Consulting on shortening procedures by "outside services" and lightly concise documents

As reported by Lao Dong Newspaper, among many banks announcing home loans for young people, Asia Commercial Joint Stock Bank (ACB) is the unit that announced the implementation of the "First House" loan package for young people. According to ACB's advertisement, the record low preferential loan interest rate is only from 5.5% with a loan term of up to 30 years, the first interest rate fixing period is up to 5 years, simple procedures.

To better understand this loan package, playing the role of a young person under 35 years old who needs to borrow from a bank to own the first house on the land given by his parents before starting a family, the reporter went to learn at an ACB transaction office on Hoang Dao Thuy - Hanoi street. With the desire to borrow about 1 billion VND and the ability to pay mainly from salary, Thuy (character's name has been changed - PV) at ACB Hoang Dao Thuy Transaction Office - Dong Do Branch, said that the application is quite complicated if borrowing to build a house on vacant land.

Consultant Thuy said that the real estate appraisal work will be carried out by the bank's management department with the borrower's wife or husband. This is to accurately determine the owner of the land plot and the coordinate location, thereby measuring and surveying market prices in the surrounding area.

Ms. Thuy advised that the appraisal process will take 2 days for the land appraisal team to inspect and determine the value of the property. After that, the bank will take an additional 2 days to prepare documents so that customers can mortgage quickly, and complete other related procedures.

wondering how the process could be so fast, Ms. Thuy explained: "If according to the state's regulations, it will take about 5 - 10 days, the number of days depends on the time is favorable. If customers want to get money quickly and can do the service, this service will cost about 5,000,000 - 6,000,000 VND, after 2 days, there is, that is, the procedure was done the day before, the next day will have results, and they can be disbursed immediately. When doing the service, do it directly with your friend to prepare the application, without going through your side. If done quickly like that, the process will be shortened to about 5 days".

Actual interest rates are higher than advertising, incentives are only "for communication"

Seeing that customers did not ask for any more, Thuy's staff advised her to use a loan package with a fixed interest rate of 7%/year for 24 months. Advertisers this is the most suitable and stable interest rate today.

wondering about the higher interest rate than advertised in the media, Ms. Thuy continued to offer another, lower interest rate, of 6.5%/year. However, Ms. Thuy said that the preferential period for this interest rate only lasts for 12 months, after the above preferential period, the interest rate will be adjusted according to the floating mechanism. At that time, the interest rate is calculated according to the basic interest rate formula plus an margin of about 3.5%.

employee Thuy said, "the basic interest rate according to State regulations fluctuates at 8.5%/year, combined with an margin of 3.5%, the interest rate after floating will be 12%/year". Ms. Thuy added that the period from now until the end of the year is the time when interest rates continue to increase, the probability of low interest rates will rarely happen.

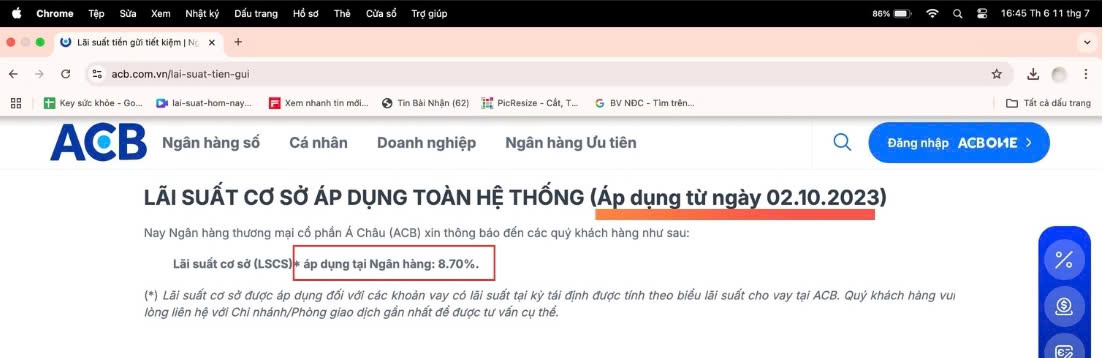

Recorded on July 11, the interest rate announced on ACB's website is 8.7%/year applied from 2023.

