in Point g, Clause 1, Article 125 of the Law on Tax Administration 2019, and these tax debts, late payment fees, and fines that have been more than 10 years from the date of tax payment expiration but cannot be recovered.

Taxpayers who are individuals, business individuals, business owners, business owners, private business owners and limited liability companies of one member whose tax debts, late payment debts, and fines before returning to production, business or establishing new production and business establishments must repay the State for the debts of taxes, late payment debts, and fines that have been erased.

Taxes, late payment fees, and fines for cases affected by natural disasters, disasters, and epidemics of wide scope have been considered for exemption from late payment fees according to the provisions of Clause 8, Article 59 of the Law on Tax Administration 2019 and have been extended for tax payment according to the provisions of Point a, Clause 1, Article 62 of the Law on Tax Administration 2019, but still have damage, are unable to recover production and business, and are unable to pay taxes, late payment fees, and fines.

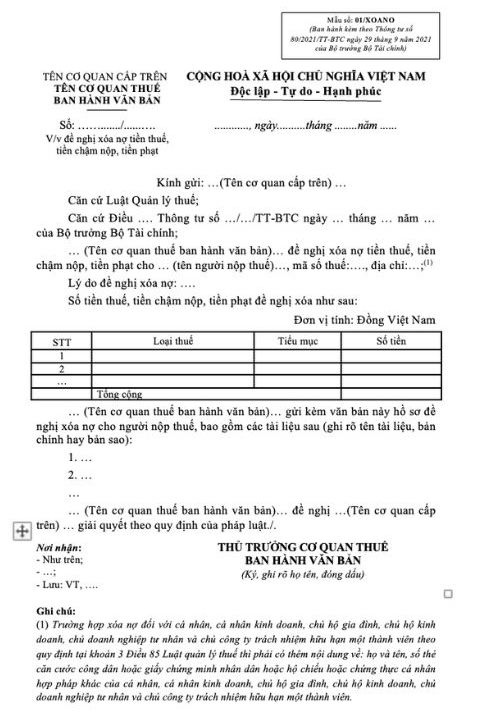

Regarding the above cases, people need to follow form 01/XOANO of the document requesting to cancel tax debts, late payment fees, and fines as prescribed in Appendix I issued with Circular 80/2021/TT-BTC, supplemented by Clause 3, Article 1 of Circular 94/2025/TT-BTC.