Continuing to wonder about the preferential interest rate from 5.5%/year widely communicated about ACB's "First House" loan package, the reporter received an answer from the credit consultant: "In fact, there are currently almost no loan packages with an interest rate of 5.5%/year".

"Because at the end of this year, credit growth will have to be registered with the State Bank and almost all growth targets have been used up for the first 6 months of the year, so the last 6 months of the year are just called adjustment and adjustment, not too much incentives.

The 5.5% interest rate is really over, no longer there, the 5.5% is just for communication. For example, the source is 2,000 billion VND, and when that package is exhausted, it will no longer be applied" - Ms. Thuy explained.

The dossier is flexibly "d finalized", many cases change the purpose of the loan

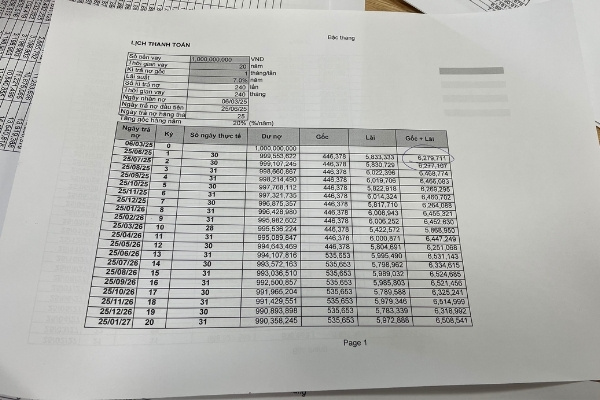

Seeing that customers were still hesitant, the consultant Thuy continued to introduce the highlight of ACB's current credit policy as a flexible payment method, instead of applying the method of paying principal every month like many other banks.

For example, with a loan of 1 billion VND for 10 years, borrowers often have to pay about 8-9 million VND/month (excluding interest). Meanwhile, at ACB alone, in the early years, borrowers only needed to pay a very small principal, about 70,000 - 80,000 VND/month. Most of the debt repayment costs during this period will be interest.

According to Ms. Thuy, with the low principal payment, the total monthly payment (including principal and interest) only ranges from 6.1 - 6.2 million VND.

Ms. Thuy added that after the preferential period, the interest rate will be applied according to the floating mechanism. Assuming the interest rate after the third year is 12%/year, the payment is calculated based on the remaining principal balance.

Next, credit consultant Thuy said that customers can flexibly repay additional principal during the preferential period without paying the early repayment fee.

Accordingly, borrowers can proactively pay an additional 50 to 100 million VND depending on their financial capacity. Compared to traditional loan packages that have to pay the same principal and interest every month (calculated at about 14 million VND/month for similar loans), this payment model helps customers be more proactive in cash flow in the early years, while optimizing interest costs by paying additional principal without fees.

Notably, consultant Thuy emphasized that the bank will have a "diseign" loan package specific to each borrower. For example, if a customer intends to build a house but asks for a construction permit that takes time and is not sure to get it right away, the credit consultant can find another option.

"This is just an internal plan for me, how can I present this level to you? Taking the money for you is the least document and the least procedure. For example, your customer is buying real estate. They have only bought the house for 13 months, but we can still refund the money to buy the house for them in 24 months. Following the standards is only the best, but it is a bit complicated and has a lot of documents. For example, if you want to build a house but apply for a construction permit takes time, it is not certain to be available immediately, we can find another option. On the other hand, you can design to borrow to repair the house, still with a loan term of 30 years.

If not, I would just consume it. Use the simplest procedure. The staff at your side also wanted to do something as quickly as possible. Whichever option is easier for both sides will receive the most incentives. borrowing 1 billion VND is a lot of design options, not too difficult" - Thuy affirmed.